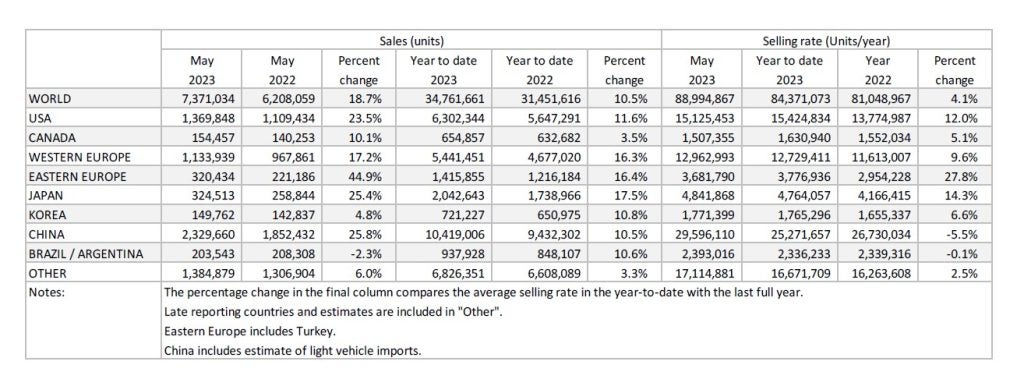

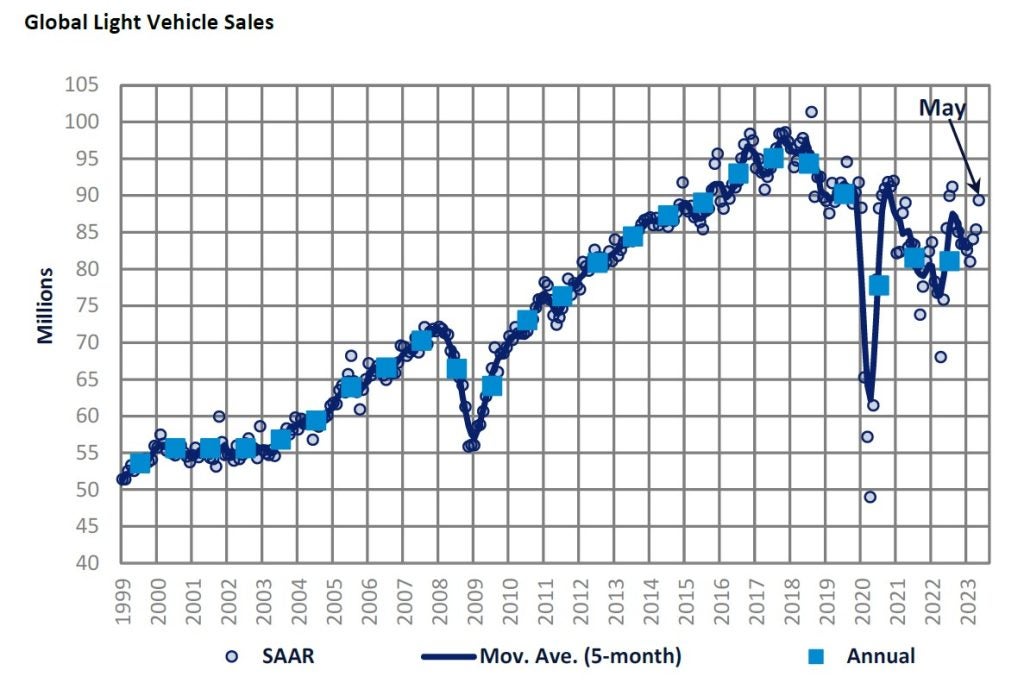

The global light vehicle market in May rose by 18.7% year-on-year to 7.4 million units, according to GlobalData estimates. The result continues a general market bounce-back from low levels last year when the semiconductor crisis restricted sales across the world.

The global Light Vehicle (LV) selling rate rose to 89 million units/year in May, from 85 million units/year in April. Most markets have outperformed 2022 which was debilitated by stringent supply constraints, that have now started to ease. As a result, nations’ LV markets have reported strong vehicle registration volumes with global LV sales at 7.4 million units (+18.7%).

US LV sales grew 23.5% YoY to 1.4 million units as OEMS raised vehicle production on the back of fewer supply issues. China performed stronger than the first four months of the year with a selling rate of 29.6 million units/year. All major West European countries reported positive YoY growth as their markets continue to recover with the easing of supply issues.

GD analyst Jonathon Poskitt warned that the market rebound caused by easing supply shortages will be of diminishing strength later this year. “That cushion of backed up orders being fulfilled in the coming months will be of diminishing strength during the course of the year,” he said. “That leaves a weak market picture overall when demand factors play a stronger role.”

A summary of market developments in the world’s regions follows.

North America

The US LV market continued its strong run of growth in May, as sales were up by 23.5% YoY, reaching 1.4 million units. The selling rate decreased from 16.2 million units/year in April to 15.1 million units/year in May, possibly due to relatively fewer sales events for Memorial Day. The average transaction price slightly decreased in May to US$46,079, likely caused by the OEMs increasing production of lower-profit vehicles as the supply crisis has eased. On the other hand, incentives increased by US$102 to US$1,781 in May, the highest monthly incentive spend so far in 2023.

In May 2023, Canadian LV sales increased by 10.1% YoY to 154.5k units, increasing volumes by 13k units month-on-month. The selling rate increased in May, to 1.5 million units/year, from 1.4 million units/year in April. LV sales in Mexico grew by 17.3% YoY in May, reaching 106.3k units. While the country saw strong growth in May, the selling rate declined to 1.3 million units/year, a reduction of 64k units/year compared to April.

Europe

The West European selling rate in May was 13 million units/year, up from 12.2 million units/year in April. Vehicle registrations stood at 1.13 million units with a 17.2% YoY growth. Supply constraints continued to ease allowing OEMs to fulfill their backlogged orders and increase their delivery rates. Aside from Spain, the top five West European markets recognized double-digit YoY growth in their LV registration figures for May.

The East European selling rate grew 3.7 million units/year in May from 3.6 million units/year in April. LV sales were at 320k units which is almost 45% higher than May 2022, however, continue to lag pre-pandemic 2019 levels. Year-to-date the region recorded 1.4 million units, up 16.4% from this time last year. Russia LV sales drove this growth with 62k units sold with a YoY growth of almost 129%.

China

According to preliminary May data, the Chinese market surprised on the upside after posting disappointing results in the first four months of this year. The May selling rate was 29.6 million units/year, up 14% from a lackluster April, and the highest rate since September 2022. In YoY terms, sales (i.e., wholesales) increased by almost 26% in May against lockdown-caused weak sales a year ago, and 10.5% YTD. NEVs remained the key driver of the market, with sales of BEVs and PHEVs increasing by 50% and 94% YoY, respectively, in May.

As the price war appears to be peaking out, consumers, who were taking a wait-and-see approach, started to go ahead with their purchases. Special sales campaigns during the week-long national holiday helped support sales, too. Yet, the post-pandemic recovery in the market has been sluggish. The YTD selling rate averaged 25.3 million units/year, which is lower than last year’s total LV sales of 26.7 million units. It is reported that the central government instructed local governments and financial institutions to introduce measures to boost vehicle sales and automotive financing.

Other Asia

The Japanese market remained robust in May, as the improved supply of semiconductors continued to help boost production. The removal of pandemic-related restrictions, the return of foreign tourists, and strong wage growth have lifted consumer confidence, too. The May selling rate reached 4.8 million units/year. In YoY terms, sales increased by 25.4% in May (the fifth consecutive month of double-digit growth) and 18% YTD against a low year-ago base. Yet, OEMs are still struggling to meet many backlogged orders.

The Korean market maintained solid sales in May, with the selling rate reaching 1.8 million units/year. Sales of locally assembled vehicles increased by 9% YoY, with all OEMs (except Renault Korea) posting positive YoY growth. In contrast, sales of imported vehicles declined by almost 15% YoY in May, as the popular German brands continued to experience supply shortages. Of note, Tesla’s sales plunged by 77% YoY in May, facing increasing competition from Korean BEVs, which are benefiting from the greater government BEV subsidies.

South America

Brazilian LV sales are estimated to have decreased by 5.3% YoY in May, as 166.4k units were sold. However, the selling rate slightly increased by 4.2k units/year to 1.97 million units/year in May, from 1.96 million units/year in April. Inventory levels increased greatly in May, to 251.7k units, rising dramatically compared to the 206.1k units in April. Also following the increase in inventory, the days’ supply increased strongly, to 43 days in May, compared to 35 in April.

In Argentina, LV sales are estimated to have increased in May to 37.2k units, up by 13.6% YoY. Also following this increase, the selling rate slightly increased to 425.2k units/year in May, up from 421.6k units/year in April. This is the third consecutive month in which the selling rate has exceeded the 400k units/year mark, as the market appears to remain resilient against economic headwinds.