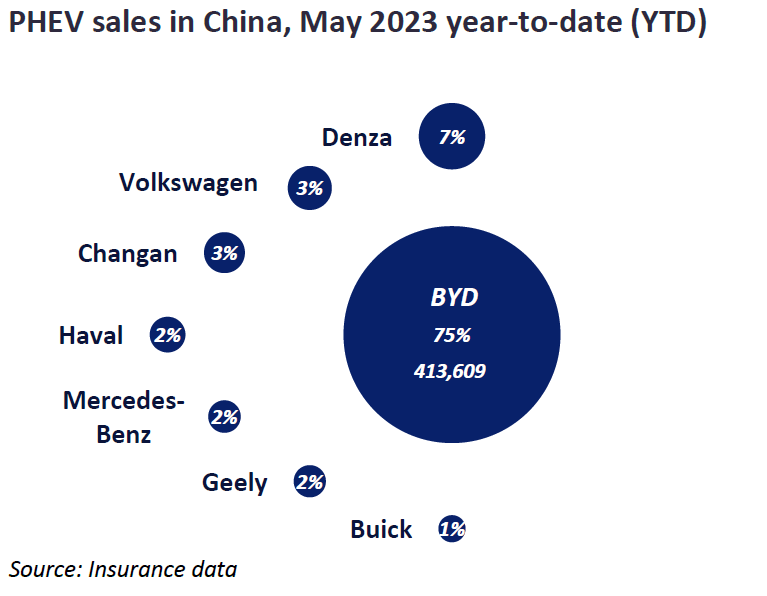

Since the Qin Plus DM-i model became the best-selling model in BYD’s portfolio in 2021, BYD’s market share in the new energy vehicle (NEV) sector has been rapidly increasing, with nearly half of its sales coming from plug-in hybrid (PHEV) models. The robust growth momentum of PHEVs continues. According to vehicle insurance data up to May of this year, BYD’s market share in the PHEV segment has reached 75% so far in 2023, with total sales volume exceeding 413,000 units. If we include its subsidiary brand Denza, the market share of the BYD group within the PHEV segment has reached 82%.

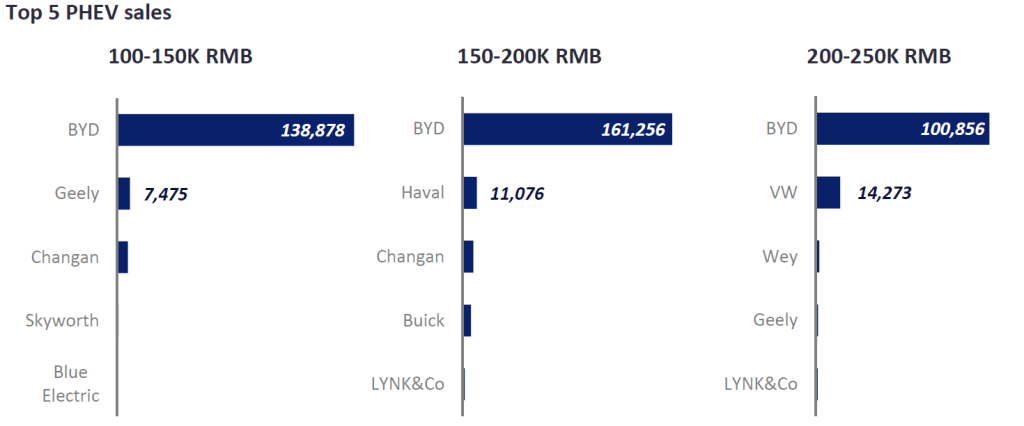

When we segment the market by different price ranges, we can see that BYD’s PHEV sales far exceed those of other automakers in the key price bands.

Despite the limited investment by European and American companies in PHEV models, many Chinese automakers, such as Great Wall, Geely, and Chery, introduced plug-in hybrid technology in 2022. However, even after more than one year of market competition, BYD’s dominant position in the PHEV segment remains unchallenged. Let’s analyse the underlying reasons for this from the perspectives of powertrain and pricing.

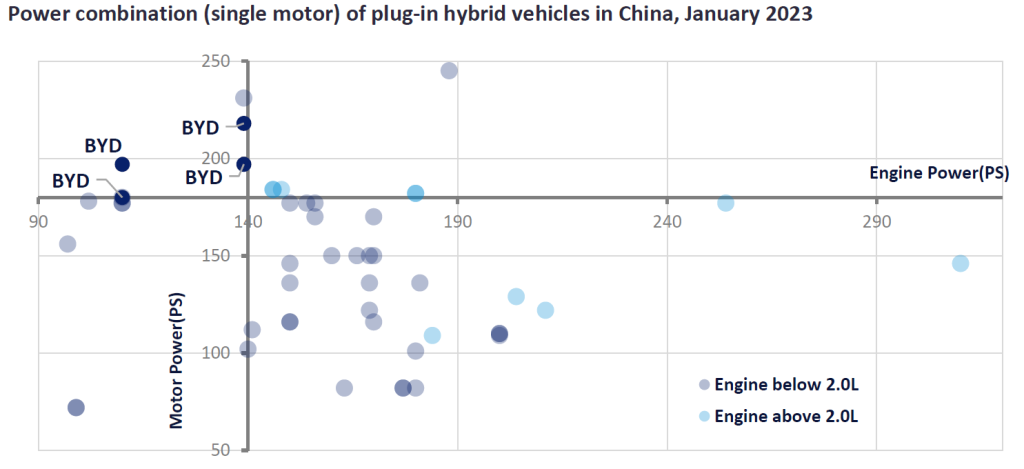

The chart below displays powertrain configuration combinations for plug-in hybrid vehicles (PHEVs) in the current Chinese market, the horizontal axis representing internal combustion engine (ICE) power, and the vertical axis representing e-motor power. The chart shows that BYD utilises high-power electric motors in their PHEV systems, with their 1.5L engine serving primarily as a power assist unit.

In contrast to BYD plug-in hybrid models, other OEMs employ multi-speed transmissions, allowing the IC engine to engage earlier in total power output, resulting in stronger overall performance. However, this may lead to lower fuel efficiency compared to BYD’s plug-in hybrid models.

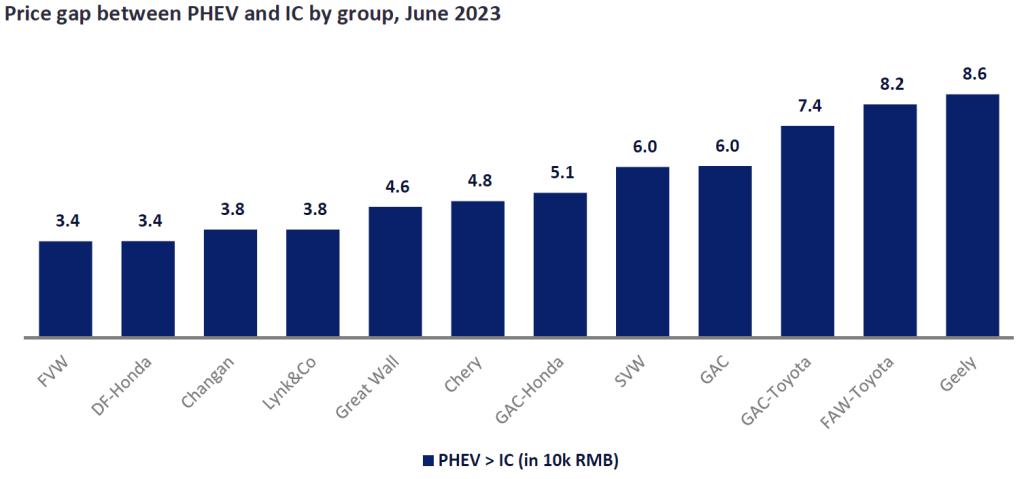

From a pricing perspective, BYD has a competitive advantage. At the beginning of the year, BYD announced a strategy of offering hybrid vehicles at the same price as their gasoline counterparts. They introduced a new version of the Qin Plus with a price below CNY100,000. On the other hand, other automakers have not completely abandoned conventional ICE configurations. Instead, they have added plug-in hybrid options to existing models. According to our calculations, the PHEV alternatives from other automakers in the market are approximately CNY50,000 more expensive (median) compared to their gasoline counterparts.

Considering the factors of powertrain performance and competitive pricing, we can maintain an optimistic outlook on the high sales volume of BYD’s PHEVs in the next 1-2 years. BYD’s strong powertrain capabilities and the attractive pricing it offers contribute to its market competitiveness and consumer appeal. If BYD continues to innovate and meet market demands, it is well-positioned to sustain success in the PHEV segment.

Patrick Zhang, Powertrain Market Analyst, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center