Sales of Chinese-made vehicles, including exports, rose by almost 15% year-on-year to 3.226 million units in September 2025, up from 2.809 million units a year earlier, according to passenger car and commercial vehicle wholesale data compiled by the China Association of Automobile Manufacturers (CAAM). Domestic sales increased by 9% to 2.470 million units, while exports surged by over 40% to 756,000 units.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In the first nine months of 2025, total sales of China-made vehicles increased by almost 13% to 24.363 million units, including an 8% rise in domestic sales to 18.679 million units, while exports rose by 32% to 5.684 million units.

The domestic vehicle market this year has been driven by an increase in government stimulus measures, including vehicle trade-in incentives and cuts in vehicle purchase taxes, which have favoured mostly new energy vehicles (NEVs). The market has also responded to strong price competition among domestic vehicle manufacturers and numerous new model launches over the last year.

Sales of new energy vehicles (NEVs) rose by over 35% to 11.228 million units year-to-date, accounting for over 46% of total deliveries by the country’s automakers. Battery electric vehicle (BEV) sales surged by 43% to 7.212 million units, while plug-in hybrid vehicle (PHEV) sales rose by 20% to 4.014 million units – with growth slowing sharply in the last several months. Domestic NEV sales rose by 30% to 9.475 million units year-to-date, while exports rose by 89% to 1.758 million units.

Overall vehicle production in the country increased by almost 13% to 24.333 million units year-to-date, compared with 18.674 million units in the same period last year.

There is some uncertainty, but the Chinese government is expected to reduce its stimulus measures at the end of 2025, with a 5% purchase tax expected to be reinstated for NEVs, compared with 10% for conventional internal combustion engine (ICE) vehicles.

Overall vehicle deliveries are expected to remain strong in the fourth quarter, resulting in around 32.5 million global deliveries in the whole of 2025, including 16 million NEV sales, while exports are expected to exceed 6.5 million units.

Manufacturer performances

BYD’s global sales fell by 6% to 396,270 units in September, resulting in an 18% rise to 3,260,146 units in the first nine months of 2025, including a 134% rise in overseas sales to 697,072 units. Overall sales of passenger PHEVs increased by just 3% to 1,612,959 units, while passenger BEV sales surged by 37% to 1,605,903 units, and commercial vehicle sales jumped by 260% to 41,284 units.

SAIC Motor reported a 20% increase in global sales to 3,193,270units year-to-date, driven by a 38% surge in SAIC-GM-Wuling’s deliveries to 1,157,655 units. SAIC-VW’s sales fell by 3% to 752,411 units, while SAIC-GM’s sales rebounded by 37% to 380,695 units from depressed levels a year earlier. Overseas sales increased by 3.5% to 765,043 units, while global NEV sales surged by 45% to 1,082,826 units.

Geely Automobile Holdings reported a 29% rise in global sales to 2,953,452 units in the first nine months of 2025, including sales by its overseas affiliates.

Chery Automobile’s sales rose by over 14.5% to 2,007,768units, with exports increasing by 12% to 936,428units, while GAC Group, including its joint ventures with Toyota and Honda, reported an 11% sales decline to 1,183,653 units. Great Wall Motor’s sales increased by 8% to 919,816 units, with overseas sales rising by 5% to 333,461 units.

Tesla’s Shanghai factory sales fell by 10% to 606,364 units year-to-date, with sales in China falling by 5% to 432,704 units despite the recent launch of the revised Model Y, while exports fell by 19% to 173,660 units.

GlobalData China domestic market forecast

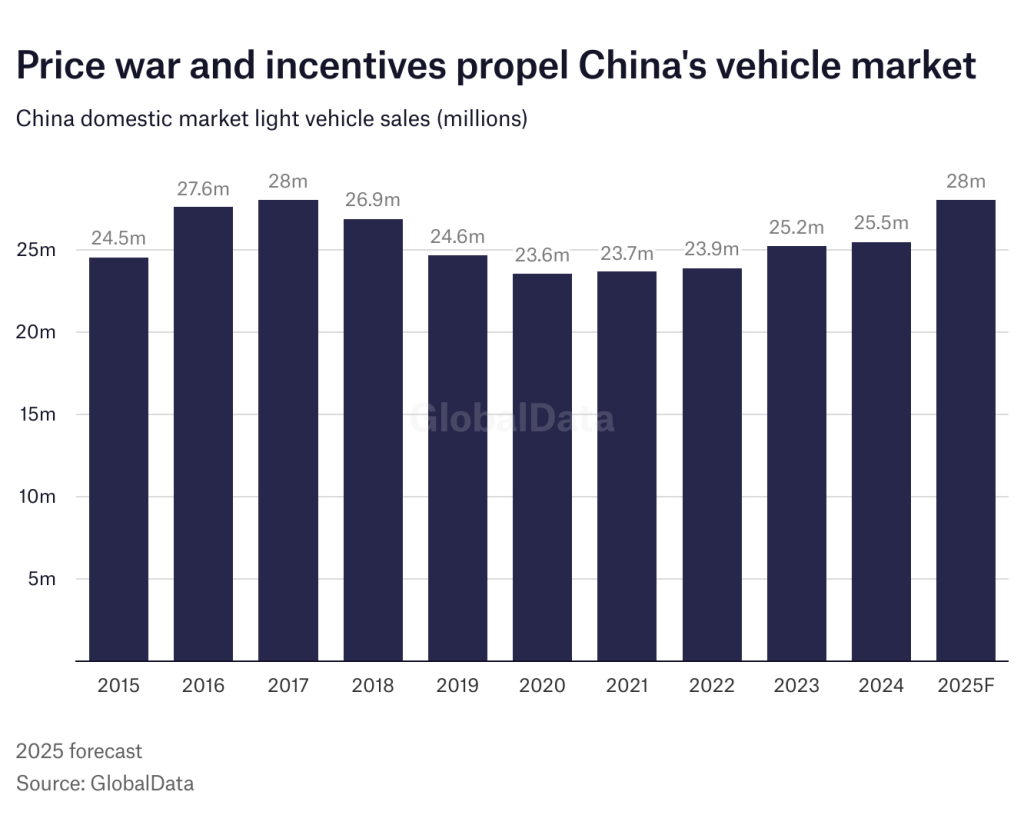

Government trade-in subsidies have been driving market momentum this year – with the 2025 market forecast at 28m units. However, following the Chinese government intervention regarding the price war, discounting has showed some signs of easing as fewer models have been discounted through the summer.

Chinese OEMs have eroded the market’s pricing in a bid to gain market share in a fiercely competitive modern vehicle market in recent years.

Chinese officials have stepped in to put an end to this, meeting with heads of the largest OEMs including BYD, where they instructed manufacturers not to offer what they deemed unreasonable discounts. The EV market has been the main battleground in the price war, as domestic and international demand for affordable electric driving has been rising.