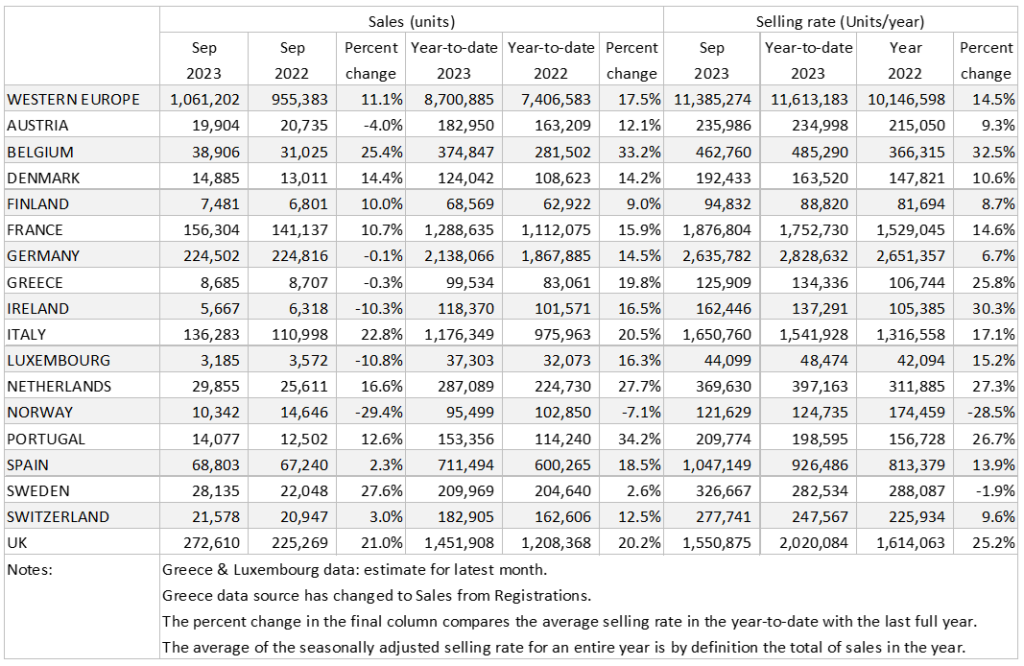

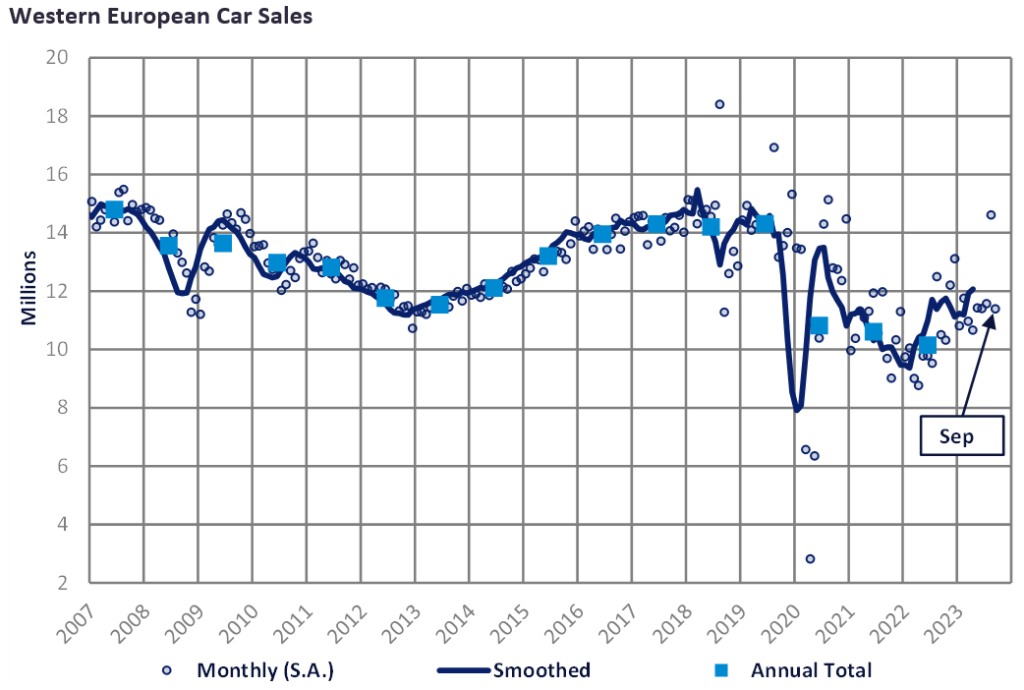

- The Western Europe PV selling rate slowed to 11.4 million units/year in September from 14.6 million units/year in August, registering 1.1 million vehicles (+11.1% YoY). The region’s growth continues to be driven by improved supply of components and higher delivery rates.

- The UK and Italy both performed particularly strongly in YoY terms, with double-digit growth of 21.0% and 22.8% respectively (September being a key month in the year for the UK market because of the numberplate change). Germany and Spain, however, performed weakly with growth of -0.1% YoY and 2.3% YoY respectively, against low bases.

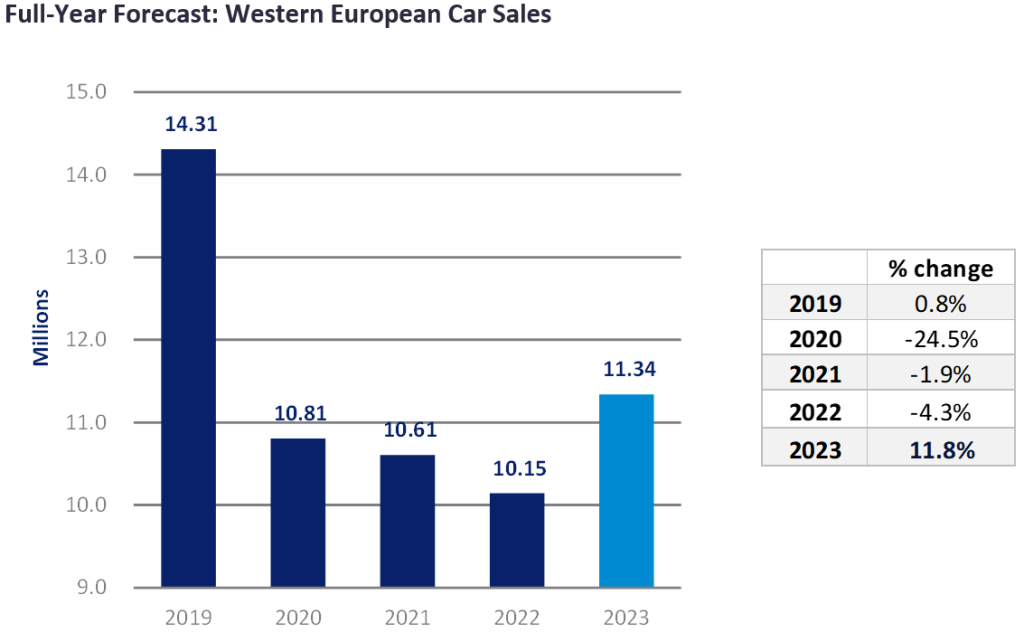

- All the top five Western European markets continued to experience double digit YTD growth over the weak performances seen in 2022. However, generally across the region, economies still face challenging conditions with high inflation and high financing costs. We continue to forecast solid growth for the full year, with 2023 set to be the best year since 2019.

Commentary

The Western Europe PV selling rate slowed to 11.4 million units/year in September, registering 1.1 million vehicles (+11.1% YoY). YTD the region has accumulated 8.7 million registrations which is 17.5% higher than the YTD September 2022 total. The five major West European countries continue to recover with improved vehicle supply supporting deliveries.

The German PV market performed slightly lower than expected in September 2023 at 225k units, volumes broadly unchanged from the same month last year. The market recorded a selling rate of 2.6 million units/year, with 2.1 million units sold year-to-date — 14.5% higher than Sep 2022 YTD. The UK PV market selling rate experienced a sharp decline in September, falling to 1.6 million units/year from 2.8 million units/year in August, though the seasonality of the market, in combination with delivery constraints, explains the large slowdown. The raw monthly registration figure of 273k units (+21.0% YoY) does represent continued recovery in the UK market though it should be noted though that the latest September figure is still down almost 30% from pre-pandemic 2019 levels.

In September, France continued its recovery path, recording 156k units, 10.7% higher YoY, with a selling rate of 1.9 million units/year. YTD the market has accumulated 1.3 million vehicle registrations, almost 16% higher than YTD September 2022. The Italian PV market registered 136k units in September, up 22.8% YoY and with a selling rate of 1.7 million units/year. Despite the strong growth this month, and the YTD figure of 1.2million units up 21% from YTD September 2022, the market is still performing well below pre-pandemic 2019 levels. Spain’s PV market selling rate remained flat from August to September at 1 million units/year, with total monthly sales of 69k units (+2.3% YoY). The monthly registration figure was again helped by easing supply issues, though political uncertainty and high inflation are among risks. YTD the market has sold 711k units, which is 18.5% higher than the volume of sales recorded YTD September 2022.