The slowdown in China’s battery electric vehicle (BEV) market over the last year has had a significant impact on the country’s developing industry, particularly among the less-established manufacturers and start-ups which have come under pressure from intensifying price competition as new brands and models continued to flood the market. Many start-ups have been busy trying to attract fresh investments to help scale up their operations and expand sales in their home market and overseas.

The country’s larger and better-funded BEV manufacturers, including BYD, Geely and offshoots of large state-owned vehicle manufacturers such as GAC Aion, have strengthened significantly over the last two years. These companies are also leading the industry’s rapid expansion into overseas markets.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

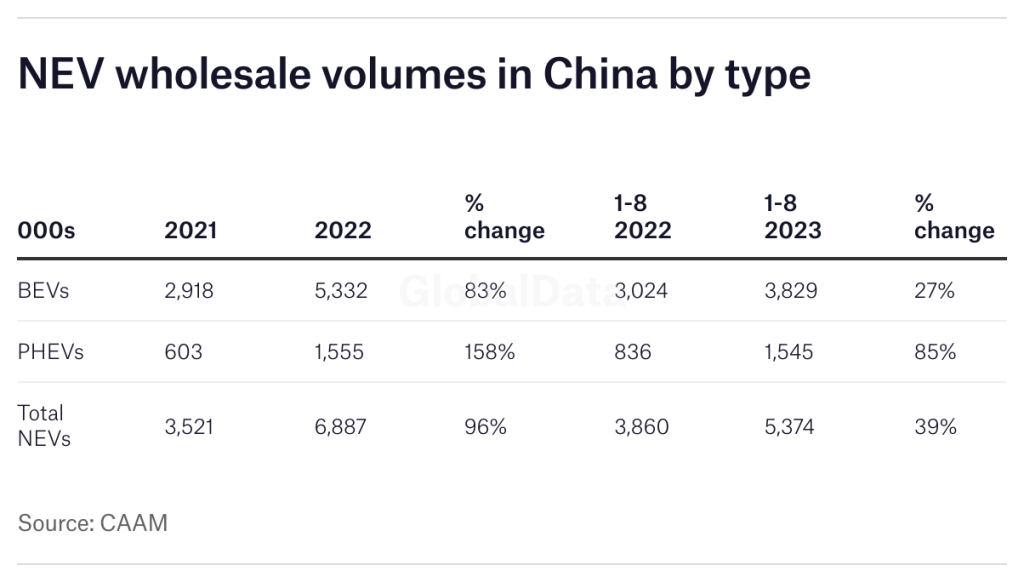

Growth in China’s new energy vehicle (NEV) market has slowed sharply from the fourth quarter of 2022, according to the China Association of Automobile Manufacturers (CAAM), particularly the BEV segment. In the first eight months of 2023 BEV sales increased by just 27% to 3.83 million units, after growing by 83% in 2022. Sales of plug-in hybrid increased by 85% in the same period after growing at twice that rate in the whole of 2022.

The economic slowdown in China has had a significant impact on consumer spending, particularly for expensive items such as BEVs. Last year’s spike in the price of battery minerals such as lithium is still being felt, putting additional pressure on the segment. Batteries packs can account for over 40% of the total cost of a BEV. Smaller manufacturers have struggled to hedge these rising input costs, while the larger more diversified automakers are better hedged.

With around 200 BEV manufacturers reported to be operating in China at present, including small regional low-tech manufacturers, industry analysts expect a wave of bankruptcies and significant consolidation to take place in the sector over the next few years. This process seems to be already well underway. According to local reports, at least 15 once-promising start-ups with a combined annual production capacity of 10 million BEVs have either collapsed or are on the edge of insolvency.

In October, BEV start-up WM Motor Technology Group Company Limited (WM Motor) filed for bankruptcy after it failed to scale up production sufficiently to pay down its debt. Founded in 2015, the company began implementing a significant cost-cutting drive last year including salary cuts and layoffs to help it stay afloat. Sales last year fell by one-third to around 27,500 units, while the release of its fifth model, the M7, was also delayed to reduce expenditure.

China Evergrande New Energy Vehicle Group, the fledgling EV unit of bankrupt property developer China Evergrande, is also struggling to raise funds to carry out its business plan. Nasdaq-listed NWTN (formerly Iconiq Motors), an automotive company headquartered in Dubai, has so far failed to fulfil an earlier agreement to acquire a stake and pump an extra US$500m into the company.

China Evergrande is said to have invested a staggering CNY47bn (CNY6.5bn) in its EV operations since 2018, including CNY25bn on acquiring core EV technologies and R&D and a further CNY22bn on facilities and machinery in the Chinese city of Tianjin. The company began making Hengchi-branded BEVs in 2021.

Most overseas vehicle manufacturers are also struggling to gain a significant foothold in the Chinese BEV market, with the notable exception of Tesla. In recent months foreign companies have been at the forefront of a new consolidation drive in the country’s BEV industry.

‘Living-rooms on wheels’

The barriers to entry into China’s mainstream BEV market have risen significantly, with manufacturers offering more smart, connected features and autonomous driving functions as standard in their vehicles. The country’s Ministry of Industry estimates that 40% new passenger vehicles sold in China this year have combined driver assistance, or Level 2 autonomous driving. With cars fast becoming “living-rooms on wheels”, having the right local connected and driver-assist features is also key to gaining market share in the country.

Volkswagen Group in July agreed to invest U$700m to acquire a 5% stake in local start-up Xpeng, as it looked to consolidate a new partnership involving the co-development of two new models by 2026. Volkswagen China’s CEO Ralf Brandsatter said at the time: “The deal will allow Volkswagen expand its position in China by tapping new customer segments and bring new intelligent, fully connected electric vehicles (ICV) to the market more quickly.”

Stellantis recently announced it has agreed to invest US$1.5bn to acquire a 20% stake Leapmotor, a local start-up with some 111,000 BEVs sales last year. The share acquisition is expected to become the foundation of a new global strategic partnership between the two companies, designed to strengthen their respective zero-emission vehicle sales in global markets including China. Stellantis is looking to tap into Leapmotor’s “highly innovative, cost-efficient EV ecosystem” to help meet its electrification targets under its core Dare Forward 2030 programme.

More deals like this will inevitably follow, involving both global automakers and also between domestic manufacturers, as Chinese growth remains sluggish and as vehicle manufacturers try to keep up with a fast-evolving market.