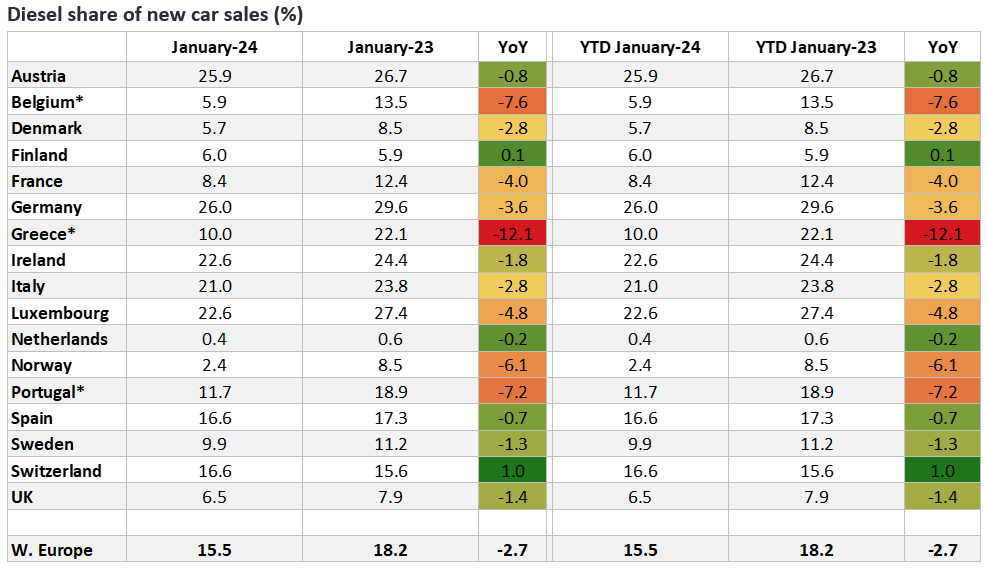

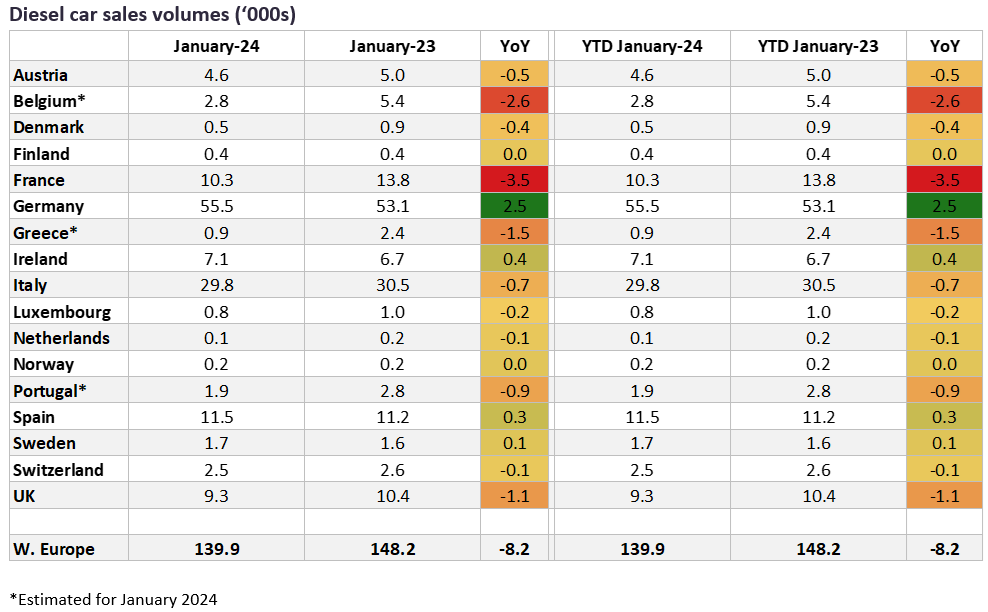

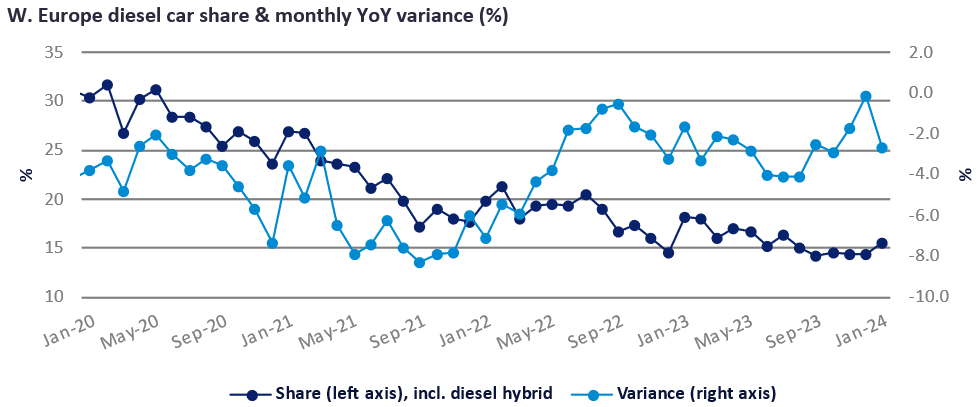

2023 full year diesel share for Western Europe’s car market is confirmed at 15.8% with 1.83 million units sold in the region while pan-Europe diesel share for the year, not including CIS, was 16.0% with 2.21 million diesel cars sold.

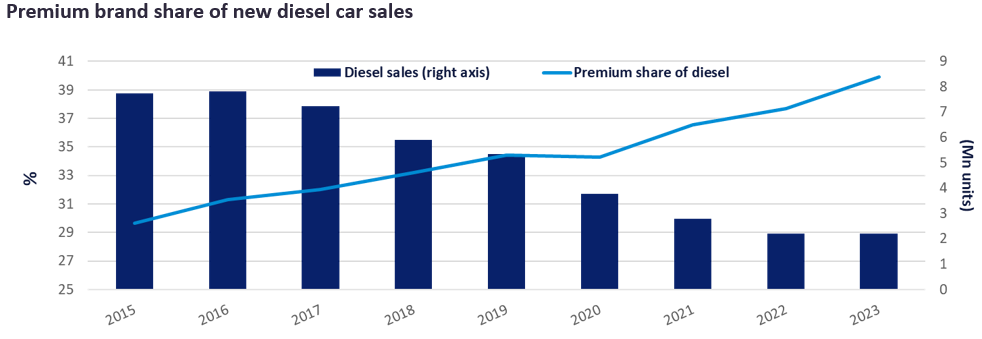

January saw another month of low MoM variation in the share of new car sales in the region that were diesel, but with share rising a little over December’s achievement, at a provisional 15.5% with a few minor markets yet to report at the time of writing. All markets lost diesel share in January on an annualised comparison basis, but Germany saw volume of diesel sales increase by 2.5k units while several other markets also saw modest volume increases. France was the biggest volume loser with January seeing diesel car sales 3.5k units lower than a year earlier. The loss of government fiscal support for plug-in cars in Germany over the last year has helped the diesel market there to maintain a level of robustness that has in turn propped up the region’s diesel car sales and share. The slowdown in BEV growth late last year (it turned negative in December, though positive again in January) has been a benefit for ICE demand in general and certainly for diesel. The migration of diesel from the mass market to the premium brands has continued.