The impacts of the war in Ukraine have been immediate and severe for the economies of Ukraine and Russia. The latter has been hit hard by Western sanctions that have effectively halted automotive foreign OEM branded operations (Renault-controlled AvtoVAZ is effectively a domestic player) indefinitely, in terms of both local manufacturing operations and imported parts or finished vehicles. Any meaningful resumption of automotive operations in Russia will be dependent on what happens in the geopolitical sphere. It’s probably not unreasonable to say that a policy reversal by Russia and a gradual return to something approaching normal for businesses through the course of this year is looking increasingly unlikely. Among the latest developments are suggestions in Moscow that foreign assets in Russia could conceivably be nationalised. It is very unclear how that could play out in practice, but automotive OEMs could be looking at some very big write-offs in worst-case scenarios. Some executives in Paris, in particular, may be having trouble sleeping.

As far as Ukraine’s automotive sector goes, the main impacts are on the supply chain front; the final market for vehicles there is relatively small at c.100-200k pa. Principally, the German OEMs have been caught out by their supply chains that extend into western Ukraine. Logistically, it is fairly close to Germany with good transport links through Poland. The Ukrainian workers are both relatively well-educated and low-cost. Wiring harnesses have emerged as an immediate pinch point in supply chains, but there are other components supplied by Ukrainian companies that OEMs will have to consider alternative supply arrangements for. The necessary supply chain adjustments will take time and there’s no avoiding the immediate disruption to some model lines at West European manufacturing plants.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

As exposed OEMs have struggled to secure vital components from the Ukrainian supply base, they have been forced to suspend light vehicle production at a number of facilities. Some, like Mercedes, have avoided complete stoppages by adjusting shift patterns. Nevertheless, OEMs and their suppliers will be working closely to minimise this disruption by re-sourcing components, although this is likely to take several weeks.

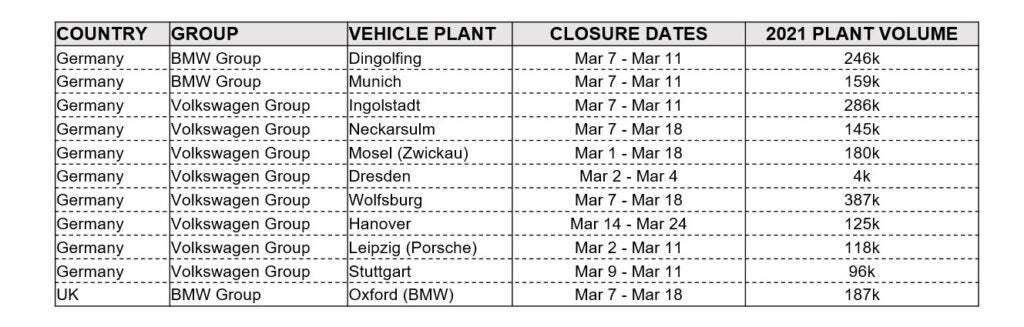

So far, Volkswagen and BMW have announced the following temporary plant closures at European facilities outside Ukraine and Russia. All but one are in Germany: BMW Mini – which extensively shares engineering architecture with other BMW Group models – in the UK is also heavily impacted.