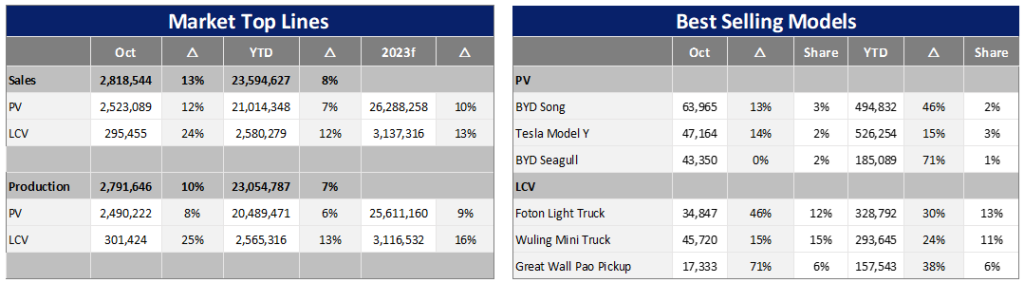

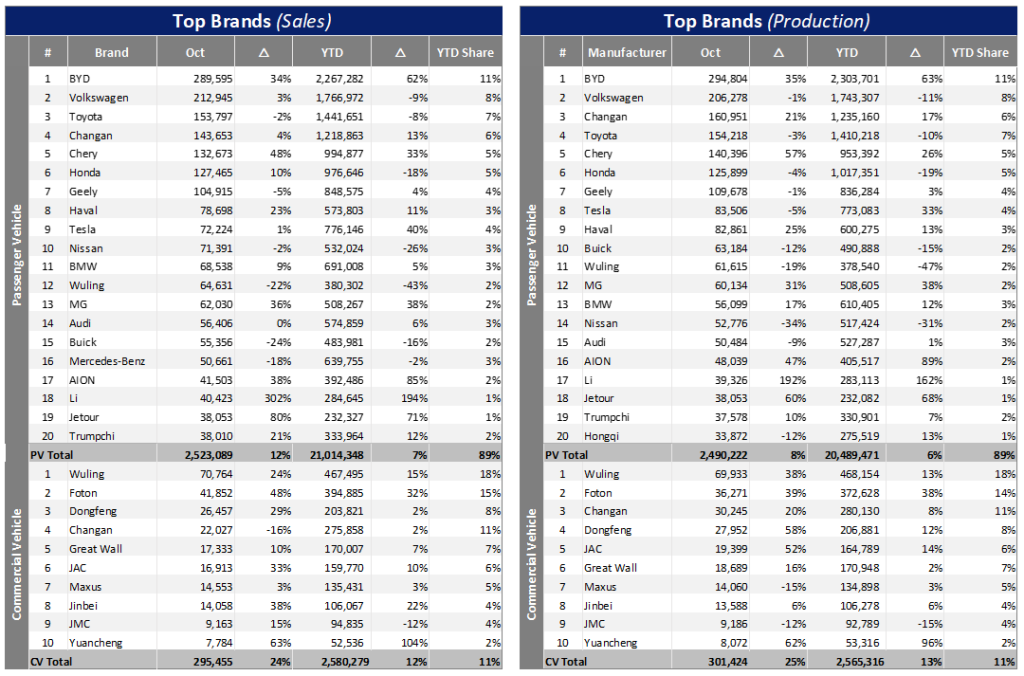

The Chinese market remained strong in October 2023, with Light Vehicle (LV) wholesales growing by 13% year-on-year (YoY) to a total of 2.8 million units.

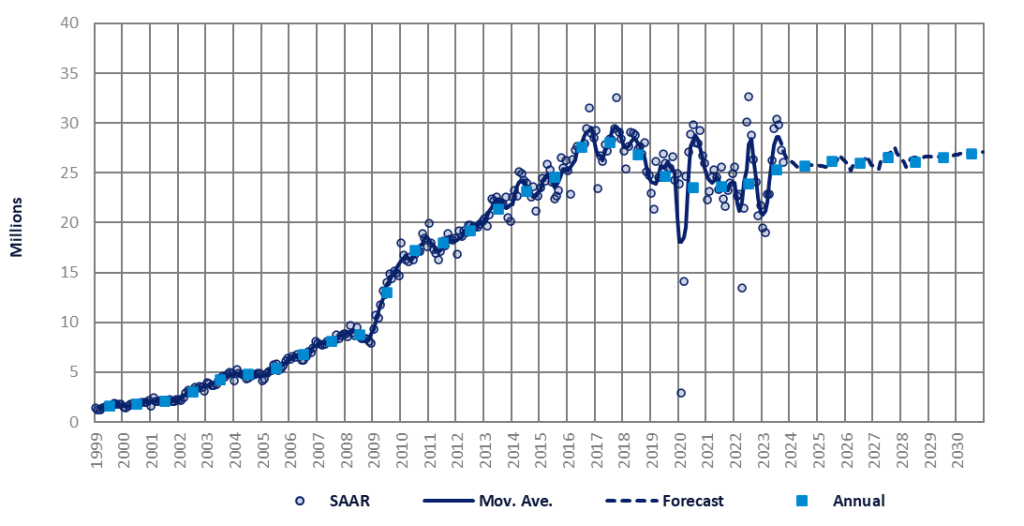

At the model type level, Passenger Vehicle (PV) sales (i.e., wholesales) for October increased by 12% YoY to 2.5 million units. At the same time, the Light Commercial Vehicle (LCV) sector grew rapidly by 24% YoY, with sales reaching 0.3 million units. On a month-on-month (MoM) basis, PV sales fell 0.3%, while LCV demand edged up 1% in October. Since the beginning of this year, the total cumulative wholesales volume of LV has reached 23.6 million units, an increase of 8% over the same period last year. The good market performance in October led to a selling rate for the month of 31.6 million units/year, the fifth consecutive month that sales exceeded the 30 million mark. That brings year-to-date sales to an average of 29.7 million units per year, compared with 26.7 million LV sales last year.

On the production side, total LV build in October was 2.8 million units, up 10% YoY. At a vehicle type level, PV production (accounting for 90% of total LV production) in October was 2.5 million units, a YoY increase of 8%. The cumulative PV output was 20.5 million units, a YoY increase of 6%. CV production in October was 0.3 million units, a rapid increase of 25% YoY. Since the beginning of the year (as of October), LV cumulative production has reached 23.1 million units, a YoY increase of 7%.

PV exports continued to be strong in October, with total PV exports for the month reaching 417k units, an increase of 53% YoY. Since the start of 2023, the cumulative volume of PV exports has reached 3.2 million, a significant increase of 68% over the same period last year. According to data from the China Passenger Car Association (CPCA), the main destinations for China’s PV exports in the first seven months of 2023 were Russia (accounting for 16.7% of total PV exports), Mexico (8%) and Belgium (5.4%). Affected by the economic sanctions imposed by Western countries on Russia, China’s exports to that country have increased significantly this year.

If exports are excluded, we can see that the domestic market grew by 6% in October, and the cumulative growth rate in the first ten months of this year was only 1%. This shows that the effect of exports on the market is obvious. Relative to the gradual recovery of domestic car sales, the performance of the export market is stronger. The main driving force of this year’s exports is the improvement of the competitiveness of Chinese products and the breakthrough into the European and American markets. Also, the international brands in the Russian market have now been fully replaced by Chinese vehicles because of the Russia-Ukraine crisis, plus a huge export increase has resulted from improvement in China’s New Energy Vehicle (NEV) competitiveness. As long as there is stable market demand in the world, there is still much scope for developing China’s auto exports in the future.

In August 2023, Tesla launched a new round of price cuts, triggering a wave of large-scale cuts by other major automakers. And according to current market activity, this trend of price reduction promotions will continue until next year. An increasing number of affordable models with advanced features are attracting consumer interest. Of course, this wave of price cuts will also further reduce OEM vehicle profits. Unless more cars are sold, their overall profitability will be significantly reduced. It is foreseeable that in the next few years, OEMs that cannot capture a substantial piece of the market may leave the game.

Following the market’s weak performance in early 2023, the Chinese government has in recent months, introduced a series of macro measures to stabilise economic growth and promote automobile consumption. Strong national finance measures will firmly support the development of the automobile market. At present, market confidence has been enhanced, production demand has simultaneously recovered, and OEMs are constantly launching new products, all of which will help to release further market demand. Hence, we believe that in the next few years, China’s automobile industry will achieve steady growth driven largely by the growth of exports and domestic NEV demand.

In terms of forecast adjustments this month, based on the continued strength of the PV market (both export and domestic sales) and our judgment on the market, we have decided to make a new round of revisions to our PV sales forecast.

Due to the recent fierce price war between major car companies, some market demand has been significantly advanced. As a result, we have raised our short-term forecasts. We are raising our PV forecast for 2023-2027 by a total increase of 1.7 million units while lowering our PV forecast for 2028 and beyond (a total decrease of about 1.3 million units for 2027-2035). While there is a small adjustment to the 2023 LCV number, the sales forecast for that sector remains unchanged. Total LV sales are expected to rise 9.9% this year to a record 29.4 million vehicles, but risks to the upside remain. However, it should be noted that near-term downside risks exist, mainly from the liquidity crisis in the real estate sector (said to directly and indirectly account for 25% of GDP), declining exports, and high youth unemployment.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center