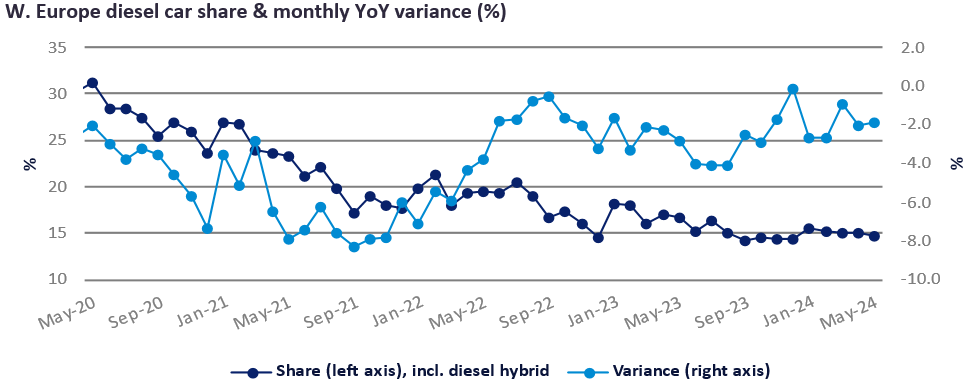

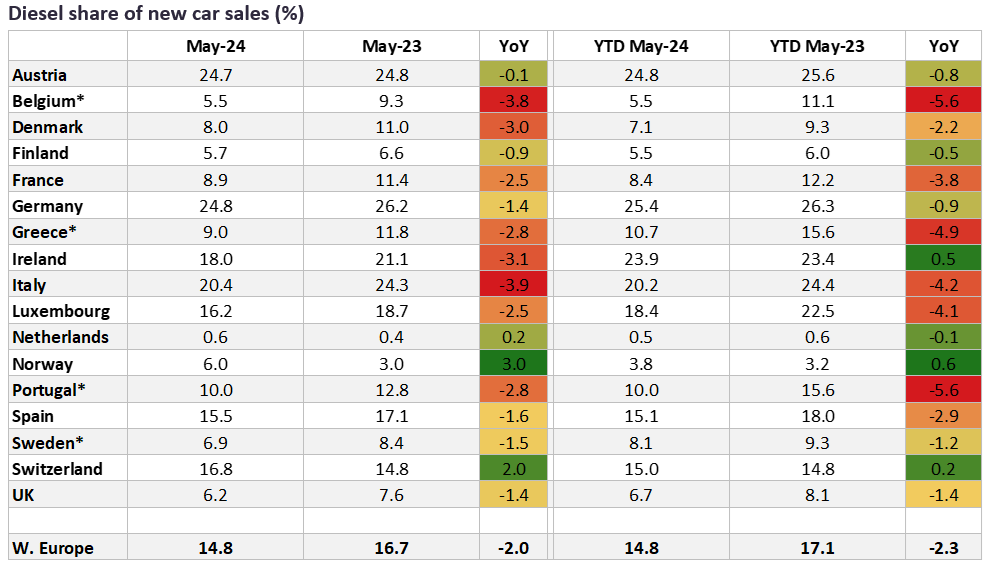

April’s diesel share of new car sales in the region is confirmed at 15.1% with a slight fall in May (subject to slight revision) leading to a provisional reading of 14.8% and year-on-year decline of just 1.9 percentage points.

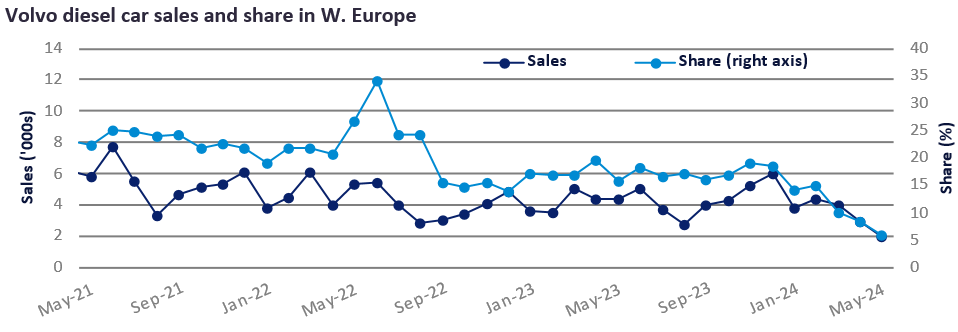

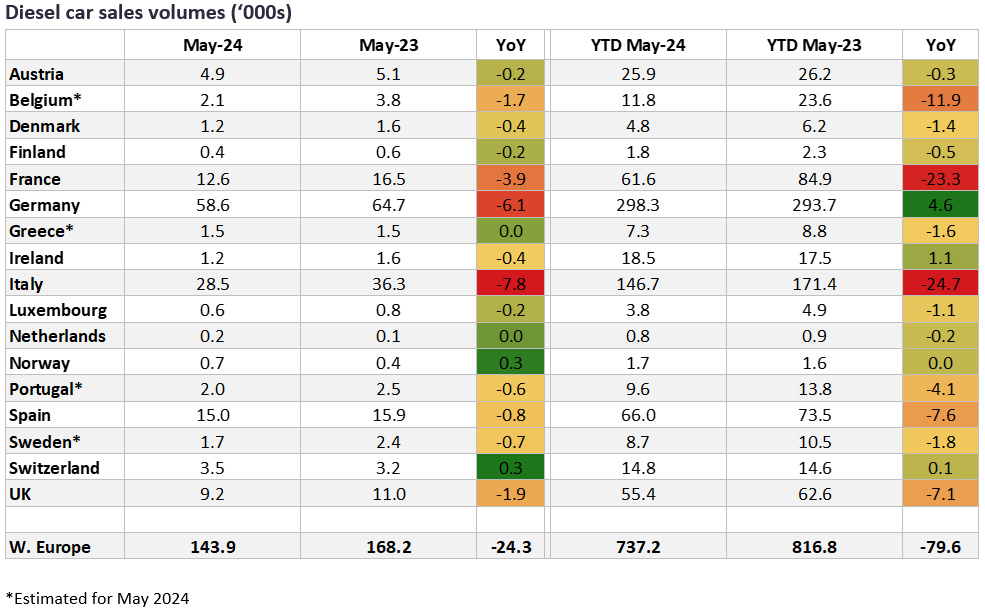

The diesel market, in share terms, has seen near-stability for almost one year though disappointing overall car sales so far in the first half of 2024 have led to diesel volumes falling by circa 25k units in May and by 80k units in the five months to May. May sales were just under 145k with YTD sales at just under 740k (versus 817k for the same period in 2023). As with April, it was only Germany that saw diesel sales rise compared with a year earlier with diesel sales to date running at 5k units up on the same period in 2023. Italy and France continue to lead the way in terms of diesel decline, both returning YTD diesel sales around 25k down on the 2023 achievement. Several markets have seen YTD diesel share increase so far in 2024 versus 2023. Ireland, Norway and Switzerland fall into this category, though the increases are very modest. Volvo’s decision to end diesel car production in March will impact the market, though to date (May) in 2024, Volvo diesel car sales were 17k units versus 21k in 2023 so the hit to Europe’s diesel car sales has yet to be fully realised.

Al Bedwell