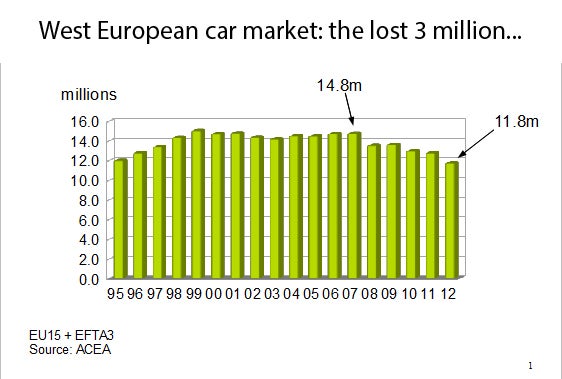

April’s sales figures for the European car market have marked a return to growth following a precipitous plunge that has left sales in Western Europe some 20% off the last peak and at a level comparable with the early 1990s. Are we at the bottom and is recovery in prospect?

The precipitous decline to the car market in Western Europe could be easing, according to the April sales figures compiled by LMC Automotive. Car sales in Western Europe grew by 2.3% in April following 18 consecutive months of year-on-year declines. The return to growth, however modest, is sure to be welcome news to many in the beleaguered European automotive sector and follows a 10% decline to sales in the first quarter.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

LMC analyst Jonathon Poskitt maintains that the annualised selling rate (SAAR) for West Europe car sales has ‘flattened out’ in recent months. In April it was a little under 11.4m units and he says it is hard to see it going much lower. “We have already seen the likes of France, Italy and Spain see a big step change downwards,” he says. “It would require another big crisis or catastrophic event for the car markets of UK and Germany – the relatively strong ones – to see a big drop and cause the European car market to dip significantly on where it is today.”

According to LMC’s analysis, the German car market has been running at an annualised rate of around 3m units so far this year. “We expect the German car market to finish the year at around the 3m unit level,” Poskitt told delegates at an LMC conference in London last week. “To put that in context, a 3m unit level for the German car market is not far off where it has been over the past decade, pre-crisis. There is no reason, at this stage, to see any further deterioration this year and we expect to see some modest growth next year. The German economy is growing, albeit slowly.”

By contrast, the situation in markets such as Spain looks much worse. April’s SAAR was just 670,000 units a year in a market that had grown to over 1.5m units a year by 2007. “There’s a scrappage scheme in Spain and without that, Spain’s car market would look even worse,” said Poskitt. “And when that scheme finishes, we can expect the market to fall back a little.”

The Italian car market has also collapsed in recent years. A car market that averaged almost 2.4m units a year over 2000-2007 has been almost halved. The running rate this year is just 1.25m units a year as Italy’s economy feels the impact of austerity budgets and rising unemployment. LMC forecasts a 9% drop in new car sales this year and 2014 will be another tough year. “It’s hard to see any improvement in the Italian car market next year with the economy not projected to see any growth,” Poskitt said. “Italian indicators of consumer and business confidence are very poor at the moment.”

Poskitt also maintained that conditions will remain very tough in France, with unemployment expected to rise from 10% last year to 11% this year. “It’s another really tough environment in terms of car sales with a selling rate this year running at around 1.7m units a year. If the market turns out at around that level for the year, which we expect, then that is 200,000 units lower than last year.”

Among the national car markets in Europe, the UK stands out as something of an outlier, posting significant car market growth this year. In the first four month of the year, car sales in the UK are 8.9% ahead of the same period last year, with the private retail side of the market especially strong. A combination of good deals (and cheap finance), improved consumer confidence and a pick up in replacement demand help account for the ongoing improvement. Anecdotal evidence from industry sources suggests that there are some very good deals around for private buyers, but also that the economic situation in Britain is not as bad as that elsewhere in Europe. “But the UK economy is not performing very well,” Poskitt acknowledged. “But there has been some improvement to consumer confidence. With interest rates so low, savings rates are low and maybe people are inclined to put a deposit on a car.” LMC forecasts 4% growth of the UK car market this year and a flat picture for 2014, but that will mean that the UK car market avoided the worst of the fallout from the eurozone crisis and the economic recession in Europe.

LMC’s forecast for the Western European car market is for a 500,000 unit drop in 2013 to around 11.25m units. By historical standards, this market cycle is showing a downturn and recovery projection that is taking much longer than in the past. “In 2014, we are showing a 0.5% gain to the market – so not much change at all,” Poskitt said. But beyond that period there is some hope based on the growth of the vehicle parc, a lengthening average age of cars in circulation and what that might do to future replacement demand. “We do have a projection for quite a sharp acceleration from the middle of the decade,” said Poskitt. “We can see average age in car parcs lengthening in recent years as people hang on to their cars for longer,” he maintained. “Partly that’s down to the economic situation and when the economic environment becomes more supportive, we expect replacement demand to be released. Also, in many countries, the driving age population – with the main exception of Germany – is expected to grow through the forecast period.”

Poskitt also told delegates that market growth could also be supported by a projected uptick in net new model introductions in Europe over the period to 2016. He also said that the premium makers would continue to be a major source of new model activity and continue to gain share from the established volume players. He highlighted small SUVs (B-Segment sized) as a high-growth sales segment in LMC’s analysis.

|