The recovery in global Light Vehicle (LV) demand in 2023 has been stronger than expected, as supply constraints eased in most markets. The outlook for 2023 has been increased by 4%, from 85.8 million units in January to 89.2 million units in November. However, this recovery and, more specifically, consumers still face headwinds from high vehicle prices (with the exception of China’s price war). High prices have kept the recovery in check and some consumers on the sidelines, as pressure on vehicle production eases.

With the current high-price environment as a backdrop, the progression of the Electric Vehicle (EV) transition and the potential for other external shocks, we can’t help but raise the caution flag about the prospects for the medium-term forecast and a recovery in demand to pre-pandemic levels. We had recently already trimmed the global LV forecast by an average of 7.5 million units a year throughout the forecast horizon, citing pricing pressure as the main driver. However, additional cuts to the outlook post-recovery could be on the horizon if pricing isn’t addressed.

Sustained higher prices effectively shrink the new vehicle market, causing it to behave more like a premium market, thus squeezing out some buyers that simply don’t have an option but to keep their vehicle, buy a used vehicle or not own one. Given the likelihood of manufactures embracing margin and not chasing volume, there is a plausible scenario that lowers demand further, adding more uncertainty to the billions invested in shifting and building vehicle capacity to support the push to electrification.

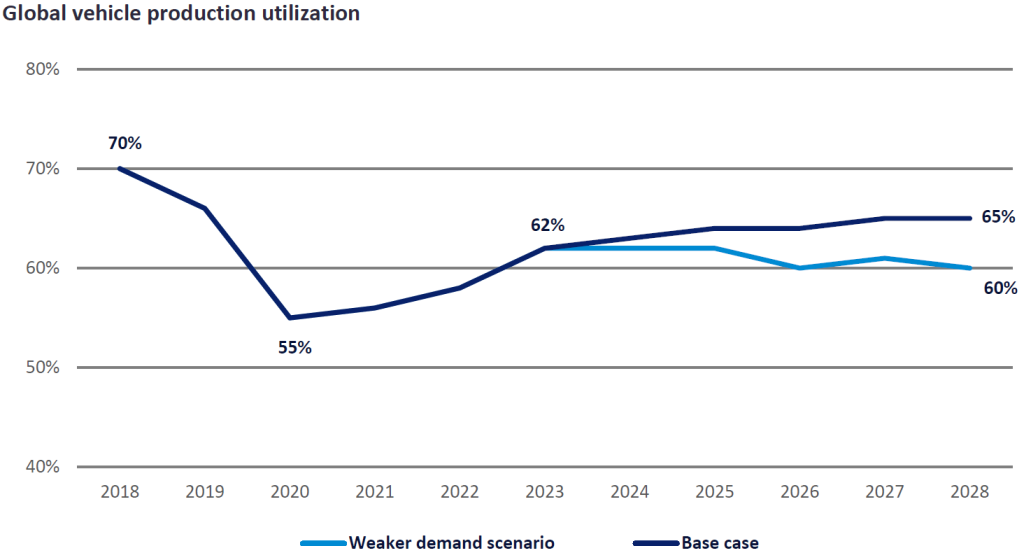

The potential for a smaller new vehicle market is real and poses a threat to production efficiency and capacity utilization. As illustrated by the chart above, global vehicle production utilization in 2018 was at 70%, which is at the lower end of the “healthy” 70-80% utilization range that is accepted in the industry. It is no surprise that utilization hit a low of 55% at the start of the pandemic, but has struggled to improve as the supply disruption took hold. We expect production to be much less constrained and for the natural law of supply and demand to take hold from 2024, which is good news for the industry. However, utilization is not expected to crest 70% in our forecast horizon, with global utilization at 65% in 2028 in our base forecast. Under a scenario with weaker demand, utilization falls to 60%, as investment in new electric plants drives up capacity that demand cannot support.

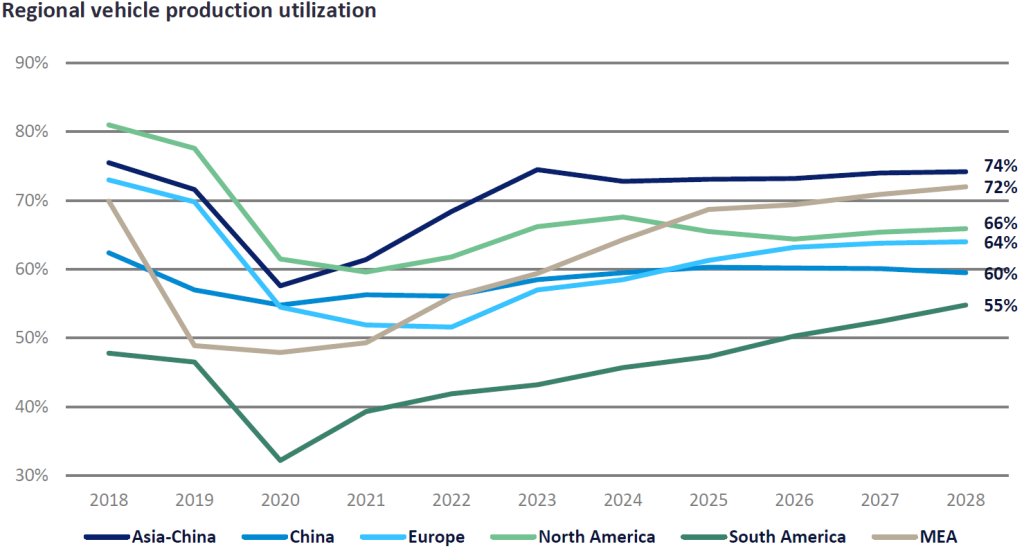

Not every market will have the same level of risk or concern. Of the major regions or markets around the world, South America continues to have the lowest level of utilization but is also the only market expected to exceed its 2018 level. However, an increase from 48% to 55% does not move South America out of the least-efficient position. Both North America and Europe are expected to continue to invest heavily in new EV capacity but are not expected to shutter unconverted internal combustion engine (ICE) capacity, given the uncertainty of EV consumer acceptance and volume growth. Both markets should be at, or near, the 80% utilization level, so with projections of 66% and 64% respectively, they are far from that mark. China has had a capacity utilization issue for most of the existence of an auto industry, primarily due to the fragmented regional or local markets. Consolidation has been something called out for the last 20+ years, so we shouldn’t expect much to change in China from that perspective. Asia, without China’s volume, is dominated by Japan and Korea, which typically operate high utilization levels, so it remains the strongest group of markets throughout the forecast horizon.

See Also:

In the ever-evolving landscape of the automotive industry, the lower utilization conundrum appears to be here to stay. This inefficiency is financially burdensome for manufacturers, raising questions about the long-term sustainability of maintaining such excess capacity. The automotive industry is, or soon will be, at a crossroads, and tough decisions lie ahead. The inevitable consequence of this overcapacity may be the closure of some manufacturing facilities, the consolidation of brands or weaker brands ceasing operations.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe road ahead may be challenging, but those who navigate it with foresight and adaptability will emerge as leaders in the new era of automotive.

Jeff Schuster, Vice President Research and Analysis, Automotive, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center