The automotive industry continues to be a hotbed of patent innovation. Activity in crash-safe battery protection systems is driven by the increasing adoption of electric vehicles (EVs), stringent government regulations, technological advancements, and competition among automakers. Examples include Toyota’s crash-safe system, Tesla‘s battery armor, and Volvo’s battery safety system. As EV adoption grows, more effective crash-safe battery protection systems are expected to be developed. The automotive industry is advancing with several innovative technologies in crash-safe battery protection. Toyota’s new system uses sensors, actuators, and structural reinforcements to protect battery packs in collisions. Tesla‘s battery armor, made of high-strength steel and aluminum, surrounds the battery pack. Solid-state batteries, a new type of battery, are being developed to make them less flammable and safer. PyroShield, a lightweight material, is being used in fire-resistant battery enclosures. These technologies are expected to revolutionize EV safety. In the last three years alone, there have been over 1.7 million patents filed and granted in the automotive industry, according to GlobalData’s report on Innovation in automotive: crash-safe battery protection. Buy the report here.

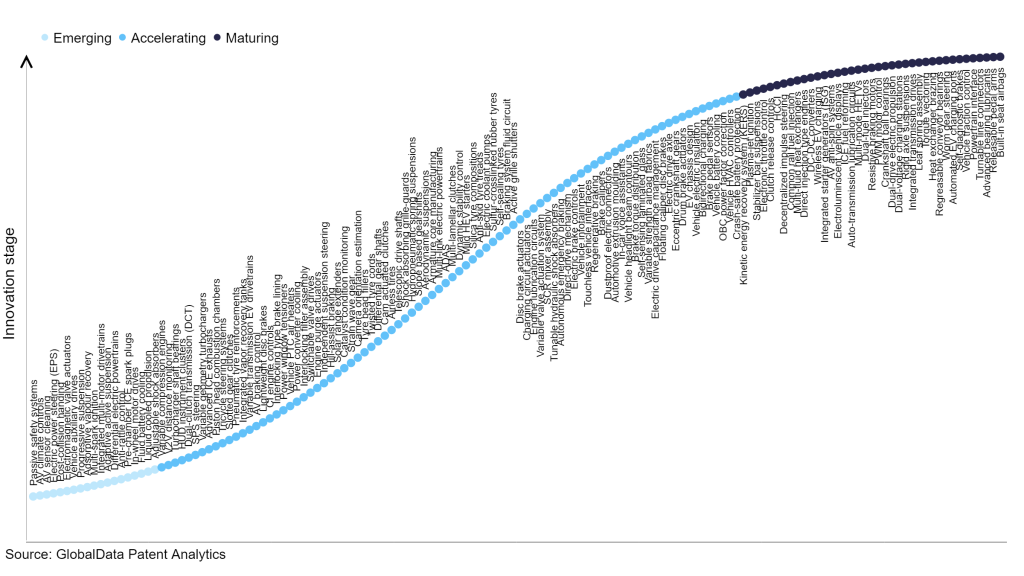

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

300+ innovations will shape the automotive industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the automotive industry using innovation intensity models built on over one million patents, there are 300+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, integrated multi-motor drivetrains, electric power steering (EPS), and post-collision handling are disruptive technologies that are in the early stages of application and should be tracked closely. Variable compression engines, V2V distance monitoring, and turbocharger shaft bearings are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are kinetic energy recovery system (KERS) and plasma-jet ignition, which are now well established in the industry.

Innovation S-curve for the automotive industry

Crash-safe battery protection is a key innovation area in automotive

The concept of crash-safe battery protection involves developing systems and methods for protecting batteries in commercial and heavy-duty vehicles during collisions. These systems may include structures for housing and securely mounting batteries in vehicles, as well as deformation-resistant and load-absorbing materials and designs to minimize damage to batteries in the event of a crash.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 30+ companies, spanning technology vendors, established automotive companies, and up-and-coming start-ups engaged in the development and application of crash-safe battery protection.

Key players in crash-safe battery protection – a disruptive innovation in the automotive industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to crash-safe battery protection

Source: GlobalData Patent Analytics

Toyota Motor is the leading patent filer in crash-safe battery protection for the automotive industry. They have consistently been at the forefront of innovation in this field, filing patents for a variety of technologies. One of their most recent patents is for a crash-safe battery protection structure for electric vehicles. This structure offers improved battery pack protection, enhanced occupant safety, and reduced vehicle weight. It has the potential to save lives and make electric vehicles more affordable. Other key patent filers in this space include Honda Motor and Porsche Automobil.

In terms of application diversity, BYD leads the pack, while LG and Mahle stood in the second and third positions, respectively. By means of geographic reach, ArcelorMittal held the top position, followed by Nikola and Renault.

To further understand the key themes and technologies disrupting the automotive industry, access GlobalData’s latest thematic research report on Automotive.

Premium Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.