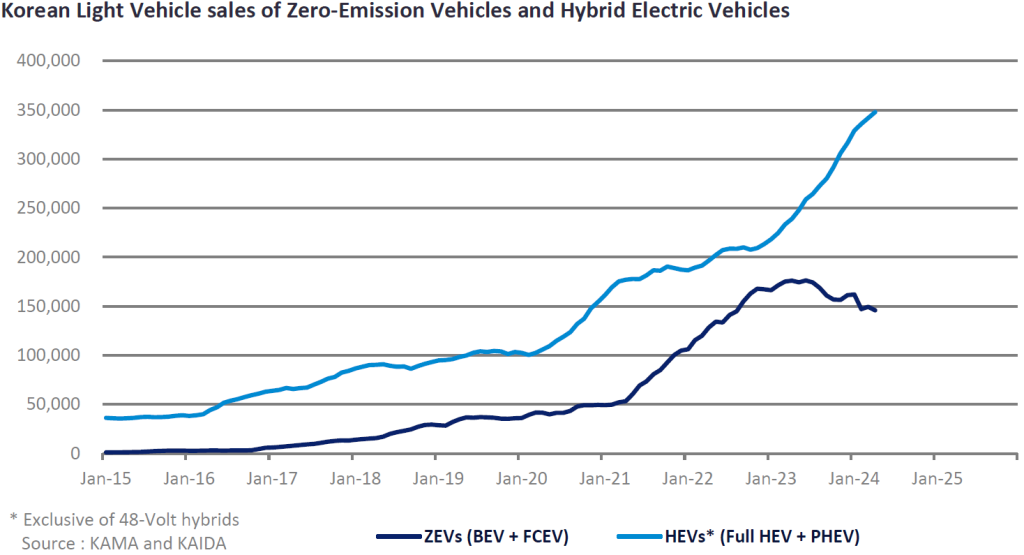

On a trend sales basis, represented by the 12-month rolling sum, Korean sales of Zero-Emission Vehicles (ZEVs) i.e., Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs), fell by 17% over the last year while sales of HEVs (full- and plug-in hybrids) increased by nearly 45%, as of April 2024. ZEV sales, 97% of which are BEVs, have been slowing since the second half of 2023, while HEV sales have been gaining greater growth momentum from early 2023. Sales of BEVS have decreased over the last year or so, but hybrid sales have increased more than BEV losses.

Amid all the BEV hype, hybrid models have quietly been taking great strides forward in Korea, overshadowing many flashy BEVs, and leaving them in their wake. Hybrid cars, still seen as a transitional step to full electrification, have never allowed fully electric vehicles to rule the electrified vehicle marketplace in Korea in the era of modern-day vehicle electrification.

We now believe that BEVs won over most Korean early adopters of electrification, but the majority of buyers aren’t yet along for the ride. Most conventional buyers remain wary of the steep cost of buying a BEV and charging it at commercial sites. In addition, charging speeds may be slow and the availability of charging stations may be limited. Lately, BEV owners are also seeing growing percentage decreases in the residual value of their vehicles. Feeling unsettled by a series of issues including range anxiety, charging anxiety and resale anxiety, mainstream buyers are finding good reasons not to buy BEVs when many hybrid models, with improved dependability and no clear reason not to buy, are now available.

Due to the current slowdown of BEV sales, dubbed the first crisis for full electrification, many Korean OEMs are reconsidering the viability of hybrid models to meet consumer demands. Even though returning to the old-school strategy runs counterintuitively to industrywide de-carbonisation commitments of recent years, the Hyundai group has positioned “hybrids” as a business pillar in tandem with their ZEVs, to help power foreseeable future growth. Following the failure of its previous BEV models in Korea, Renault Korea now appears to be betting entirely on hybrid vehicles for the next several years as the path to reducing greenhouse gas emissions.

Despite everything mentioned above, we believe a complete switch to carbon-free cars is necessary and inevitable. However, the transition may take longer than expected as HEVs are playing a more pivotal role in appeasing anxious drivers who baulk at jumping straight into more expensive and less convenient BEVs and FCEVs in Korea. Of note is that car buyers — not politicians, regulators, or carmakers — will dictate the pace of the transition in the end.

As today’s BEVs are too expensive for many, automakers are pursuing affordable BEVs in earnest. For example, Kia will launch the much-touted EV3, and Hyundai will soon launch a BEV version of its A-segment SUV, the Casper. However, the assumption that cost is the main reason consumers are not buying BEVs may be too naïve. In reality, BEV sceptics have a long list of genuine practical concerns underpinning their rejection of BEVs.

Many self-claimed experts, mocking hybrids as a bridge technology to BEVs, once predicted that aggressive government regulation and a consumer preference for zero-emission models would quickly extinguish the hybrid market. However, the Korean case study proves that the bridge to full electrification is long. We owe hybrids an apology.

Korean Light Vehicle Forecasting Team, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here