Thailand’s new vehicle market continued to decline in November 2023, by almost 10% to 61,621 units from 68,284 a year earlier, according to the latest wholesale data released by the Federation of Thai Industries (FTI). The data excludes some key brands including BMW and Mercedes-Benz.

The market has been in decline for over a year, after an initial rebound from the Covid pandemic, driven lower mainly by a sharp decline in pickup truck sales. Economic growth in the country continued to slow in the third quarter, to 1.5% year-on-year from 2.2% in the first half of the year, despite a rebound in the country’s tourism sector. The central bank has hiked its benchmark interest rate from 0.5% to 2.5% over the last year to help support the baht, putting pressure on the country’s heavily-indebted consumers and domestic businesses.

Domestic vehicle sales in the first eleven months of 2023 declined by almost 8% to 707,454 units after rebounding by 17% to 766,589 units in the same period of last year. Vehicle financing companies have tightened their lending criteria significantly this year, along with higher loan repayment rates.

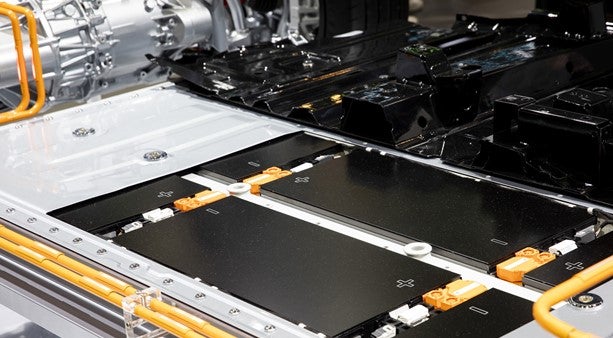

Sales of battery electric vehicles (BEVs) surged eightfold to 64,815 units year-to-date, driven by the recent entry of Chinese models into this market - with BYD accounting for one-third of segment sales year-to-date.

In October the FTI cut its full-year domestic vehicle market forecast further to 800,000 units from 850,000 units in response to the continued sales decline, but increased its estimate for battery electric vehicle (BEV) sales to around 70,000 units.

Vehicle production in the country fell by 1% to 1,708,042 units in the eleven-month period, with output in November dropping by 14%, while exports rose by 16% to 1,027,200 units following last year’s supply chain shortages.