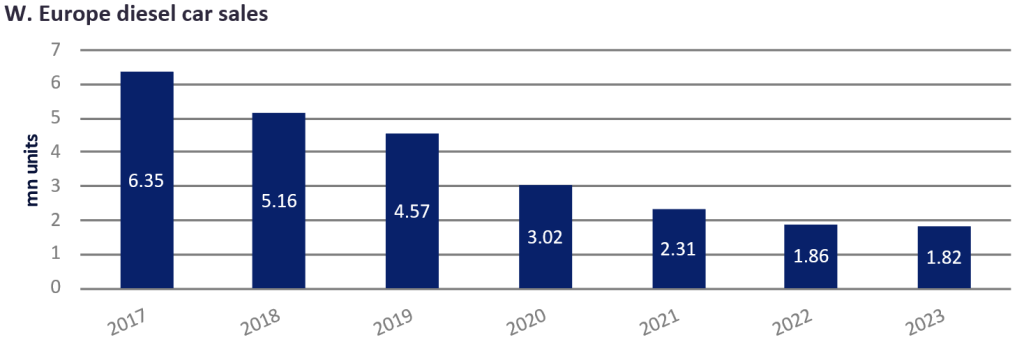

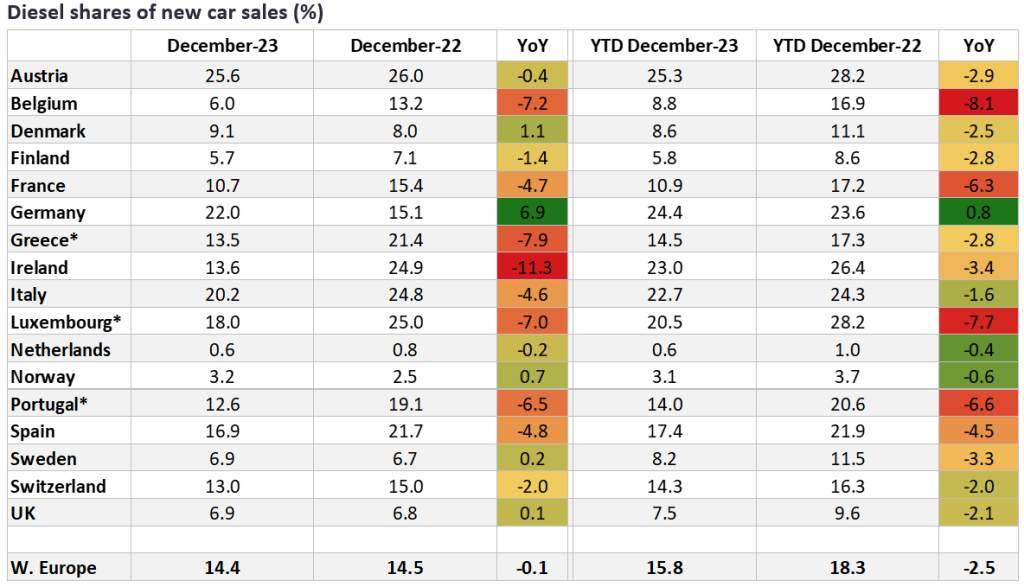

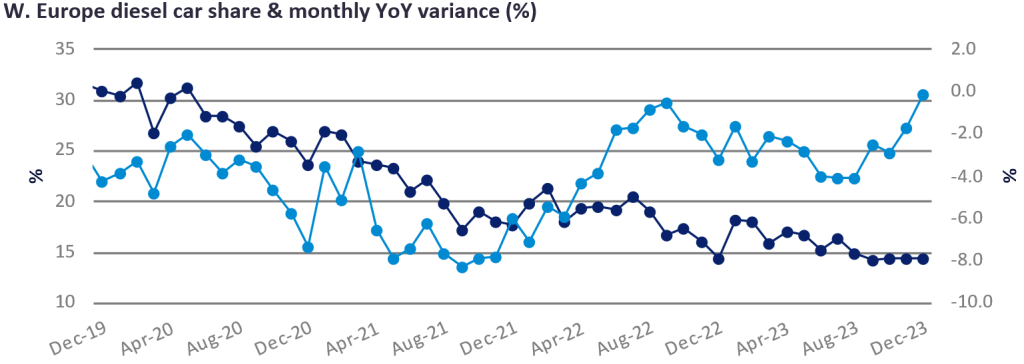

Full-year 2023 figures indicate that diesel share of new car sales in the region was just below 16% with December’s result being the same as that of November at 14.4% and very close to what was seen in December 2022, with monthly YoY declines diminishing recently.

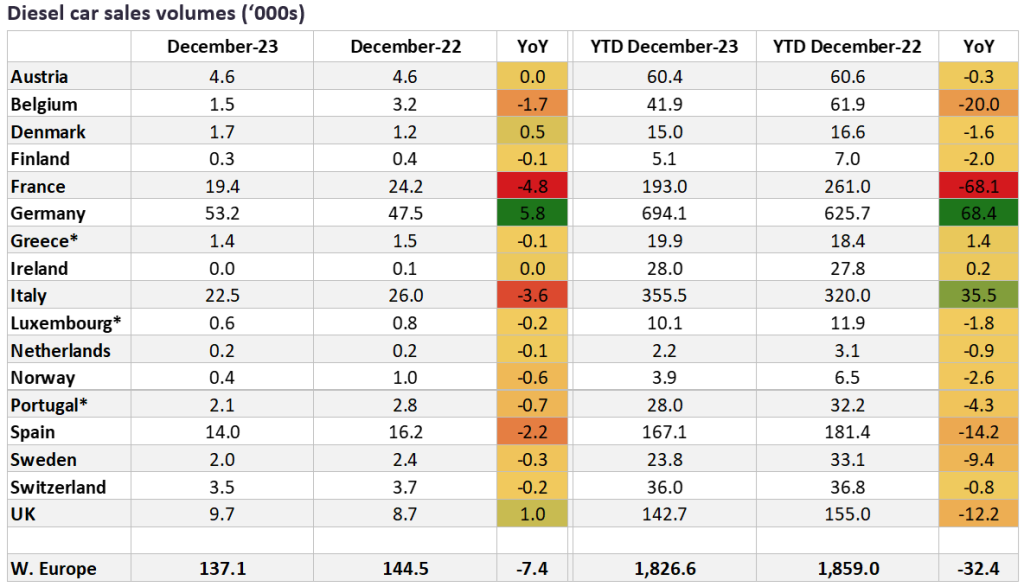

The slowdown in BEV growth will no doubt have boosted the ICE sector to some degree and perhaps fed into the relatively buoyant end to the year as far as diesel is concerned. All markets ended 2023 with a smaller diesel share than seen in 2022 except one. Our figures indicate that Germany, with a diesel share of 24.4% for 2023 saw a rise from the 2022 value of 23.6%. Diesel demand has held up well in the country, supported by plenty of product from the dominant domestic brands and driving patterns that highlight the value available from diesel versus alternatives very well.

We’ve mentioned it before, but it’s worth restating that as well as a slight rise in share, diesel sales in Germany rose YoY in 2023. The actual increase was 68k units which exactly offset the fall seen in France. No other markets saw shifts of this magnitude. Italy, though seeing diesel share fall marginally in 2023, also saw sales rise (by 36k units) contributing to a net regional diesel car sales decline of just 32k units for the year.