Domestic sales by South Korea’s five main automakers combined rose by over 7% to 127,639 units in April 2025 from 118,978 units a year earlier, according to preliminary wholesale data released individually by the manufacturers. The data do not include sales by South Korea’s low-volume commercial vehicle manufacturers including Tata-Daewoo and Edison Motors, while import brands are covered in a separate report later in the month.

The domestic vehicle market last month continued to be driven by the recent rollout of new products, particularly by the country’s largest automakers Hyundai and Kia. Overall demand in the country remains sluggish, however, due to high household debt and weak sentiment – with consumers spending less on durable goods. Corporate sentiment has also taken a hit due to uncertainty over US trade policies.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The latest economic data show GDP shrank by 0.2% in the first quarter of 2025, after growing by 2.0% in 2024. The central bank continued to cut its benchmark interest rate in February, to 2.75% from a peak of 3.5% in 2024, to help support domestic consumption.

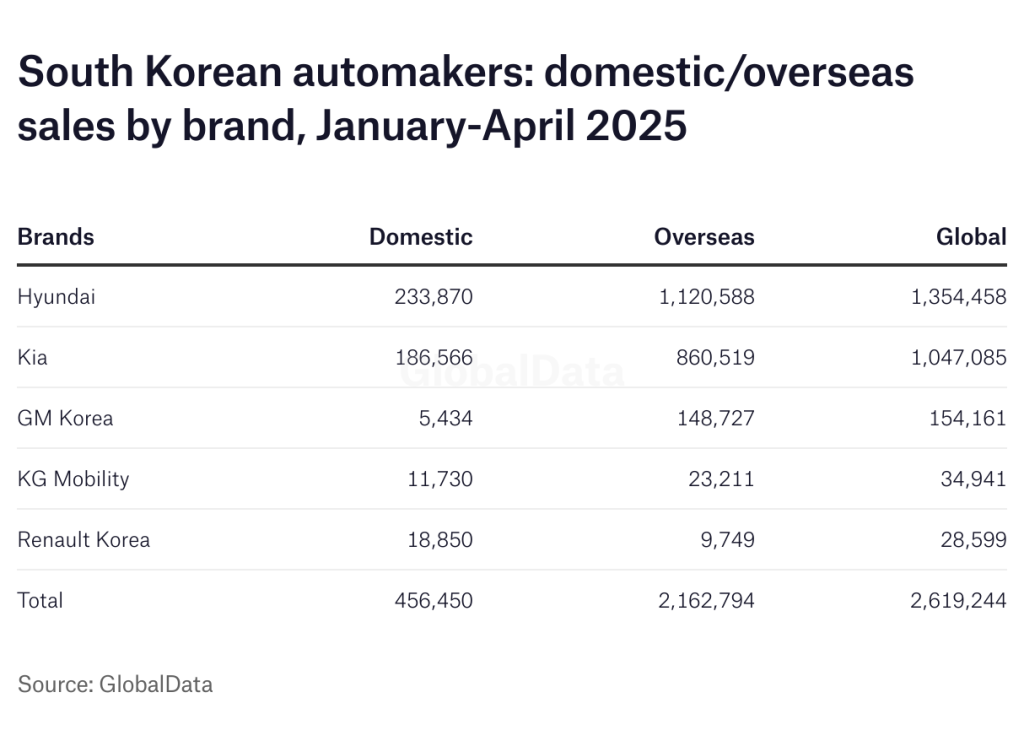

In the first four months of the year the country’s five main domestic vehicle manufacturers reported a 3.3% increase in domestic sales to 456,450 units combined, from 441,938 in the same period last year. Hyundai drove the market higher in this period with sales rising by 4.5% to 233,780 units, while Kia’s sales increased just slightly to 185,417 units. Renault Korea reported a 160% surge in domestic to 18,850 units, reflecting the recent launch of the new Geely-based Grand Koleos hybrid SUV, while KG Mobility saw its sales drop by 26% to 11,730 units and GM Korea’s volumes plunged by 41% to 5,434 units

Global sales by the country’s “big-five” automakers, including vehicles produced overseas, increased slightly to 2,619,244 units in the first four months of 2025 from 2,610,144 units a year earlier – with overseas sales declining slightly to 2,162,794 units from 2,167,755 previously.

Hyundai Motor’s global sales increased by 2% to 353,338 vehicles in April 2025 from 346,473 a year earlier, reflecting both stronger domestic and overseas sales. In the four months of the year the company delivered 1,354,458 units, slightly lowered compared with the 1,353,179 units sold previously.

Domestic sales rose by 6% to 67,510 units last month from 63,733 a year earlier, with SUVs accounting for 25,728 units while sales by its luxury brand Genesis amounted to 11,504 units. Year-to-date domestic sales were up by 4.5% to 233,870 units from 223,700 a year earlier.

Overseas sales increased by just over 1% to 285,828 units in April from 282,740 units a year earlier, while year-to-date volumes were 0.8% lower at 1,120,588 from 1,129,479 units, underpinned by strong demand in North America while sales in India weakened. The company’s new EV plant in the US state of Georgia became operational last October, producing the Ioniq 5 followed by the Ioniq 9 earlier this year. A Kia model is also set to go into production in 2026. The automaker said it will expand capacity at the plant to 500,000 units per year later in the decade from 300,000 at present.

Hyundai has set a global sales target of 4,174,000 vehicles for 2025, including its Genesis luxury brand, representing a slight increase over 2024 volumes. This includes 710,000 domestic sales and 3,464,000 overseas sales. To achieve this goal, the company said it will focus “on strengthening its market competitiveness with a stronger range of electrified models, including hybrids and battery electric vehicles, and scaling up local production at its global manufacturing facilities.”

Kia’s global sales rose by 5% to 274,437 vehicles in April from 261,283 a year earlier, reflecting stronger domestic and overseas sales. Growth was underpinned by strong demand for recently-launched SUVs such as the Sportage and Sorento, with 47,737 and 23,855 deliveries respectively, and the Seltos with 25,543 units. In the first four months of the year global sales rose by 2.5% to 1,047,085 units from 1,021,797 a year earlier.

Domestic sales rose by 7.4% to 50,005 units last month from 47,505 units a year earlier, with the Sorento being its best-selling model with 8,796 domestic deliveries, followed by the Carnival MPV with 7,592 sales and the Sportage with 6,703 units. Year-to-date domestic sales rose slightly to 185,417 units from 185,127 a year earlier, following a 14% decline in January. The company sold a further 1,149 special purpose vehicles (SPVs), up from 749 a year earlier, most of which were military vehicles delivered domestically.

Overseas sales increased by 4.6% to 223,113 units in April from 213,327 a year earlier and by 3% to 860,519 units year-to-date from 835,470 units, underpinned by a 21% rise in US sales to 273,649 units. The Sportage was the brand’s best-selling model overseas last month with 41,034 deliveries, including 16,178 in the US.

Kia is targeting a 4% increase in global sales to 3,216,200 units in 2025, including 550,000 domestic sales, 2,658,000 overseas sales and 8,200 SPV sales, supported by the recent launch of the new K4 and revamped K5 sedans and the Syros SUV in India. In the first quarter of the year the company roll out its new Tasman pickup truck and the EV4, to be followed by the EV5. Its medium-term plan is to sell 4.3 million vehicles globally by 2030, including 1.6 million BEVs.

GM Korea’sglobal sales fell by 6.3% to 41,644 units in April, down from 44,426 units a year earlier, with domestic and overseas sales both declining. Global sales in the four months of the year dropped by 9% to 154,161 units from 169,638 units previously. The Trailblazer SUV and Trax crossover vehicle remain by far the company’s best-selling models, with most output shipped overseas.

Domestic sales continued to drop sharply last month, by 42% to 1,326 units from 2,297 units a year earlier, with year-to-date sales plunging by 41% to 5,434 units from 9,216 units – as the automaker struggled with rising competition from other domestic manufacturers and from importers.

Exports declined by 4.3% to 40,318 units in April from 42,129 a year earlier and by over 8% to 148,727 year-to-date from 160,422 units. With around 85% of output shipped to the US last year, GM Korea’s CFO Paul Jacobson last month said the company may consider relocating its operations to the US if the recent US import tariff hikes become permanent.

KG Mobility (KGM) reported an 11% fall in global sales to 8,642 vehicles in April from 9,751 units a year earlier, reflecting lower domestic and overseas sales. Total sales in the first four months of the year were down by almost 11% to 34,941 from 39,077 a year earlier. The company, previously known as Ssangyong Motor, was acquired in late 2022 by a consortium led by local steel and chemicals firm KG Group.

Domestic sales fell by 3% to 3,546 units last month from 3,663 a year earlier, resulting in a 26% drop to 11,730 units year-to-date from 15,875 units, as the automaker struggled to keep up with rising competition from other domestic manufacturers and from importers.

Overseas sales dropped by over 10% to 5,386 in April from 6,008 a year earlier, but were still slightly higher at 23,211 units in the first four months of the year from 23,202 units, as the company continued to expand its global market coverage.

KGM plans to further expand its zero-emissions vehicle range, following the launch of a new minivan version of the Torres EVX battery-powered SUV last September. Earlier this year the company launched the new battery-powered Musso EV pickup truck.

KGM has entered into a strategic partnership with China’s Chery Automobile Company, involving platform licensing and product sharing aimed at helping it strengthen its SUV line-up. The deal will also give KGM access to readily available new energy vehicle (NEV) technologies including vehicle platforms.

Renault Korea‘s global sales fell by just over 1% to 10,427 units in April from 10,572 units a year earlier, reflecting sharply lower overseas shipments while domestic sales rebounded strongly from weaker year-earlier levels. In the first four months of the year, global sales were up by 8% to 28,599 units from 26,453 previously.

Domestic sales tripled to 5,252 units last month from 1,780 units in the same month last year, resulting in year-to-date sales surging by 160% to 18,850 from 7,271 units – reflecting the recent launch of the new Geely-based Grand Koleos hybrid SUV. The company recently restructured its assembly plant in Busan, resulting in more production being allocated for the local market.

Exports fell by 41% to 5,175 units in April from 8,792 a year earlier, resulting in a 49% plunge in the first four months of the year to 9,749 from 19,182 units – mostly comprising shipments of the Arkana hybrid crossover vehicle (a rebadged XM3).

Renault Korea last year confirmed it will continue to overhaul its product range with a strong focus on SUVs, BEVs and hybrid vehicles, starting with the launch of the new Geely-based Grand Koleos hybrid SUV last July and the phasing out of its aging SM6 mid-size sedan at the end of last year. The company recently agreed to produce the Geely Polestar 4 BEV at its Busan plant from the second half of 2025, for sale domestically and for export.