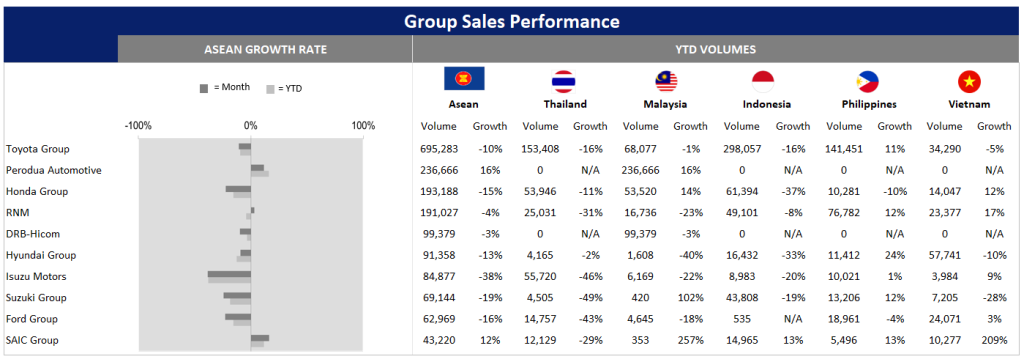

The ASEAN Light Vehicle (LV) market dropped by 7% YoY in August and 7% YoY from January to August 2024. This negative sales performance was weighed down by double-digit declines in Indonesia and Thailand.

In Indonesia, sales plunged by 15% YoY in August and 17% YoY in the first eight months overall. According to Daihatsu’s management, the market was impacted by tightened credit approvals and lower purchasing power. Furthermore, many consumers and businesses adopted a wait-and-see approach around the presidential election in February, and many are likely still waiting until the new president takes office on October 20, 2024, and potentially announces incentives for vehicle sales.

Key developments for the Indonesian market include GAIKINDO’s request for a tax cut policy in early October, following the current government’s rejection of GAIKINDO’s proposal for tax cut measures in August, as well as the central bank’s surprise interest rate cut from 6.25% to 6.0% in September. However, the interest rate cut is not expected to have a significant impact on LV sales, as it remains high compared to the rate of 3.5% that was seen during the COVID-19 era, and the financial sector may not loosen credit approvals due to high nonperforming loans (NPLs). Due to this negative sentiment, the country’s LV sales will drop by 14% YoY to 799k units in 2024.

In Thailand, LV sales continued to decline by 24% YoY in August, resulting in a 23% YoY decrease from January to August. By vehicle type, Passenger Vehicle (PV) and Light Commercial Vehicle (LCV) sales fell by 14% YoY and 38% YoY, respectively, in the first eight months. This downturn can be attributed to a weak economy, with financial institutions tightening car loan criteria to mitigate the risk of NPLs, as high household debt undermines consumer purchasing power. It is important to note that household debt has escalated to nearly 90% of GDP from approximately 80% prior to the pandemic. Additionally, the delayed approval of the government budget has resulted in postponements of public projects, adversely affecting LCV sales.

The overall outlook for the Thai LV market continues to pose challenges, with sales anticipated to encounter persistent obstacles in the short term. Projections for 2024 now indicate a decline of 24% to 580k units, which would be the lowest level recorded since 2009. Moreover, the severe floods affecting the north and northeast of the country are likely to have adverse effects on agriculture, tourism, and the broader economy.

In contrast, Malaysia, the Philippines, and Vietnam all experienced sales growth. Malaysia’s LV volumes increased by 8% YoY from January to August, with LCVs (accounting for 7% of total sales) dropping by 9% YoY, while the larger PV segment (accounting for 93% of total LV sales) surged by 9% YoY. This indicates that Malaysia’s LV sales were primarily driven by PVs, thanks to the large backlog of orders created by the government’s temporary tax cut measures and automakers’ policies to compensate buyers whom companies could not deliver to before the policy expired—particularly the market leader, Perodua.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBased on our advanced data, sales in September dropped by 14% YoY and 21% MoM. The sluggish sales performance in the month was likely due to two key factors: a) Malaysian consumers awaiting the announcement of the government’s Budget 2025 in October, which included auto, transportation, and economic stimulus measures; and b) Perodua’s sales falling by 18% YoY in the month, implying that the backlogged orders should be fulfilled. As such, Malaysia’s LV volumes are expected to decline for the rest of the year, with sales in full-year 2024 projected to drop by 0.4% YoY to 790k units.

LV volumes in the Philippines grew by 9% YoY from January to August, driven by pent-up demand following the pandemic, robust remittance inflows from overseas Filipino workers, alleviation of supply constraints, and the market entry of Chinese automakers offering competitively priced vehicles. For the outlook, 2024 sales are projected to rise by 6% YoY to 462k units, marking the country’s highest annual figure.

After Vietnam’s LV market fell by 20% YoY in 2023 and 9% YoY in Q1 2024, sales gradually improved and increased by 4% YoY from January to August. This recovery is attributed to the country’s large export and export-driven manufacturing sectors rebounding strongly from last year’s slump, along with a booming tourism sector. These positive developments in the economy are boosting confidence, investment, and consumer spending. As a result, Vietnam’s 2024 sales are projected to increase by 3% YoY to 391k units.

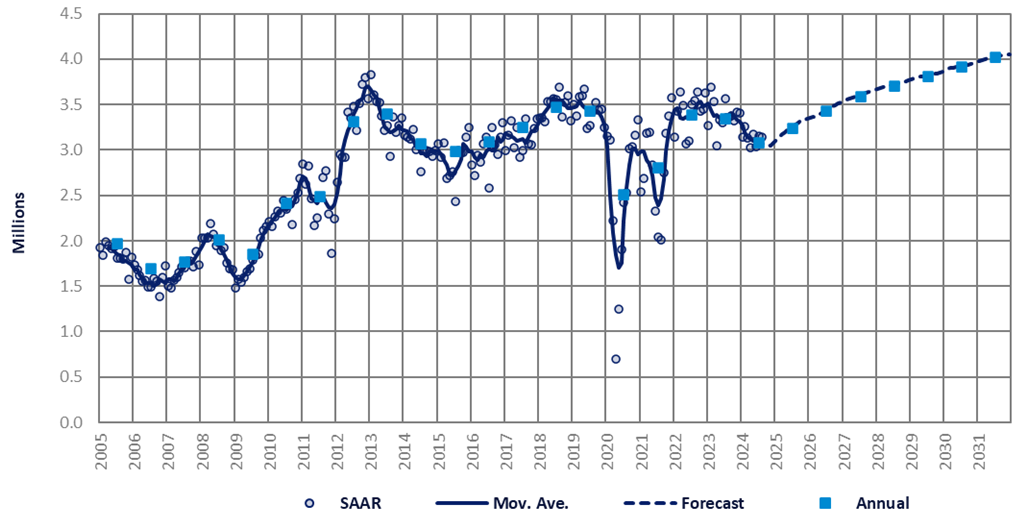

Combining all countries, ASEAN LV sales are currently projected to drop by 8% YoY to 3.00 millon units in 2024, weighed down by weak demand in Indonesia and Thailand. However, total sales could fall below 3.00 million units for the full year, as severe flooding in Thailand may impact LV demand and consumer spending, alongside the negative sales trend in Indonesia

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.