Alongside our daily news coverage, features and interviews, the Just Auto team sifts through the week’s most intriguing data sets to bring you a roundup of the week in numbers.

This week brought GlobalData market and industry reports looking at India and Western Europe, as well as some intriguing Ford financials that revealed how difficult it is for the big players to turn a profit on EVs. The month of January saw the US market hit payback after a bumper December. It was also a very good month for Kia in a UK car market that was up again. We also took in the outlook for sales in Asia and were reminded just how important North America is for Toyota’s premium Lexus brand.

Indian market hits a new record in 2023

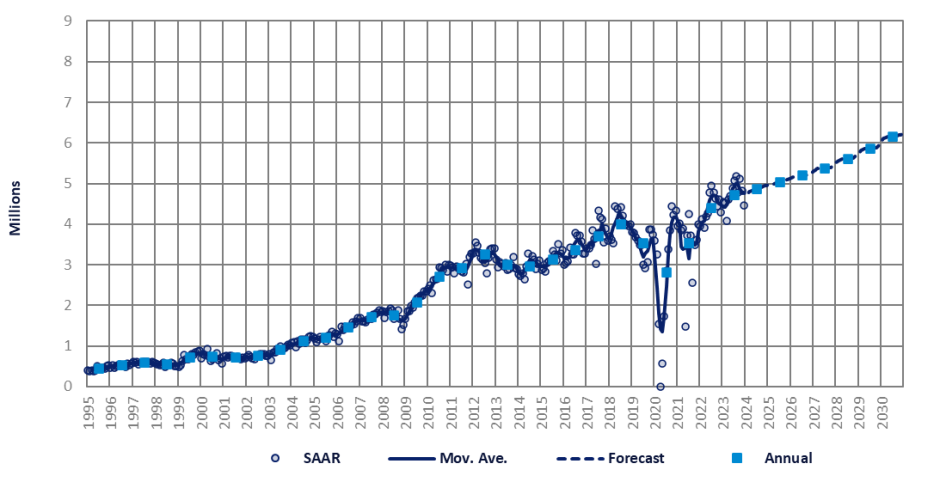

The Indian light vehicle (LV) market broke the record for the second consecutive year in 2023: LV wholesales reached a fresh all-time high of 4.71 million units (+7% YoY) and were virtually in a tie with Japan’s 4.74 million units.

GlobalData’s 2024 latest LV sales outlook is unchanged at 4.9 million units (+3% YoY). The fiscal boost ahead of the April/May general elections will likely continue through H1 2024 and help support job and income growth.

More: Indian market hits a new record in 2023

Western Europe's January decline

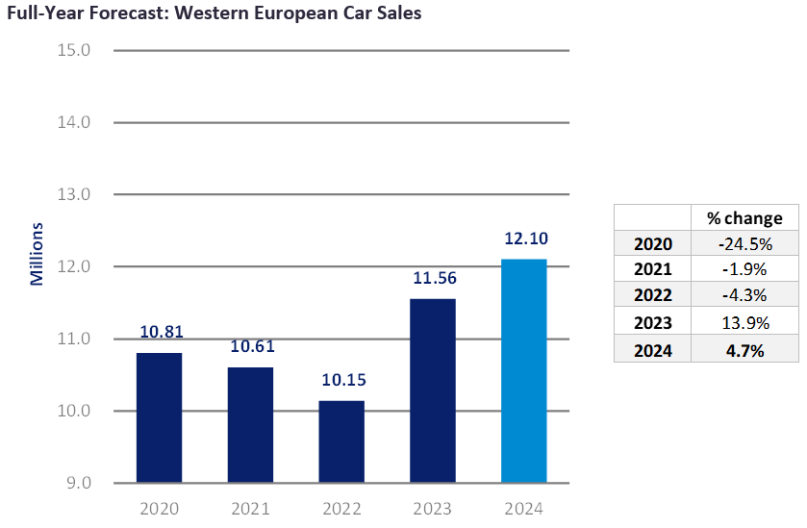

According to GlobalData, the Western Europe car market selling rate fell slightly in January.

The Western Europe new car (passenger vehicle – PV) selling rate fell slightly to 12 million units/year in January, with 901k vehicle registrations. In YoY terms, January grew 10.7% YoY, helped by a strong growth in Germany along with the other major West European countries. However, relative to pre-pandemic January 2019, the PV market is down almost 19%.

More: Western European car market falls slightly in January

Ford's positive Q4 results on ICEs (Blue) and LCVs (Ford Pro) papered over EV losses (Model e)

In the fourth quarter, Ford’s EV business unit, Model e, posted an EBIT loss of $1,570 million. By contrast, Ford Blue, the company’s ICE unit earned $813 million EBIT in the fourth quarter. Ford Pro – mainly light commercial vehicles (LCVs) – was a major profit centre for Ford in Q4, with $1.8bn in EBIT.

More: Ford surprises investors with latest financials

Lexus sets sales record

Lexus said it achieved record global sales in 2023 with 824,258 new cars sold, an increase of 32% year on year. The growth was attributed to strong demand, particularly in Europe, North America and Japan, and a return to more stable parts supply.

European sales rose 46% to 69,000 including a record 15,963 in the UK. Japan sales doubled to 94,647 units and North America volume was up 24% to 355,606.

More: Lexus sets sales record

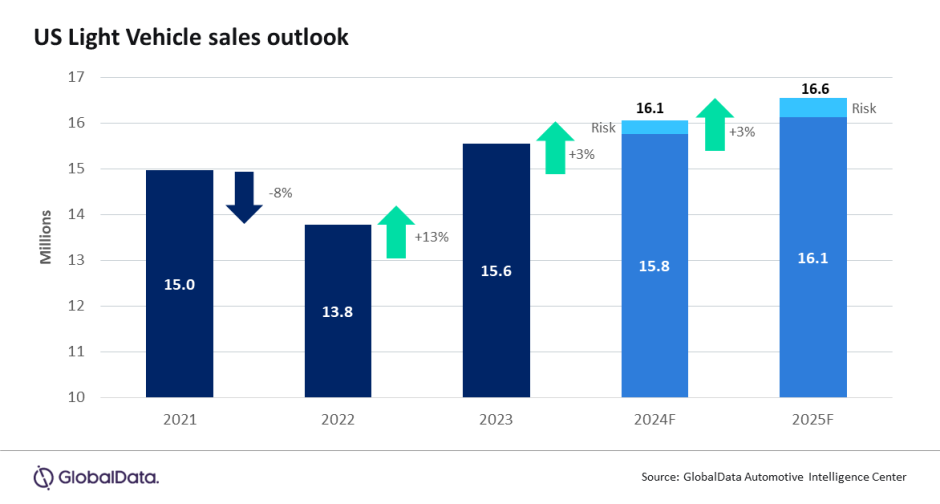

US vehicle market off to slow start in January

US sales in January were disappointing after a strong December. It was not unexpected and is seen as part of a process of market normalisation. If it were not for the presence of an additional selling day as compared to January 2023, the result would have been in negative territory.

More: US vehicle market off to slow start in January

UK car market up 8.2% in January

January saw 142,876 new cars registered in the UK, some 8.2% up on January 2023 and the 18th consecutive month of growth.

More: UK car market up 8.2% in January.

What model was Britain's best seller last month? The Ford Puma (2023's top seller) was knocked off its perch by (drum roll...) the Kia Sportage.

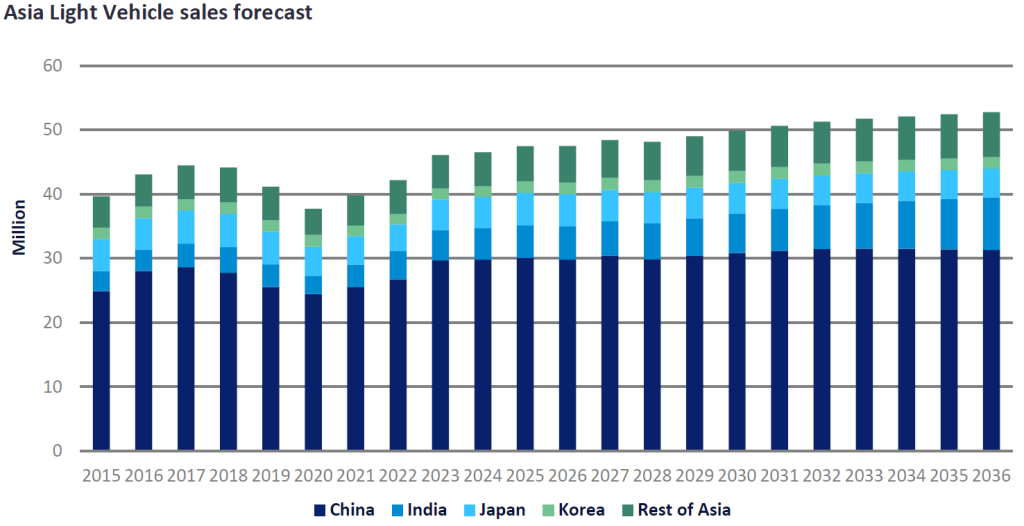

The Asian sales outlook – slowdown ahead

According to GlobalData analysis, the Asian automotive market finished 2023 with phenomenal results. Total light vehicle (LV) sales in the region reached an all-time high of 46.1 million units (+9.3%), exceeding the previous record-high of 44.5 million units in 2017.