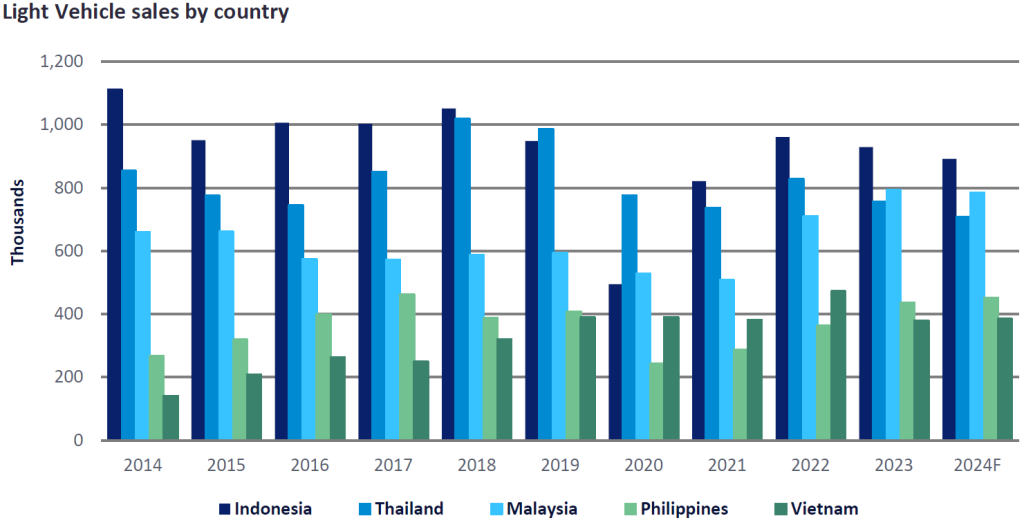

After Malaysia surpassed Thailand to become the second-largest Light Vehicle (LV) market in the ASEAN region in 2023, second only to Indonesia, our sales outlook requires careful consideration.

In 2023, Malaysia’s total LV sales increased by 12% YoY to a record high of 793k units. Meanwhile, the Thai and Indonesian markets experienced 9% and 3% YoY declines, with sales reaching 756k and 929k units respectively. Consequently, Malaysia has risen to the position of ASEAN’s second-largest LV market, overtaking Thailand—a notable shift given that Malaysia had consistently ranked third while Thailand and Indonesia alternated as the largest and second-largest markets for over a decade.

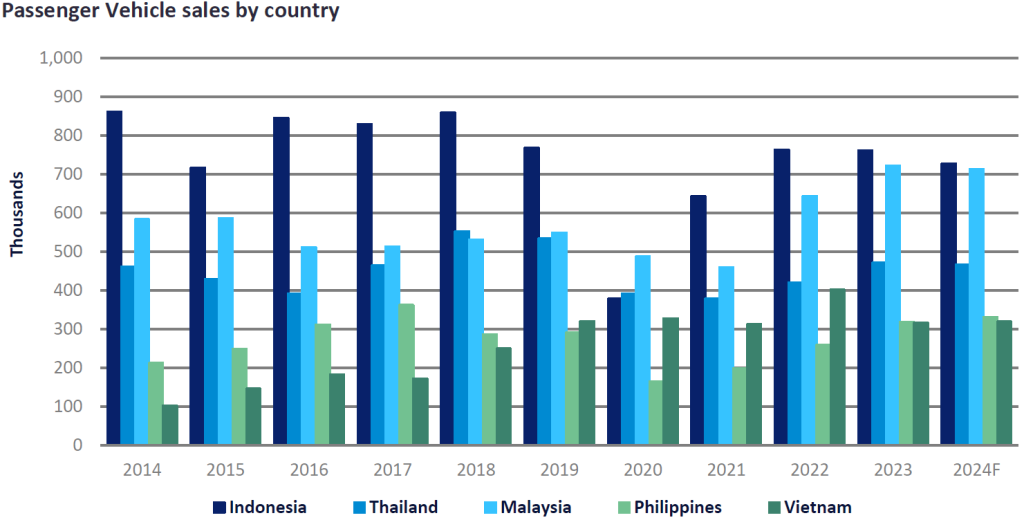

The government’s sales tax exemption policy bolstered the growth in Malaysia’s market last year. To stimulate demand and sustain sales momentum for the pandemic-impacted Passenger Vehicle (PV) sector, the government implemented a 100% sales tax exemption on locally assembled PVs and a 50% exemption on imported completely-built-up (CBU) passenger vehicles from June 15, 2020, to June 30, 2022. Registrations for these exemptions were required to be completed by March 2023.

However, the LV market in Malaysia faced challenges in 2020 and 2021, with sales declining by 11% and 4%, respectively. This was due to the on-off restrictions on sales activities during the pandemic and a semiconductor shortage that disrupted carmakers’ production plans and vehicle deliveries.

With the easing of the pandemic, sales in the Malaysian market surged by 40% to 711k units in 2022. However, this figure was still lower than Thailand’s sales of 827k units. From January to March 2023, sales in Malaysia rose by 22% YoY as carmakers rushed to deliver vehicles before the March 31, 2023, deadline. Despite the tax exemption scheme’s expiry in March 2023, the market remained robust, with a 9% YoY increase from April to December 2023. This resilience was due to aggressive promotions by carmakers to partially offset the end of the tax cut, a large backlog of orders—particularly from Perodua, the market leader—and the recovery of auto component supply chains, along with several new model launches. Perodua, notably, fully absorbed tax cuts for all booking orders that the company could not deliver by March 2023.

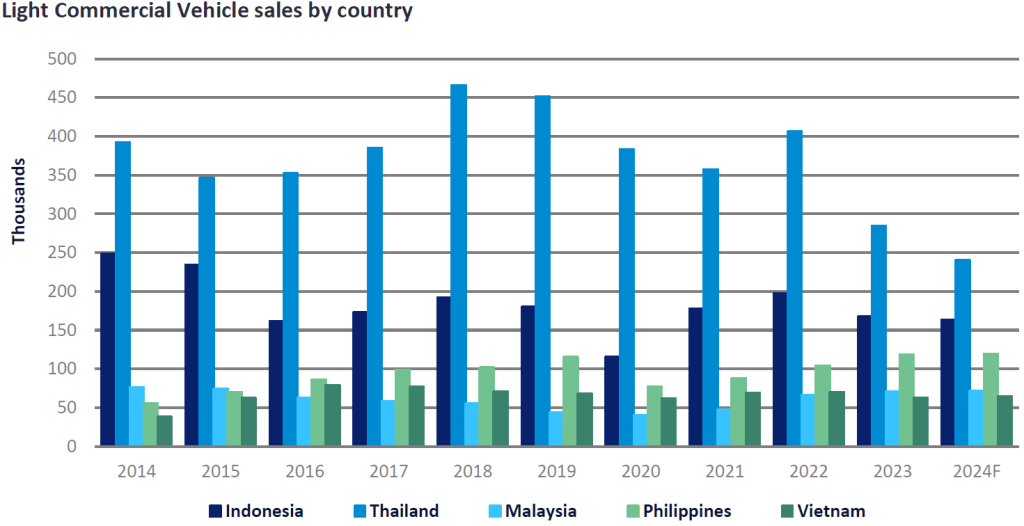

In contrast, Thailand’s LV sales in 2023 declined by 8.7% YoY to 756k units, a 23.4% decrease from the 2019 pre-pandemic level. The demand for passenger vehicles remained robust throughout the year, with sales increasing by 12% YoY to 471k units, driven by a surge in demand for Battery Electric Vehicles (BEVs), supported by government tax incentives and subsidies. However, Light Commercial Vehicle (LCV) sales plummeted by 30% YoY to only 284k units. Stricter credit policies, significantly reduced pickup truck sales as financial institutions grappled with rising non-performing loans (NPLs) in the automotive sector, particularly among Pickup Truck owners, and high levels of household debt. Local reports indicate that currently, 30-50% of auto loan applications are being rejected. Notably, one-ton pickup trucks, which are the most popular segment in the Thai market, accounted for 35% of Thailand’s total LV sales in 2023, falling from the average of 44% market share in the 2013 to 2022 period. Moreover, 96% of LCV sales in Thailand are one-ton pickups.

Over the past ten years, Malaysia has typically been the second-largest market for PVs after Indonesia, with Thailand ranking third. For the LCV segment, Thailand has been the largest market in the region and maintained its lead in 2023 despite a downturn in sales. However, when combining PV and LCV segments, Thailand’s total sales last year dropped to third place.

The Malaysian market started 2024 on a positive note. Local reports indicate a backlog of approximately 200k units at the end of January 2024. In the first quarter of 2024, sales increased by 6% YoY, driven by strong demand for newly launched models, including the next-generation Perodua Axia, Proton S70, and Honda WR-V. The entry of new Chinese manufacturers, such as Chery and BYD Auto, also contributed to the upward sales trend.

Perodua, Malaysia’s leading LV brand, which accounted for 42% of the country’s total LV sales in 2023, announced a 15.8% increase in sales from 97,438 units to 112,854 units for the period between January and April 2024. However, the company has maintained its sales target at 330k units for 2024, the same level achieved in 2023. This suggests that the company anticipates a potential decline in demand in the latter months of the year. Additionally, the waiting period for vehicle delivery has improved from 8-10 months last year to 1-5 months currently.

We predict that Malaysia’s LV sales will decelerate in the second half of the year as Perodua clears its backorders and the market adjusts to the end of the temporary tax exemption on PVs. We forecast a slight decline in Malaysia’s total LV sales for 2024, with an estimated decrease of 1% to 785k units.

Conversely, the Thai market had a weak start in 2024. Following last year’s 30% decline in the LCV sector, the pickup truck segment has not shown any signs of recovery. In the first quarter of 2024, LCV sales continued to disappoint, dropping by 43% compared to the same period in 2023. Additionally, the BEV sector saw a slowdown in February and March following the expiration of the government’s BEV cash subsidies under the EV 3.0 scheme on 31 January 2024, resulting in a nearly 12% YoY decline in the PV segment’s sales in the first quarter.

Early this year the government introduced the “EV 3.5 program,” the second phase of the Electric Vehicle (EV) policy. It offers a cash subsidy, albeit at a reduced level compared to the previous scheme.

While we initially anticipated a recovery in Thailand’s LV sales for 2024, current economic sentiment suggests another challenging year ahead. We project that total LV sales in Thailand will decrease by approximately 6% to 708k units.

In conclusion, Malaysia is poised to maintain its position as the second-largest LV market in the region for another year. Nonetheless, we anticipate that the Thai market will recover and surpass Malaysia’s sales again in 2025 after the large backlog of orders in the Malaysian market is fulfilled. We expect this trend to continue through our forecast horizon.

Tanitta Tumrasvin, Manager, Southeast Asia Forecasting, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here