It is hard to believe that we are in July, but as the year flies by, it leads us to a question. Amid so much disruption, how did sales fare in the first half of the year in the US?

Here are some “races” that I have been following closely and our view of what to expect in the second half of 2022.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

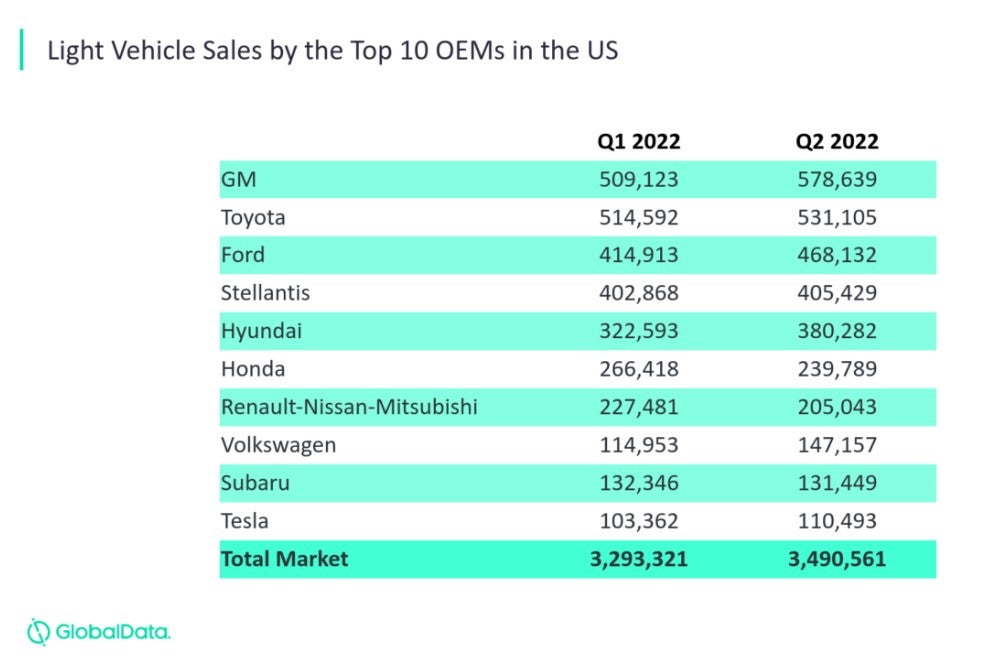

GM vs. Toyota: Toyota started the year ahead of GM by 16k units, they tied in February, and GM was ahead of Toyota in March-June, ending the first half of 2022 with a 42k-unit advantage. If the Detroit 3 were severely affected by the chip crisis last year, this year Asian OEMs have faced more disruptions, exacerbated by China’s zero COVID-19 policy. Well, not only Asian OEMs. Buick sales plunged by 57% YoY as only one of its vehicles is built in the US. GM’s size masks some of its struggles. Volumes of the Chevrolet Traverse, for example, were down by 47% YoY and even profitable SUVs such as the GMC Yukon faced double-digit declines. But not all is bad news for Toyota. Only the Toyota brand sold more than 900k units in January-June, outselling Ford by 74k units. With just over 200k units sold, the Toyota RAV4 was ahead of the Ford F-150 by 19k units, and the F-150 itself was barely the second most popular model, ahead of the Chevrolet Silverado by just 500 units. We forecast that GM will end 2022 ahead of Toyota by 145k units and that the Toyota brand will outsell Ford by 150k units.

Honda vs. Hyundai: June was the best month for Hyundai so far this year, but the weakest for Honda. Honda has struggled to secure parts, and its sales plunged by 39% from January-June 2021, the worst result of any OEM. Honda lost 2.6 pp of market share, accounting for just 7.5% of US sales – its weakest performance in 20 years. Sales of only two vehicles grew. It sold 5k units more of the Honda HR-V and 63 units more of the Acura NSX, while it lost 97k units of the Honda CR-V, its bestseller with 117k units. On the other hand, Hyundai’s most popular vehicle, the Hyundai Tucson, totaled 84k. Helped by a much wider portfolio, we forecast that Hyundai will outsell Honda by 450k units this year and will remain ahead through 2034.

Tesla vs. everybody: Tesla has led the Premium segment since January, with its sales soaring by 71% YoY through June. The Model Y barely kept its title of bestselling Tesla, with the Model 3 behind it by just 1,400 units. As Tesla focused on ramping up the Model Y in early 2021, sales of all other models struggled. Updating the Model S and X added further disruption – and made volumes of the Model S soar by 717% this year off a low 2021 base. While BMW led the Premium segment in January-June 2021, ahead of Mercedes-Benz by 7k units, Tesla was ahead of BMW this year by 61k units and helped the Premium segment to represent more than 16% of sales between April and June. The segment’s 16.5% share in June alone was the third highest on record, just behind December 2020 and December 2021 – usually Premium sales grow in Q4. In the second half of the year, the competition for second place will heat up. BMW was ahead of Mercedes-Benz by 12k units YTD, but the arrival of the new C-Class in May placed Mercedes ahead of BMW by 200 units in Q2. Yet, we foresee BMW selling about 13k units more in the year.

Pickups vs Cars: With the Detroit 3 being hit harder by the semiconductor shortage in 2021, Pickups’ victory over Cars was put off until this year. In the first six months of 2022, they were ahead by 41k units, after ending 2021 213k units behind Cars. While Cars lost 2.2 pp of share so far in 2022, accounting for less than 20% of sales for the first time, Pickups gained 1.6 pp. There are two main reasons behind this substantial gain: base effect and a new subsegment. In January-June 2021, Pickup sales were up by just 14% in a market that recovered by 29% – all other body types grew more than that. At the same time, Hyundai and Ford introduced their Compact models in July and September, respectively, and they sold a combined 57k units so far this year, more than enough to compensate for the 36k units that Midsize models lost. We project that Pickups will end 2022 with a 19.2% share, compared to Cars’ 18.4%.