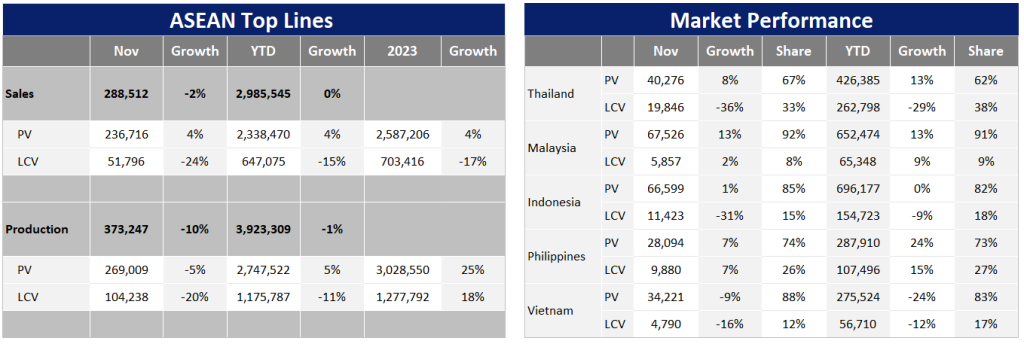

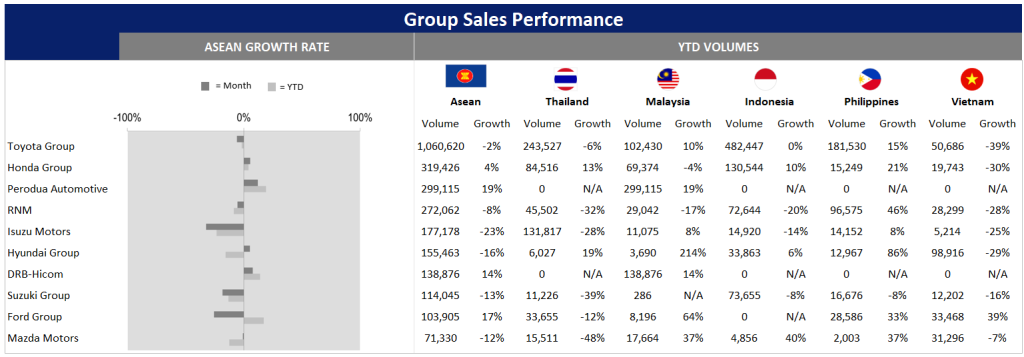

The Indonesian, Thai and Vietnamese light vehicle (LV) markets fell in the first eleven months of 2023 by 2% Year-on-Year (YoY), 8% YoY and 22% YoY, respectively. In contrast, demand in Malaysia and the Philippines rose by 13% YoY and 21% YoY, respectively.

If we focus on Indonesia, Malaysia and Thailand, the three largest markets in the region, they accounted for around 75% of total LV sales in ASEAN5 in the YTD period.

The first eleven months’ data and December estimates enable GlobalData to project full-year sales for countries in the region showing that Indonesia was, again, the largest LV market in 2023; Malaysia overtook Thailand in second place.

Indonesia

The Indonesian market started 2023 with positive sales growth of 5% YoY in Q1 2023 and a 9% YoY gain in Q2 2023, driven by new models and backlogged orders from the auto component shortage. After that, demand began to deteriorate and has dropped off since July; LV sales declined by 10% YoY in July-November 2023. The market turned from a 6% YoY increase to a 2% YoY decline in January-November.

Based on our preliminary data, December LV sales remained weak and saw a 19% YoY decline. GlobalData estimates that Indonesia’s 2023 LV sales recorded around 929k units or dropped by 3% YoY. The weak sentiment is due to a) tighter financial conditions; and b) that consumers are waiting to assess the new government’s policy after the presidential election in February 2024. Despite the sharp decline in H2 2023, Indonesia was still the biggest LV market in the region in 2023.

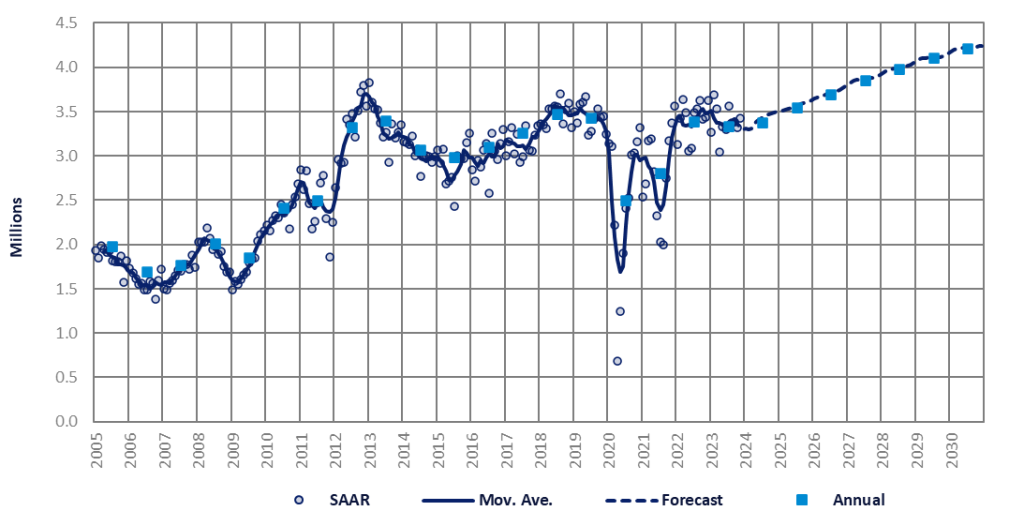

Although 2023 LV sales did not reach 1.0 million units, the Association of Indonesia Automotive Industries (Gaikindo) target, Gaikindo expects 2024 sales will be 1.1 million units. At GlobalData, we do not expect Indonesia LV sales will return to 1.0 million units until 2025.

Thailand

Thailand LV sales dropped by 8% YoY in January-November 2023 with lower sales result in all months except May 2023 (+2% YoY). Behind the poor sales performance was weak demand for light commercial vehicles (LCVs). LCV sales plunged by 29% YoY in January-November, with double-digit percentage decreases for all months due to the fact that a) the economy is slowing and its outlook is uncertain; and b) there is tighter auto loan approval in this segment. In contrast, passenger vehicle (PV) YTD sales jumped by 13% YoY, which was inflated by the government cash subsidy incentive for buying BEVs. BEV sales rose from 10k units in 2022 to 66k units in January-November 2023.

Despite high orders booked at the Thailand International Motor Expo (30 November to 11 December 2023), our market intelligence reported that Thailand LV sales continued to decline by around 17% YoY in December as high booking orders were for Chinese BEV models. Moreover, the Thai government amended the THB 150k cash subsidy for BEVs. Originally, buyers must purchase or book and register BEVs within the month of December 2023. Then, the government allowed consumers to purchase or book within December 2023 and register within January 2024.

As a result, Thailand’s 2023 LV sales were estimated at around 756k units in 2023, a drop of 9% YoY. This poor result led the Thailand LV market to be relegated to third spot in the ASEAN LV market in 2023, overtaken by Malaysia. For 2024, we expect Thailand LV sales to marginally increase by 4% YoY to 785k units, but the market features downside risks: a) China’s slowdown and sluggish global demand for Thailand’s goods exports; b) the recovery in tourism appears to be already stalling; and c) worsened global warming is having an impact on agricultural output.

Malaysia

Malaysia LV sales rose by 13% YoY to 718k units in January-November 2023. The strong sales performance this year was boosted by: the temporary tax cut until March 2023; the recovery of auto component bottlenecks; and a number of new-model launches.

After the tax cut period ended, carmakers offered aggressive promotions to at least partially offset the end of the tax cut. Market leader Perodua fully absorbed tax cuts for all booked orders that the company could deliver by March 2023. Also, we learned that Perodua had large order backlogs from inflated demand driven by the temporary tax cut scheme and supply bottlenecks. Based on our interim data, Malaysia’s LV sales closed 2023 at around 790k units or an 11% YoY increase. Therefore, Malaysia overtook Thailand and became the second-largest LV sales market in ASEAN5 in 2023.

However, we expect the Malaysia LV market to drop to 744k units and return to being the third largest market in 2024 as LV sales may slow after Perodua clears its backlogged orders and due to the pull-ahead effect from the temporary tax on PV that was introduced in June 2020 and concluded in March 2023.

Region outlook

ASEAN LV sales are now projected by GlobalData to drop by 1% YoY to 3.29 million units in 2023 and increase by 1% YoY to 3.33 million units in 2024. However, the near-term forecast will be affected by the downside risks from domestic and global economic uncertainty, the decline in the sales trends in Indonesia and Thailand, and the pull-ahead effect in Malaysia.