Domestic sales by South Korea’s five main automakers combined surged by 18% to 124,515 units in September 2025 from 105,448 units a year earlier, according to preliminary wholesale data released individually by the manufacturers. The data do not include sales by South Korea’s low-volume commercial vehicle manufacturers, including Tata-Daewoo and Edison Motors, while import brands are covered in a separate report later in the month.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The sharp sales rise was attributed mainly to significantly more working days during the month due to the timing of the ‘Chuseok’ national holidays, which this year fall in October instead of September last year. The market last month continued to be supported by the recent roll-out of new products, particularly by the country’s largest automakers, Hyundai and Kia.

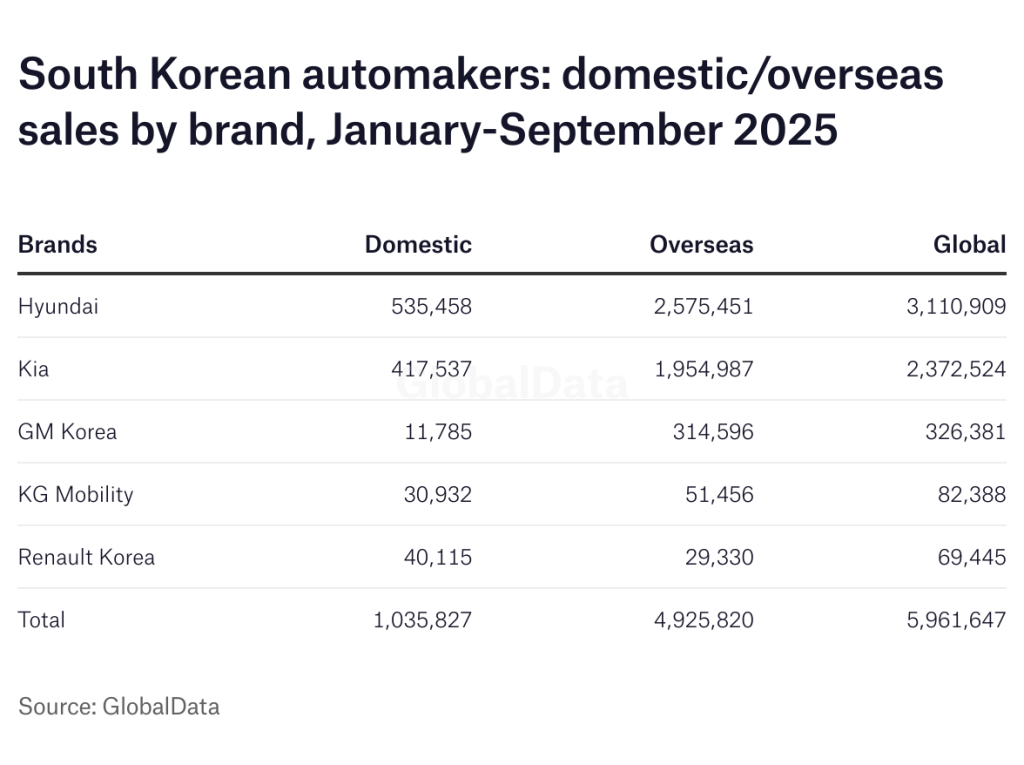

In the first nine months of the year, the country’s five main domestic vehicle manufacturers reported a 4.6% increase in domestic sales to 1,035,827 units, up from 990,558 units in the same period last year. Hyundai reported a 3.9% rise to 535,458 units, while Kia’s sales increased by 3.5% to 413,942 units. GM Korea was the worst performer, with sales plunging by 39% to 11,785 units, while KG Mobility reported a 16% drop to 30,932 units. Renault Korea was the best-performing brand in the domestic market so far this year, with domestic sales more than doubling to 40,115 units, following the recent launch of the Geely-based Grand Koleos Hybrid and the Scenic E-Tech.

Global sales by the country’s “big-five” automakers, including vehicles produced overseas, increased by 1.3% to 5,961,647 units in the first nine months of 2025 from 5,886,921 units a year earlier – with overseas sales up just slightly to 4,925,820 units from 4,892,500 units.

Hyundai Motor’s global sales rose by 8.3% to 372,298 vehicles in September 2025 from 336,140 a year earlier, with domestic and overseas sales both sharply higher. In the first nine months of the year, the company sold a total of 3,110,909 vehicles globally, up by 1.1% from 3,075,720 units sold a year earlier.

Domestic sales rose by 18.3% to 66,001 units last month from 55,805 a year earlier, helped by the favourable timing of the ‘Chuseok’ national holidays this year, resulting in a 3.9% increase to 535,458 units in the first nine months of the year from 515,605 previously. Overseas sales increased by 6.4% to 306,297 units in September from 287,872 units a year earlier, while year-to-date volumes were just slightly higher at 2,575,451 from 2,560,115 units, underpinned by strong growth in North America.

The company’s new EV plant in the US state of Georgia became operational last October, producing the Ioniq 5, followed by the Ioniq 9 earlier this year. A Kia model is also set to go into production in 2026. The automaker said it will expand capacity at the plant to 500,000 units per year later in the decade, from 300,000 at present.

Earlier this year, Hyundai set a target of 4,174,000 global vehicle sales for 2025, including its Genesis luxury brand, representing a slight increase over 2024 volumes. This includes 710,000 domestic sales and 3,464,000 overseas sales. The automaker said in August that it has agreed to increase its planned investments in the US by 24% to US$ 26 billion to increase local production and content, in support of South Korea’s ongoing import tariff negotiations with the US government.

Kia’s global sales increased by 7.3% to 268,238 vehicles in September from 249,900 a year earlier, supported by recently launched battery electric vehicle (BEV) and hybrid models, and strong demand for core SUVs such as the Sportage and Seltos, with 49,588 and 27,052 deliveries, respectively. In the first nine months of the year, Kia’s global sales rose by 2.3% to 2,372,524 units from 2,319,315 a year earlier.

Domestic sales surged by over 28% to 49,001 units in September from 38,140 units a year earlier, helped by the annual ‘Chuseok’ national holidays falling in October this year. The Sorento was Kia’s best-selling domestic model last month with 8,978 domestic deliveries, followed by the Carnival with 6,758 units and the Sportage with 6,416 units. Domestic sales in the first nine months of the year increased by 3.5% to 413,942 units from 399,990 a year earlier. The company sold a further 3,595 special purpose vehicles (SPVs) in this period, down from 4,000 a year earlier, most of which were military vehicles delivered domestically.

Overseas sales rose by 3.7% to 218,782 units in September from 211,060 a year earlier, and were up by over 2% to 1,954,987 units year-to-date from 1,915,415 units. The Sportage was the brand’s best-selling model overseas last month with 43,172 deliveries, followed by the Seltos with 22,087 units. In August, the company began production of its EV4 hatchback at its manufacturing hub in Slovakia, its first BEV to be produced in Europe.

Kia is targeting a 4% increase in global sales to 3,216,200 units in 2025, including 550,000 domestic sales, 2,658,000 overseas sales, and 8,200 SPV sales, supported by the recent launch of the new K4 and revamped K5 sedans and the Syros SUV in India. This year the company has also launched the new Tasman pickup truck, and the EV4, EV5 and PV5 battery-powered models. The company aims to sell 4.3 million vehicles globally by 2030, including 1.6 million BEVs.

GM Korea’sglobal sales plunged by 39% to 23,723 units in September from 38,967 units a year earlier, reflecting sharply lower domestic and overseas sales. Deliveries in the first nine months of the year were almost 6% lower at 326,381 units from 346,587 units. The locally-produced Trailblazer SUV and Trax crossover vehicle remain by far the company’s best-selling models, with most output shipped overseas.

Domestic sales continued to drop last month, falling by 37% to 1,231 units from 1,958 units a year earlier, with year-to-date sales down by 39 % to 11,785 units from 19,228 units, as the automaker struggled with rising competition from other domestic manufacturers and from importers.

Exports plunged by 39% to 22,492 units in September from 37,009 a year earlier, and were 4% lower at 314,596 units year-to-date from 327,406 units. Around 85% of output was shipped to the US last year, making the company particularly vulnerable to US import tariff hikes.

KG Mobility (KGM) reported a 39% surge in global sales to 10,636 vehicles in September from 7,637 units a year earlier, reflecting sharply higher exports. Total sales in the first nine months of the year rose by just over 2% to 82,388 units, compared with 80,643 a year earlier. The company, previously known as Ssangyong Motor, was acquired in late 2022 by a consortium led by local steel and chemicals firm KG Group.

Domestic sales declined by almost 10% to 4,100 units last month from 4,535 a year earlier, despite the recent launch of the Actyon Hybrid, and were down by 16% to 30,932 units year-to-date from 36,693 units, as the automaker struggled to keep up with rising competition from other domestic manufacturers and import brands.

Overseas sales more than doubled to 6,536 units in September from 3,102 a year earlier, resulting in a 17% rise to 51,456 units year-to-date from 43,950 units a year earlier, as the company continued to expand its global market coverage.

KGM plans to further expand its zero-emissions vehicle range, following the launch of a new minivan version of the Torres EVX battery-powered SUV last September and the new battery-powered Musso EV pickup truck earlier this year. The company has entered into a strategic partnership with China’s Chery Automobile Company, involving vehicle and platform sharing aimed at helping it strengthen its SUV line-up. The deal will also give KGM access to readily available new energy vehicle (NEV) technologies. The automaker recently said it aims to introduce at least eight new models by 2030.

Renault Korea‘s global sales rose by 1% to 8,710 units in September from 8,625 units a year earlier, with a sharp drop in domestic sales offset by stronger overseas shipments. In the first nine months of the year, global sales rose by over 7% to 69,445 units from 64,656 previously.

Domestic sales fell by over 16% to 4,182 units last month from 5,010 units a year earlier, resulting in year-to-date volumes rising by 111% to 40,115 from 19,042 units – following the recent launch of the new Geely-based Grand Koleos Hybrid SUV and the Scenic E-Tech BEV.

Exports increased by 25% to 4,528 units in September from 3,615 a year earlier, but were down by 36% to 29,330 units in the first nine months of the year from 45,614 units.

The company recently restructured its assembly plant in Busan, resulting in more production being allocated for the local market. A model based on the battery-powered Geely Polestar 4 is scheduled to go into production later this year.