Many thought the UK government was going to ban the sale of internal combustion engine vehicles from 2030. Instead, the government decided to push the ban back until 2035, in line with neighbouring EU markets.

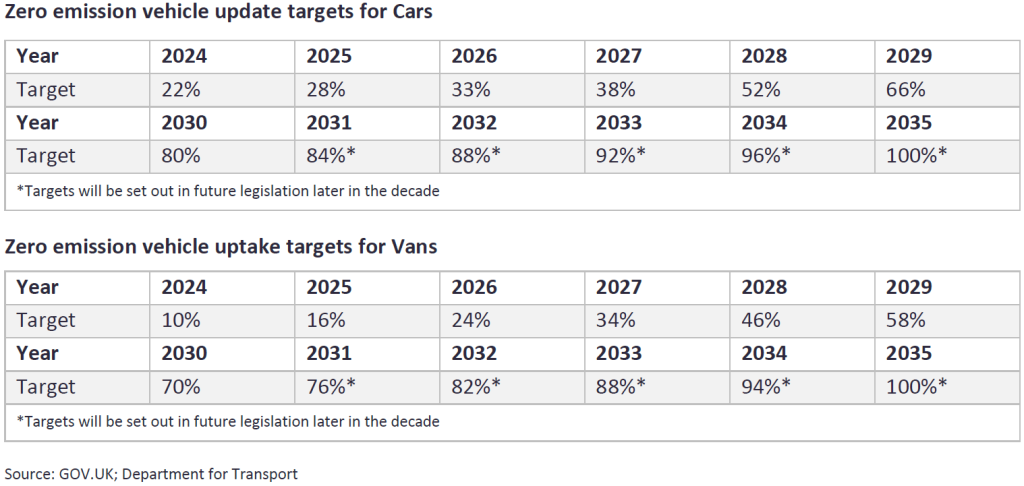

What the government also did, however, was announce its long overdue zero emission vehicle (ZEV) mandate which essentially requires carmakers to sell a certain percentage of ZEVs each year, with the target gradually increasing every year until they are fully adopted in 2035. For example, next year automakers must sell 22% ZEVs, before rising to 28% in 2025. Failure to do so puts automakers at risk of a hefty fine of up to £15,000 per vehicle above the threshold. However, there are some flexibilities through a trading scheme where automakers can sell, buy, bank, borrow or even convert CO2 emission allowances to help them meet the target.

While this policy will be welcomed by many, especially pure-play battery electric vehicle (BEV) carmakers who can potentially take advantage of flexibilities and allowances, it puts pressure on automakers who are behind the ZEV targets, such as Honda, Ford, Toyota and JLR. One safety net for these brands is that they can borrow up to 75% of their annual target in the first year, before falling to 25% in 2026.

That said, compliance may still be tricky for several brands, forcing them to prioritise selling BEVs versus other propulsion types. This could result in cheaper BEVs, particularly towards the end of the year, as OEMs scramble to meet compliance. What we might find later in the year is some OEMs holding back BEV deliveries ahead of the start of the mandate next year, in order to put them in a better position to meet the target, although the flexibilities and allowances should provide a cushion for most.

One potential headwind in the future for European-based automakers is the Rules of Origin (RoO) policy – a Brexit trade deal agreed under the Trade and Cooperation Agreement (TCA) which is set to come into force next year. What this means is that from 2024, electric vehicles may be subject to a 10% tariff if 45% of the value of the vehicle, 50% of the battery cell and 60% of the battery pack does not originate in the UK or EU. This makes it especially tricky for BEVs given that the relative value of a battery is between 30-50%, as well as considering that OEMs have not fully localised their upstream battery supply chains yet. For example, the European Automobile Manufacturers’ Association (AECA) predicts a compliance rate of around 10% in 2024.

This would have a negative effect on UK- and EU-based OEMs supplying BEVs to the UK and vice versa, with the Society of Motor Manufacturers & Traders (SMMT) claiming that EU-built BEVs would face an average price uplift of £3,400, while UK-built BEVs would increase by an average of £3,600. Not only would this make domestically-produced ZEVs sold in the UK-EU more expensive, it would give an upper hand to foreign OEMs, making them more price competitive. While this could have a noticeable effect on the BEV model and brand mix going forward, it could also make it harder for UK-EU carmakers to comply with the UK’s ZEV mandate, as well as potentially even reduce overall consumer demand for BEVs, considering the price increase.

While we are keeping a close eye on this policy, our current base case assumes a pragmatic solution will be found to overcome the RoO deal, with the trade policy likely to be pushed back a few years to allow OEMs to build up their BEV supply chains domestically. In terms of the ZEV mandate, over the short- to medium-term these flexibilities and allowances should really help OEMs who are behind the required ZEV target, until they have built up their BEV capabilities. However, one final food for thought is that if BEV demand does stall, then in theory we could see a contracted UK car market, unless the UK government is willing show some flexibilities to the annual ZEV target. In truth, this is not a completely unrealistic scenario given that most BEV deliveries have been from fleet sales, while private BEV sales have actually declined this year compared to the same period last year, which remains a concern.

David Leah, Senior Analyst, Powertrain Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center