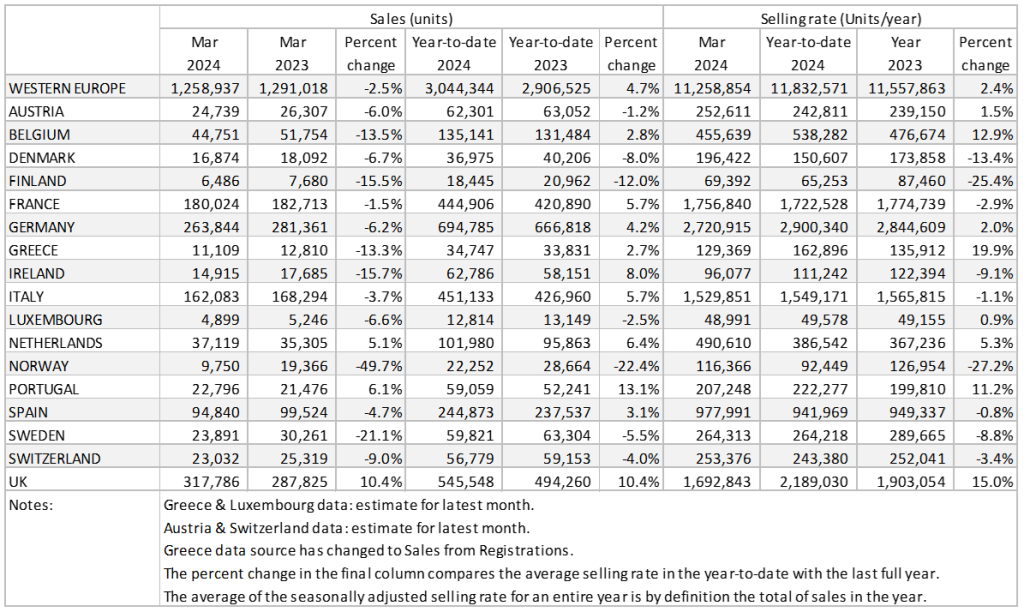

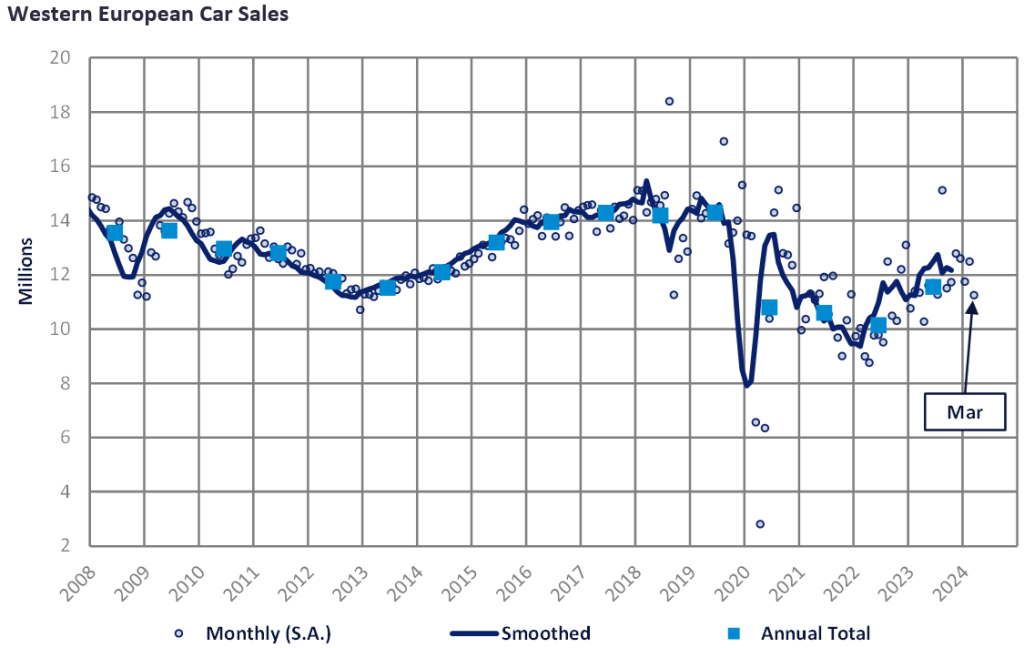

The Western Europe new car (Passenger Vehicle – PV) selling rate slipped back in March, to 11.3 million units/year, with 1.3 million vehicle registrations – in YoY terms, this is 2.5% below March 2023.

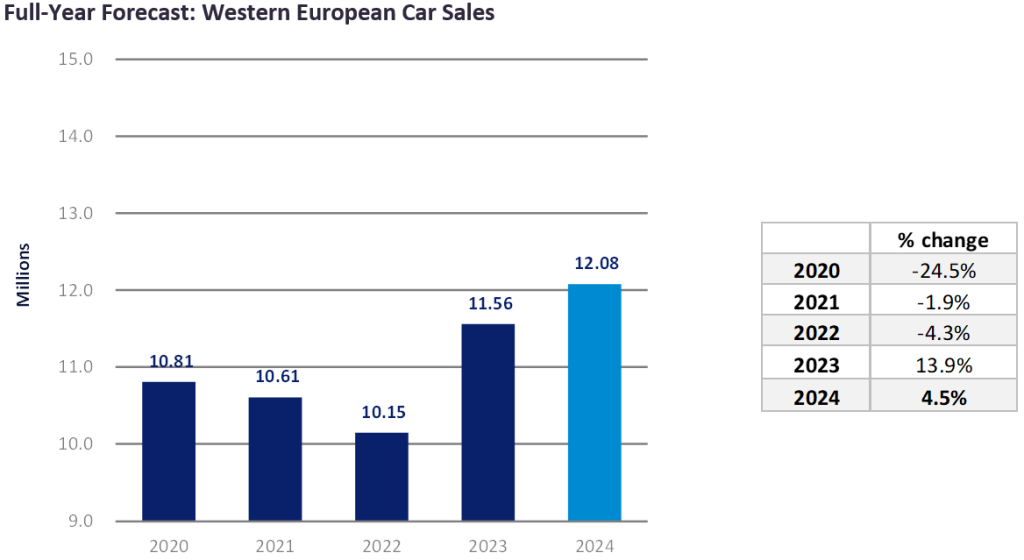

Despite this negative result, YTD sales grew by 4.7%, helped by strong growth for the first three months in France, Italy, and the UK, along with mostly positive results in other countries. Thanks to a more supportive supply environment, the Western Europe PV market is forecast to surpass 12 million units in 2024, which would be the strongest annual result since the COVID-19 pandemic.

The UK PV market improved well in March, with 318k vehicles registrations – 10.4% higher YoY, with the fleet side of the market performing strongly. Meanwhile, the German PV market registered 264k units, a 6.2% decrease compared to 2023, but YTD sales improved by 4.2%. The other major West European countries saw declining sales in March with Easter falling earlier this year than last, although their YTD sales also increased.

The outlook for 2024 remains broadly in line with the previous update to this report. Although the macroeconomic outlook appears subdued across the region, fading supply issues and assumed vehicle price easing this year should support the market, even though previous monetary tightening will at as an ongoing drag, and geopolitical risks have the potential to undermine the baseline forecast.

The PV selling rate for Western Europe fell month-on-month to 11.3 million units/year in March, while raw registrations were also lower (-2.5% YoY). However, there are several factors to consider on these uninspiring headline results. In terms of raw YoY results, with Easter falling in March this year, there were fewer selling days available last month versus a year ago. From a selling rate point of view, there is also a distortion because of the strength of the UK market at this time of year. Along with September, March is a seasonally strong month for the UK market because of the registration plate number change that helps identify the vehicle age. Supply issues over recent years have meant that March and September have seen selling rates perform poorly in those key months and do somewhat better at other times. The latest UK selling rate, for March 2024, is the best March result since the pandemic first struck, but it does not appear to have fully normalised yet, even with the improved supply conditions.

All that said, in volume terms, Western Europe remains weak (-15%) in comparison to pre-pandemic March 2019, and the economic outlook remains challenging. In Germany, the selling rate stood at 2.7 million units/year, a slightly disappointing result given the market’s recent performance. Meanwhile, Spain saw a selling rate of 978k units/year – the best result this year. The French PV market achieved a selling rate of 1.8 million units/year in March, although raw volumes fell YoY due to seasonal factors. Italy’s PV market registered 162k units in March, 3.7% below March 2023 – this is the first monthly YoY decrease since July 2022.

With eventual monetary policy easing, production in a stronger position to supply the market and vehicle prices edging lower, we still view the growth outlook as positive, despite this slightly disappointing quarter-end result.