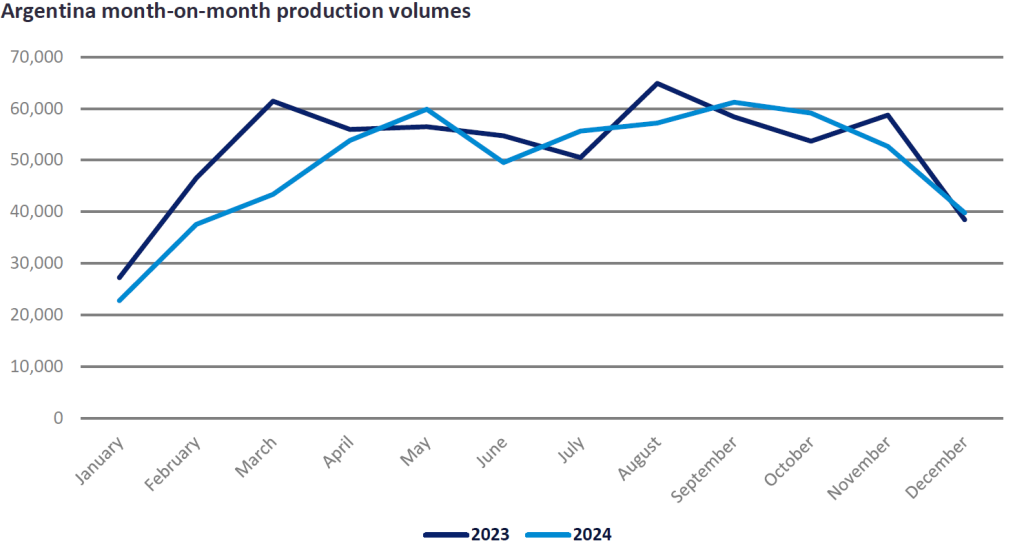

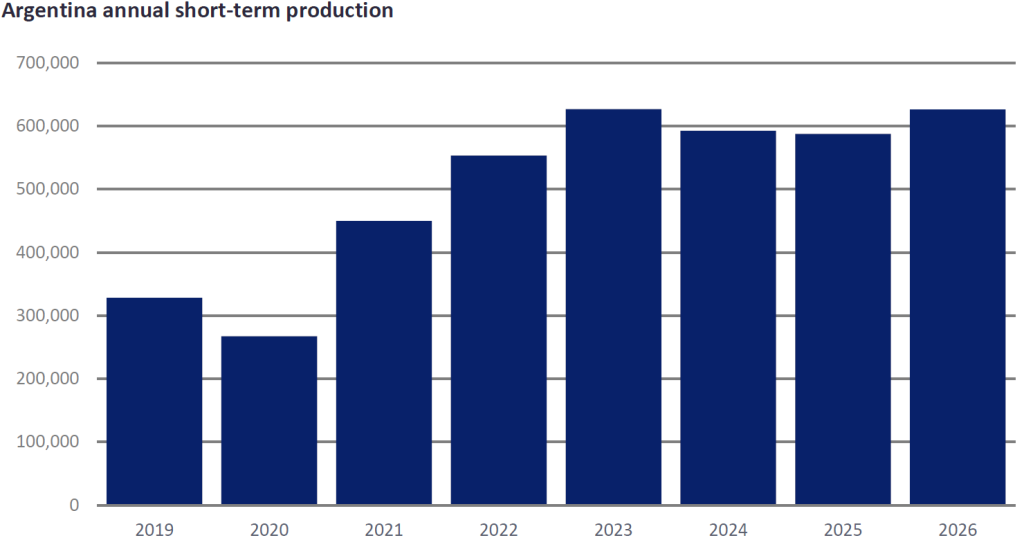

The Argentine automotive industry is confronting a downturn in production volumes, primarily due to persistent economic challenges that began in the latter half of 2023. The Argentine automotive sector has suffered a three-month consecutive decline in production volumes over the first quarter of 2024. The forecast for the South American country for the full year 2024 currently estimates a 5.5% year-on-year decline in Light Vehicle (LV) production, with the likelihood of a further decline if these issues persist. This analysis aims to dissect the multifaceted impact of these economic issues on LV production volumes, provide a brief background on the economic difficulties, and share recent updates on the situation.

The economic issue that has been threatening Argentina since the second half of 2023 is rooted in the country’s difficulty in obtaining dollars to pay off debts to suppliers. This shortage of currency has led to instability in securing the parts necessary for LV production, causing a ripple effect across the automotive sector. The challenges in securing secondary sources of materials have exacerbated the situation, leaving automakers in a precarious position.

A clear case in point is when 2023 came to an end and production was stunted at the General Motors (GM) Rosario plant in Q4 for 10 days, impacting production of the Chevrolet Tracker SUV. Other plants also noted impacts before the end of 2023, including the Renault-Nissan-Mitsubishi (RNM) Córdoba plant and the Ford Group Pacheco facility. Ford Group brought forward a vacation period from 2024 as a strategy to mitigate the impact on the facility, which produces the Ranger Pickup, and production was resumed towards the end of January 2024. RNM’s Córdoba plant experienced stuttering production during the period, which was anticipated to last through the end of 2023 but continued into Q1 2024. The automaker resumed production in February 2024, but output has been intermittent since that time.

As 2024 began, additional automakers were plagued by this over-arching issue as Volkswagen Group (VW) and GM notably fell victim to the inability to secure imported parts. These difficulties manifested in a gradual resumption of operations, extended vacation periods, reduced shifts, and delayed production resumption, resulting in an overall production decline in Argentina. A vacation period at VW Group’s Pacheco plant, which produces the Amarok Pickup and Taos SUV, began in January and spanned until late March, with production resuming on reduced shifts. Production at GM’s Rosario plant returned in mid-April but was shut down again during the last week of the month, impacting the assembly of the Chevrolet Tracker.

In addition to the touch-and-go supply constraints in the country, a drop in sales in key export markets has led automakers to further revise down production. Toyota Group’s Zárate facility is facing an anticipated staff voluntary retirement period due to a drop in sales in key export markets including Chile, Peru, and Colombia. This, coupled with the expected constrained production volume for the year, paints a depressed picture of the facility’s near-term outlook. The RNM Córdoba facility is also feeling the pressure of market declines, with voluntary layoffs being a direct consequence.

The Argentine automotive industry is navigating a rocky period, marked by declining production volumes and economic instability. The forecast for 2024 reflects a contraction in output. As the industry looks ahead, it must contend with the likelihood of continued production volatility and the need for strategic adjustments to navigate the ongoing economic headwinds. Despite the likelihood of the current economic troubles easing around 2025, volumes are forecast to be relatively flat as key domestic models are anticipated to reach their end of life before new model offerings arrive to provide a fresh influx of volumes in 2026.

Emily Vihonsky, Analyst, Americas Vehicle Production Forecasts, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Production Forecast module, click here