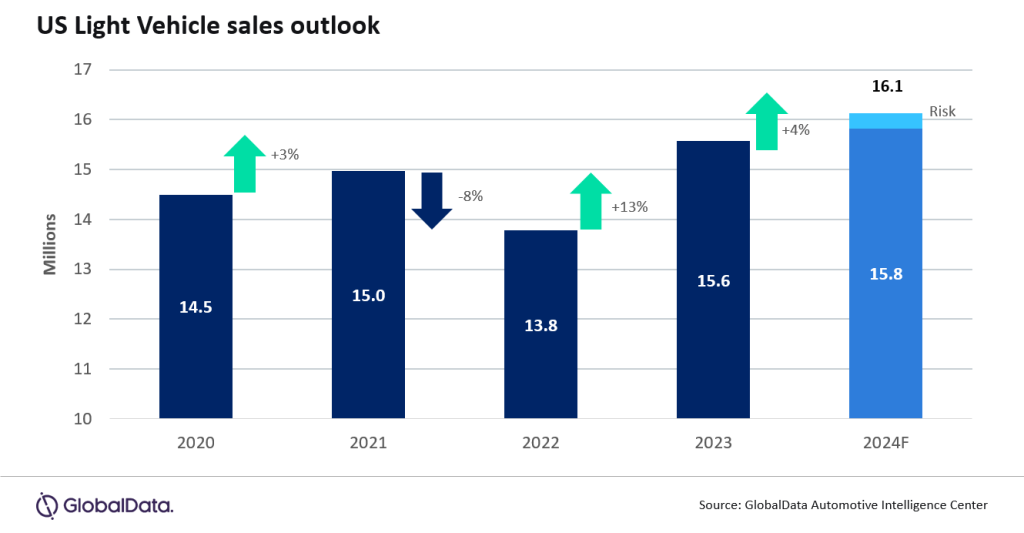

- US light vehicle market up 13% in 2023 to 15.6 million units

- General Motors was top OEM in the US by sales in 2023 with sales of 2.6 million units; GM sales in December, at 234k – were just 8k ahead of Toyota (2.3 million for the year)

- 2024 market forecast is 16.1 million units, +4% on 2023

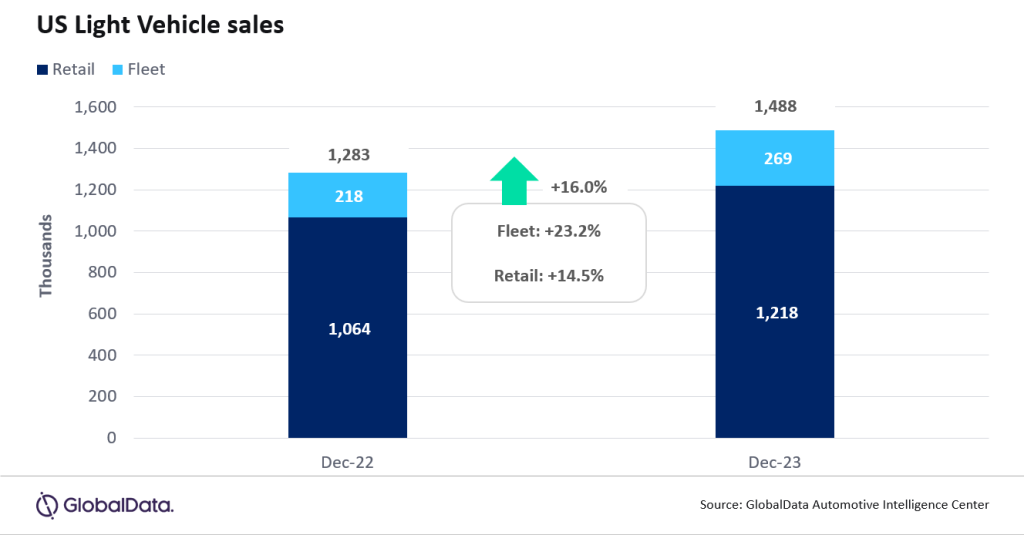

According to preliminary estimates, US Light Vehicle (LV) sales grew by 16.0% year-on-year (YoY) in December to 1.49 million units. While year-ago sales were still relatively weak, December sales surpassed expectations and indicated that the market was heating up as 2023 came to a close.

For 2023, sales totaled 15.6 million units, a YoY gain of 13.0%, as the market recovered from the chip shortage-induced slump in 2022.

US LV sales totaled 1.49 million units in December, according to GlobalData. The annualized selling rate was 16.4 million units/year in December, the highest it has been since May 2021, and up from 15.4 million units/year in November. The daily selling rate was estimated at 57.2k units/day in December, compared to 49.1k units/day in November. After a slightly disappointing Black Friday, end-of-year deals appeared to lure many more buyers across the country, with automakers willing to offer more significant discounts and, in some cases, divert more volume to fleet sales. According to initial estimates, retail sales totaled 1.22 million units, while fleet sales accounted for approximately 269k units, representing around 18.1% of total sales.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “December has traditionally been a good time of year to buy a vehicle as automakers seek to hit year-end targets, but that had been less true in recent years amid tight inventory levels. However, with stocks now significantly replenished across the industry, discounting was back on the agenda last month. Consumers who have been sitting on the sidelines appear to have been willing to jump back into the new vehicle market again, although it also seems that fleet deliveries accounted for some of the December surge. In the strongest years for the market, between 2015 and 2019, it was not unusual to see December sales of 1.5-1.6 million units. While we did not quite get to those levels, last month felt like the closest we have seen to a fully healthy market for some time. With that said, we expect to see dealer margins shrinking this year, even as volumes increase, as supply and demand will be more evenly balanced”.

The blockbuster close to the year pushed 2023 to 15.6 million units, up by 13% compared to 2022. The more pronounced availability of vehicles played a factor in the year-end boost and should set 2024 up for continued growth. However, given the close to 2023 and balancing risk factors, the outlook for 2024 is holding at 16.1 million units, an increase of 4% from 2023.

The average daily selling rate for 2023 was 50.8k, up from 44.8k last year. Overall inventory is expected to decline to 2.1 million units, a decrease of 7% from last month. Days’ supply is projected to slip to 38 days from 48 days in November as a result of a much stronger daily selling rate.

At an OEM level, General Motors returned to the top of the sales rankings with 234k units, finishing around 8k units ahead of Toyota Group after the Japanese OEM led the market in the previous two months. Ford Group was in third on 186k units and, at 12.5%, its market share was the highest since July. At a brand level, Toyota led the way on 188k units, ahead of Ford on 176k units. While Ford was only marginally ahead of Chevrolet in November, last month the difference widened to 23k units. For a third consecutive month, the Toyota RAV4 was the bestselling model, on 47.0k units, but the gap to the Ford F-150 was smaller than in November, at 3k units. The RAV4 appears to have continued to benefit from an abnormally high level of imports, but this is understood to be a temporary situation. Compact Non-Premium SUV was comfortably the leading segment once again, although its market share eased slightly from November levels to 20.7%. Midsize Non-Premium SUV saw its highest share since May, at 16.2%, followed by Large Pickup on 13.6%.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “While one month’s results should not be interpreted as necessarily heralding a return to previous highs, consumers in December showed a willingness to purchase if the price was right. Continued discounting or moderating pricing could bring a more pronounced lift to demand in 2024. That said, we expect a slight January hangover in demand, given the likely pull forward, and there remains economic risk that needs to be factored as we start the new year. The overall state of the economy and pricing trends will be the dominant drivers in auto demand for 2024.”

Global outlook: Global LV sales in November were robust and continued the trend of a selling rate above 90 million units. November reached a rate of 95 million units and a volume increase of 15% in YoY terms. China’s strong sales pace continued with an increase of 27% compared to November last year. Europe and North America had consistent growth, up by 13% and 11% YoY respectively. December’s selling rate is projected to finish at 91 million units and most markets are expected to grow on a YoY basis. 2023 is expected to finish at 89.9 million units, an increase of 11% from 2022. The forecast for 2024 remains at 92.3 million units as growth slows to 3%. Note – starting with the 2024 releases, GlobalData will be moving to reporting and forecasting domestic sales in China, thus lowering the global market by an average of 4 million units a year.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center