EXOR NV – Fiat-Chrysler’s (FCA’s) largest investor – has confirmed the timing for the proposed FCA-PSA merger for completion by early 2021 as initially announced. It is both a timely reminder that the long-term drivers of mergers and acquisitions (M&A) in the automotive sector have not gone away and that the COVID-19 crisis and its impact on companies will actually accelerate restructuring.

The COVID-19 crisis will be adding pressures for corporate restructuring in the global automotive industry – for both vehicle manufacturers and companies in the supply chain.

The proposed FCA-PSA merger is on track to be completed in early 2021 and the sizeable synergies and efficiencies it brings – projected at €3.7bn a year before the crisis – have become even more important as the companies look at their recovery paths this year.

Combining operations creates the opportunity to look for further efficiencies and reduce cost at a time when the industry is having to endure an exceptionally tough business environment.

The two companies also face long-term challenges such as the CASE (Connected Advanced Shared Electrified) megatrends and developing strategies for the automotive sector’s industrial transformation.

The planned FCA-PSA merger will create the third largest global car company by revenues and fourth largest by volume, yielding the greater scale and resources to tackle CASE.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSimilarly, Tier 1 supplier BorgWarner has said that its planned acquisition of Delphi Technologies will go ahead. The deal’s drivers are similar to the FCA-PSA merger in terms of CASE megatrends and the need to exploit scale and synergies.

Again, they will also be very aware of the changed business landscape caused by COVID-19 and the benefits that combining for greater scale and cost reduction can bring.

Pressures are also building throughout the automotive supply chain. As the auto industry emerges from this unprecedented crisis, many suppliers will be financially stressed, in administration or close to going out of business. In these circumstances, M&A activity will get a boost as opportunities for acquisition at low price emerge.

The advanced emerging technologies involved in CASE – such as electrification – are much more expensive than longer established technologies, creating a heavy cost burden for supplier companies. That will have weighed particularly heavily on some suppliers during the crisis. Suppliers have also had to contend with delays to major vehicle programmes – such as Volkswagen‘s all-electric ID.3 – putting back future revenue flows.

Further, many of the companies in this area are start-ups. Their backers and financing thus far won’t have banked on such a cataclysmic series of events. These companies will be really hurting, backers will be reluctant to increase funding as CASE may take a back seat in the short-term and it’ll be more difficult for initial backers to see a pathway to returns. They may well want out.

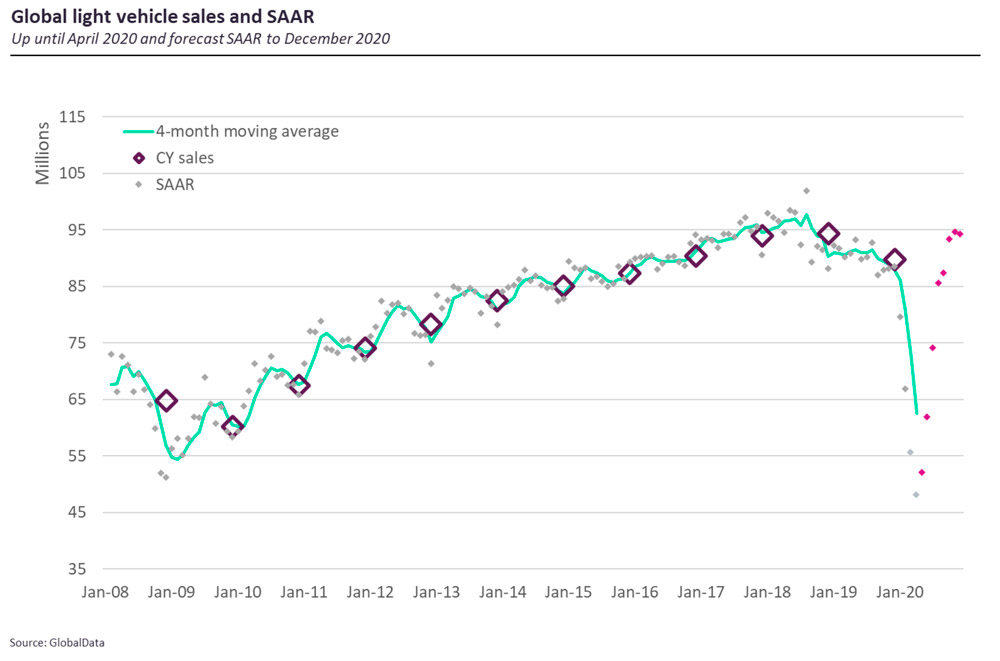

The upshot is further financial pressures – in concert with longer-term CASE drivers – coming to bear on OEMs and suppliers as a result of the COVID-19 crisis (as the chart below illustrates, sales have a long way to come back to get anywhere near to ‘normal’), creating the conditions for an upsurge to M&A activity as the industry recovers.