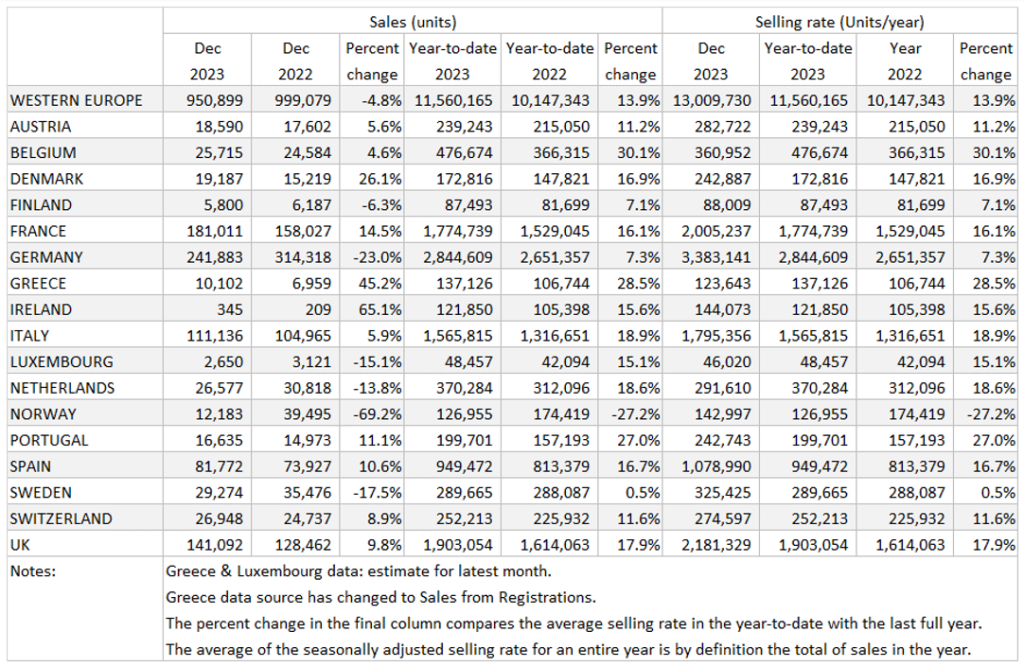

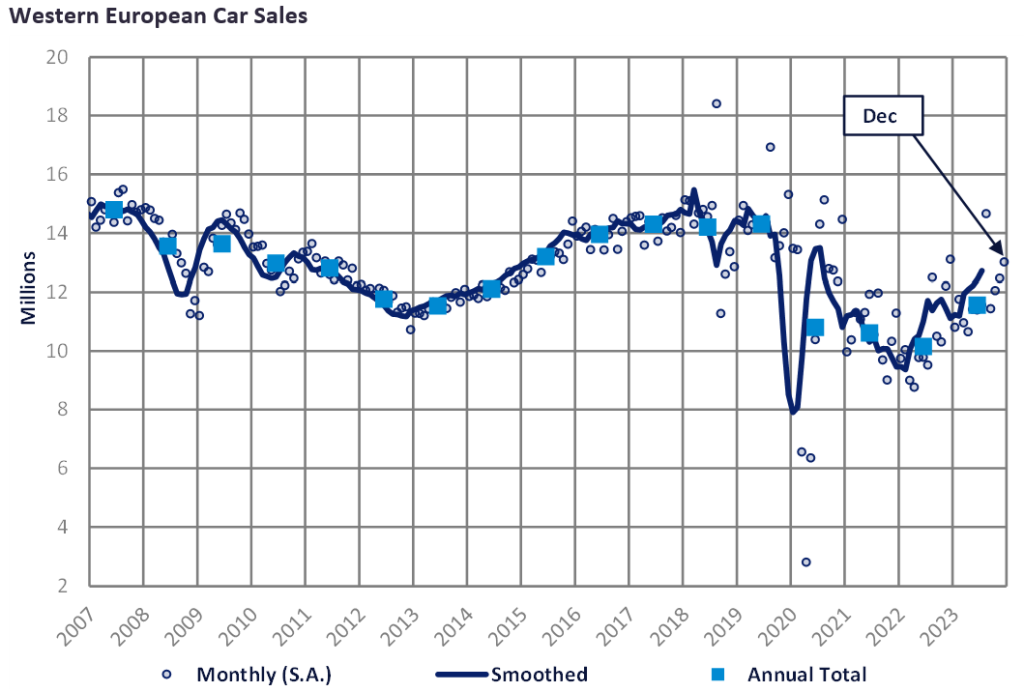

- The Western Europe PV selling rate rose to 13 million units/year in December 2023, with 951k car registrations in the month.

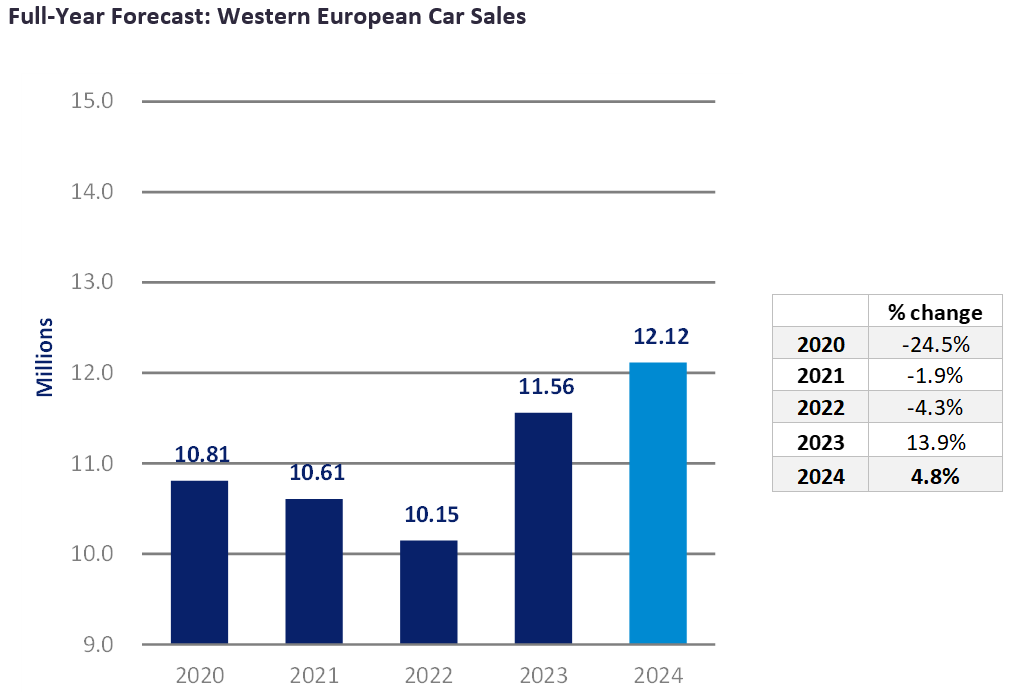

- In YoY terms, sales were down almost 5%, though that compares to a strong December 2022. The region finished 2023 overall with 11.6 million units, higher than the 10.1 million units recorded in 2022 but well behind the 14.3 million units registered in 2019.

- Germany was the only major West European country with negative YoY growth last month (at -23%), mainly due to December 2022 being an unusually strong month given the ending of EV incentives. France and Spain continued to recover with double digit YoY growth as supply conditions continue to ease, with solid improvements coming from the UK and Italy.

- For 2023, Western Europe’s PV market performed almost 14% higher than in 2022 as supply bottlenecks eased and OEMs fulfilled backlogged orders. With the fading of supply constraints, the focus will now be on demand conditions, notably headwinds such as high interest rates, inflation, and low consumer confidence. However, the base for comparison, 2023, was still weak and some further growth is forecast for 2024.

The Western Europe PV selling rate rose to 13 million units/year with 951k vehicle registrations. Despite this, a strong December 2022 meant the YoY result was negative. The market’s YoY activity saw a drag from Germany along with Netherlands, Norway and Sweden. The region finished 2023 with 11.6 million units, higher than the 10.1 million units recorded in 2022 but well behind the 14.3 million units registered in 2019.

Germany recorded 242k vehicle registrations in December 2023, 23% lower than the same month in 2022, which constitutes the largest YoY fall of the year. Despite the selling rate rising to 3.4 million units/year in December, the latest YoY fall came due to December 2022 being an unusually strong month given the end of EV incentives in January 2023. However, there may also be an element of sales being dampened due to worsening economic conditions in Germany. Overall, for 2023, the PV market reached 2.8 million vehicle registrations. The UK PV market registered 141k units in December 2023 (+9.8% YoY), completing a clean sweep of positive monthly YoY results. With a selling rate of 2.2 million units/year last month, the PV market reached 1.9 million registrations in 2023, better than other post-pandemic years but still behind 2019 levels.

In December 2023, the French PV market registered 181k units, 14.5% higher than in December 2022. The PV market finished 2023 with 1.8 million vehicle registrations, higher than the 1.5 million units registered in 2022 yet lower than the 2.2 million units recorded in 2019. As elsewhere, we expect supply bottlenecks will not present serious issues in 2024 in France, with underlying demand dictating sales. The Italian PV market recorded 111k vehicle registrations in December 2023, almost 6% higher YoY. With December achieving a similar selling rate as in November at just under 1.8 million units/year, the PV market finished 2023 with 1.6 million vehicle registrations. In December 2023, Spain’s PV market registered 82k vehicles (+10.6% YoY), with a selling rate of 1 million units/year. The Spain PV market finished 2023 with 949k vehicle registrations, comfortably higher than the 813k units registered in 2022 but again well behind pre-pandemic levels.