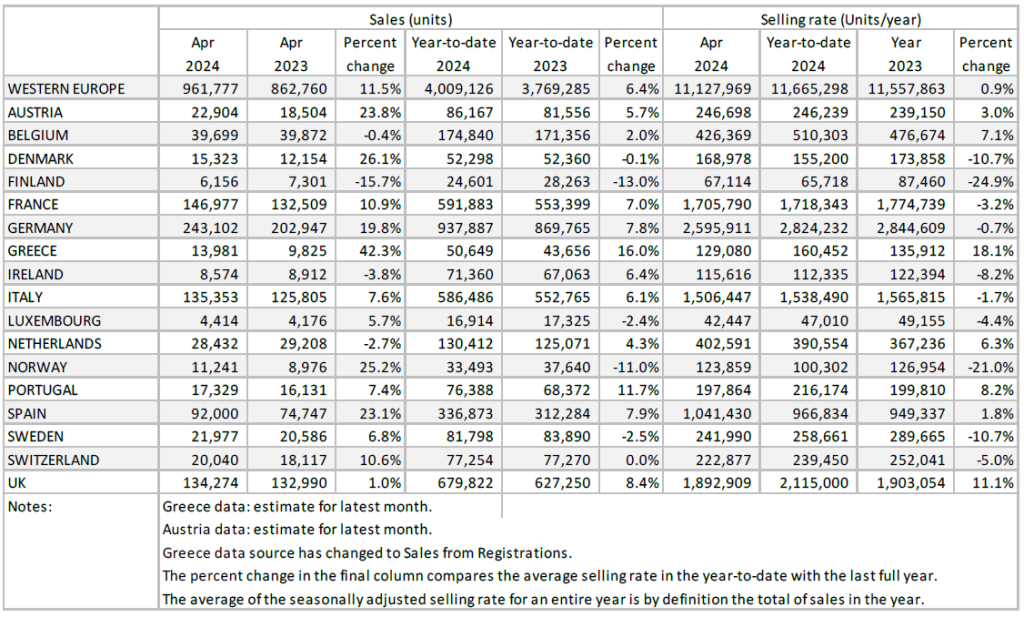

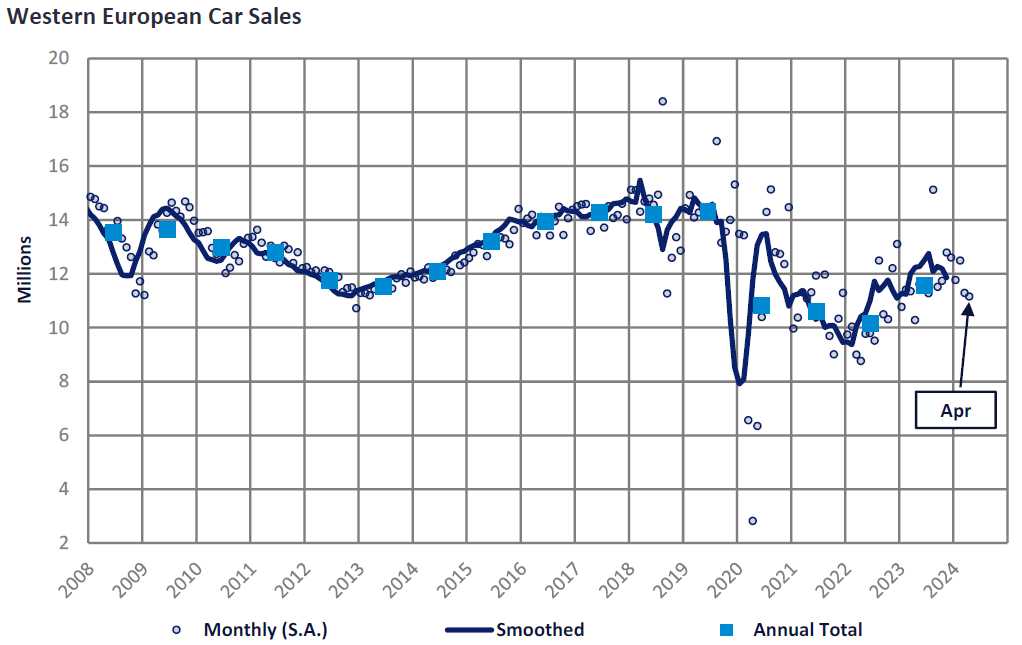

The Western Europe PV selling rate for April stood at just over 11 million units/year, similar to the March result and weaker than the close of 2023 or first two months of this year. With 960k vehicle registrations recorded, this represents an 11.5% improvement year-on-year (YoY). Year-to-date (YTD) sales grew by 6.4%.

The YoY volume gains last month were primarily driven by strong growth in Spain and Germany, with generally solid performances in the other major markets too.

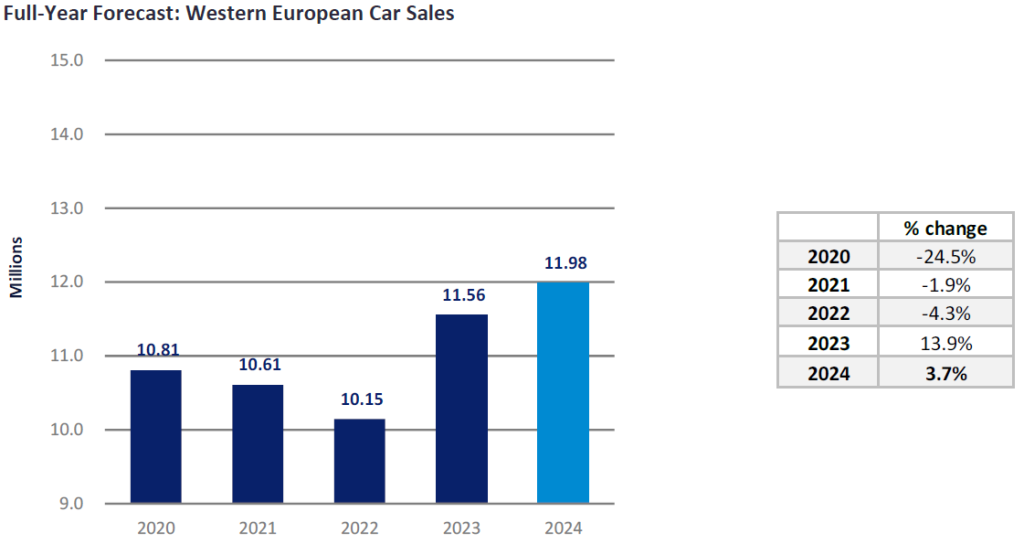

While the outlook for 2024 remains broadly in line with the previous update to this report, we have slightly trimmed the forecast due to two consecutive months of disappointing results. That said, while the macroeconomic outlook appears subdued across the region, fading supply issues and assumed vehicle price easing this year should support the market. Added to which, we should see the beginning of monetary loosening as inflation pressures ease. That said, geopolitical risks still have the potential to undermine the forecast.

The PV selling rate for Western Europe stood at 11.1 million units/year in April. That is in line with March, though both are weaker than preceding months. In YoY terms, sales volumes rose by 11.5%, with the market benefiting from the fading of supply issues. Volume growth last month was boosted particularly by Spain and Germany. Despite volume improvements versus last year, the selling rate remains weak as the region struggles with continued economic headwinds. For context, Western Europe volumes last month were 21% below pre-pandemic April 2019. With monetary policy easing likely to begin in the second half of this year, production in a stronger position to supply the market and vehicle prices edging lower, we view the growth outlook as positive, despite recent selling rate results.

The Spanish PV market registered 92k units in April 2024, a 23.1% improvement YoY – the market was supported by rental companies building their fleets for the summer holidays. The selling rate rose to 1 million units/year last month, the best result so far this year. We expect continued growth throughout the year. Germany’s PV market saw a strong improvement as registrations were up nearly 20% – however, April 2023 was a low base of comparison. In selling rate terms, the market declined slightly month-over-month, with the April result standing at a rather lacklustre 2.6 million units/year.

The UK market was up slightly last month as the fleet segment continued to perform strongly. The market is forecast to register just under 2 million units for the full year 2024 – but still 15% behind the pre-pandemic 2019 total. In France, selling rate stood at 1.7million units/year, while sales were up 11% YoY – the market continues to benefit from the government’s EV incentives. Meanwhile, Italy’s selling rate fell to 1.5 million units/year, although registrations improved by 7.6% YoY.