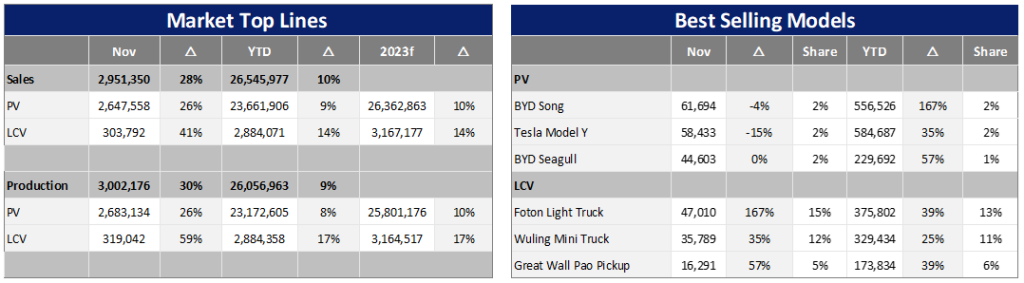

The market reached a record high in November with Light Vehicle (LV) wholesales growing by 27% year-on-year (YoY) resulting in a total of almost 3.0 million units.

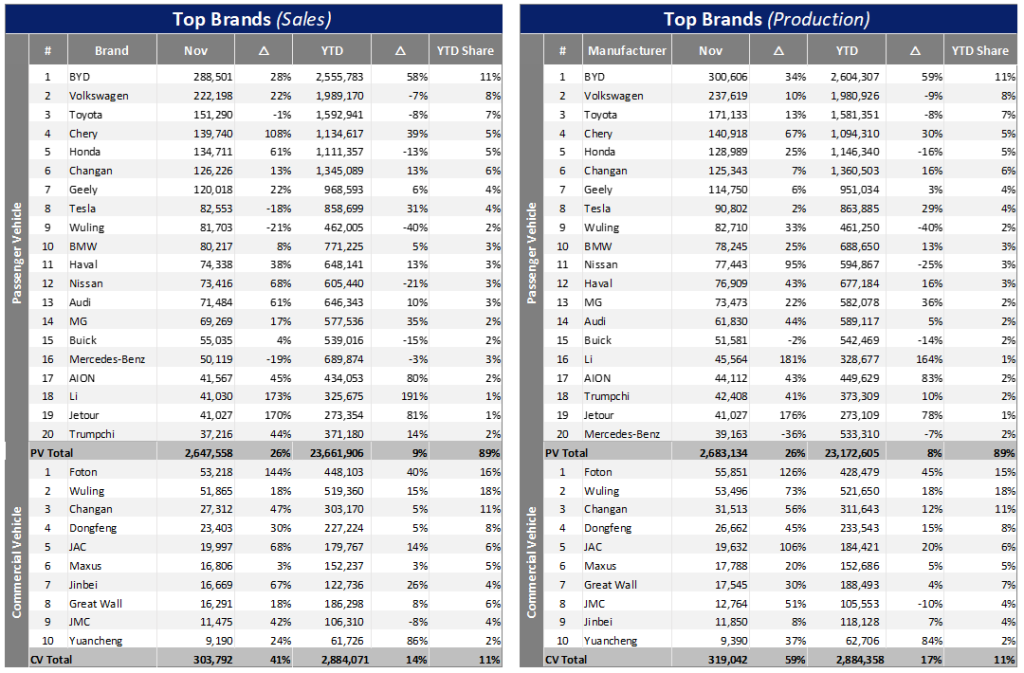

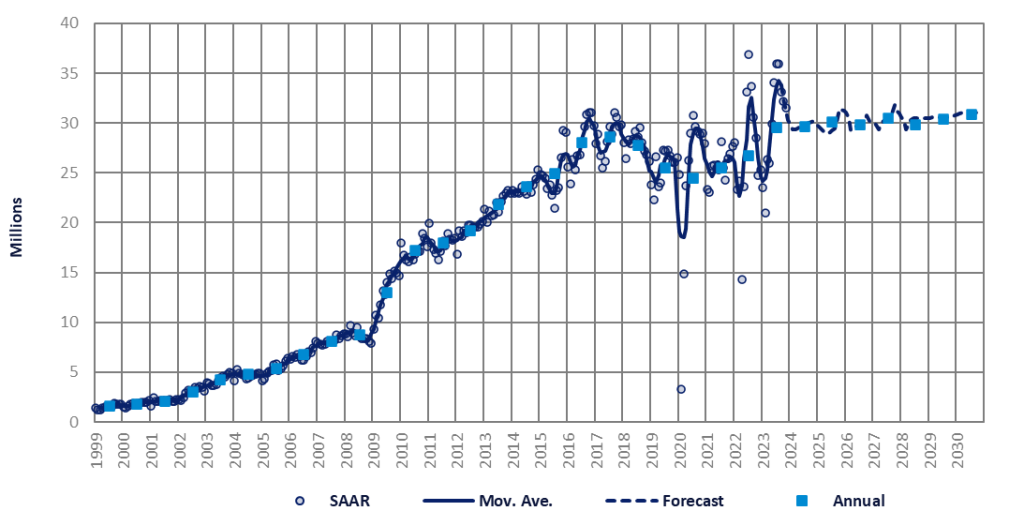

At the vehicle type level, Passenger Vehicle (PV) sales (i.e. wholesales including exports) for November increased by 26% YoY to 2.6 million units. At the same time, the Light Commercial Vehicle (LCV) sector grew rapidly by 41% YoY, with wholesales reaching 0.3 million units. On a month-on-month (MoM) basis, PV sales increased by 5.0%, while LCV demand edged up 2.8% in November. Since the beginning of this year, the cumulative wholesale volume of LVs has reached 26.5 million units, an increase of 10% over the same period last year. According to the data, the sales rate (SAAR) continued to slow from the peak in July and August (of nearly 36 million units/year) to 31.4 million units/year in November, but it was still an impressive result. Year-to-date (YTD) sales averaged 29.9 million units/year. On an annual basis, wholesales increased 26.5%, partly due to a low base in 2022, while YTD growth was 9.7%.

On the production side, the total LV build in November was 3.0 million units, up 29% YoY. At a vehicle type level, PV production (accounting for 90% of total LV production) in November was 2.7 million units, a YoY increase of 26%. The cumulative PV output was 23.1 million units, a YoY increase of 8%. CV production in November was 0.3 million units, a rapid increase of 59% YoY. Since the beginning of the year, LV cumulative production to November has reached 26.1 million units, a YoY increase of 9%.

The November car market continued to be very active. With the help of the “Double 11” promotion and other consumption stimuli, increased demand for vehicle purchases was released, and the market continued to improve, exceeding expectations. Both the production and sales of LVs achieved substantial YoY growth, with PVs continuing to sustain good momentum and CVs maintaining rapid growth, with New Energy Vehicles (NEVs) and exports leading the way.

In fact, PV export growth slowed slightly in November compared with the prior month, with total PV exports for the month reaching 400k units, a large increase of 49% YoY. Since the start of 2023, the cumulative volume of PV exports has reached 3.6 million, a significant increase of 66% over the same period last year.

The main driving force of this year’s exports was the improved competitiveness of Chinese products and the breakthrough into the European and American markets. Also, the international brands in the Russian market have now been fully replaced by Chinese vehicles because of the Russia-Ukraine crisis. In addition, a huge export increase has resulted from the improvement in China’s NEV competitiveness. As long as there is stable market demand in the world, there is still plenty of scope for developing China’s auto exports in the future.

If exports are excluded, we can see that the domestic market still grew by 22% in November, and the cumulative growth rate in the first eleven months of this year was 3%. This shows that the domestic market has grown significantly this month, and that the introduction of various promotions has released market demand. As the year draws to a close, all OEMs have also increased inventory at dealers to hit sales targets.

In November 2023, the NEV wholesales volume broke the one-million-unit level for the first time, with YoY growth of 43%. The BEV segment share of NEV sales increased by 1% compared with October, accounting for 65% of plug-in (BEV+PHEV) wholesales. The new Technical Requirements for NEV products to qualify for exemption from the vehicle purchase tax came into force in November, increasing the difficulty of getting this subsidy from the central government. As a result, some Mini size vehicles’ production volume decreased because of high inventory built up in previous months which needed to be consumed by the market by the end of the year. Newly-produced models will be upgraded in certain areas including the battery and e-motor to improve efficiency and sustainability. The government is aiming to promote the technical excellence of NEVs and maintain their leading position in the market.

In China, with the recent intensive introduction of a series of macro-control policies and measures, enterprises’ confidence in market development has been further enhanced, production demand has recovered synchronously, and major car companies are also regularly launching new products, further helping to release market demand. And so, we believe that in the next few years, China’s automobile industry will achieve steady growth increasingly driven by the growth of exports and NEVs.

China’s sales volume reporting has long been based on wholesale numbers as the data source, which includes exports, and our production forecast is driven by sales volume. Due to the surge in China’s vehicle exports in recent years, it is becoming necessary to show the constituent elements of the wholesale figures individually in order to better track domestic demand in China. In future sales-based forecasts and reports we plan to separate the export numbers from the wholesale numbers and show domestic demand history and forecast. Future production forecasts will be driven by domestic sales forecasts and forecasts of imported Chinese cars by the destination country. This process may bring about some fluctuations in forecasts. But the overall trend in our near-term forecasts has remained unchanged.