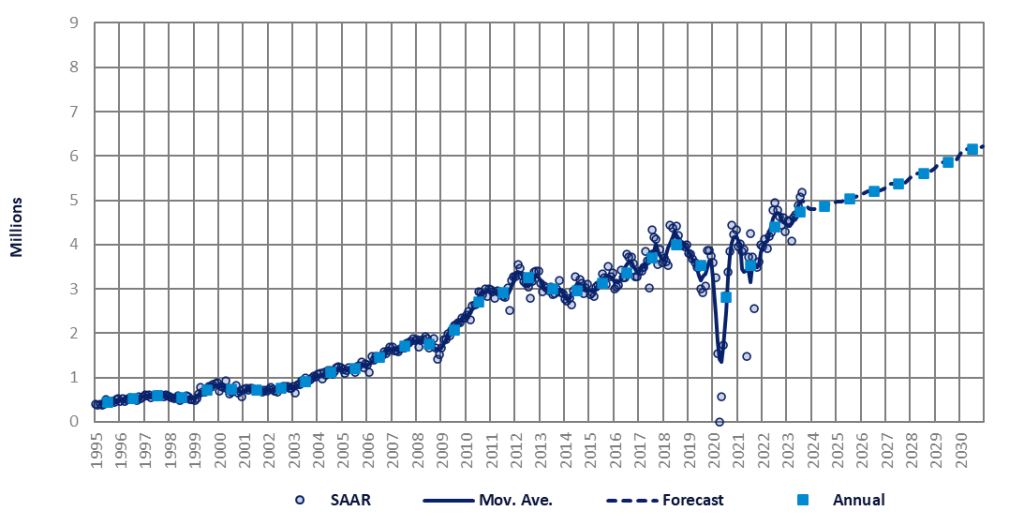

The Indian market continued to accelerate strongly, as the August selling rate reached a fresh record high of 5.18 million units/year, up almost 2% from an exceptionally strong July.

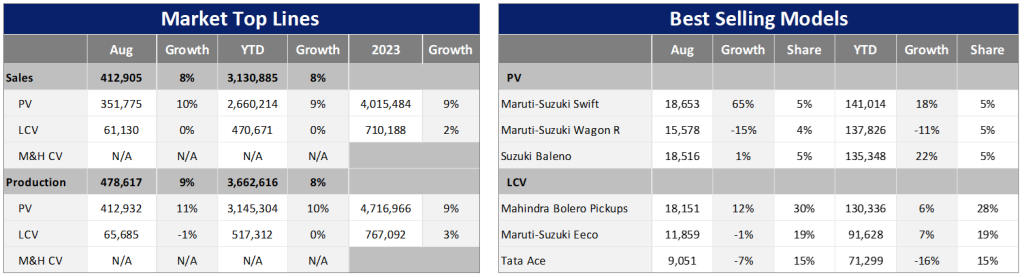

Wholesales in August were up by 2% month-on-month (MoM) and by 8% year-on-year (YoY) to 413k units. Passenger Vehicle (PV) sales grew by 2% over the previous month to 352k units (+10% YoY), while volumes of Light Commercial Vehicles (LCVs) with GVW up to 6T were at 61k units (+2% MoM, 0% YoY).

Meanwhile, retail sales of PVs and LCVs in August increased to 359k units, versus 327k units in July and 337k units in June, according to the Federation of Automobile Dealers Associations (FADA). This upturn was driven by PVs.

“In the PV arena, improved vehicle supply, bolstered by expanded customer schemes, has maintained positive market dynamics. Despite such advances, supply chain bottlenecks persist, particularly in timely deliveries. A constrained product range in popular segments, such as midsize SUVs, continues to limit overall potential,” noted FADA President Manish Raj Singhania.

Consequently, the inventory levels for PVs surpassed the 60-day threshold in August, establishing an all-time high even before the onset of the 42-day festive period. But that is due at least partially to the mismatch of supply and demand. Apparently, there is sufficient supply of Mini Cars (and lower-end models) while consumers are willing to pay more and asking for upper-level variants with high-tech features.

Another reason for higher inventory is that OEMs and dealers are preparing for the festive season, as sales of Mini Cars tend to go up in rural areas during the festivals (which are also a popular wedding season).

Total LV sales during January-August surged by 8% YoY to 3.13 million units, comprising 2.66 million PVs (+9% YoY) and 471k LCVs (zero growth). The YTD selling rate averaged 4.70 million units/year, far exceeding last year’s total LV sales of 4.39 million units.

The sustained strength in the market forced us to make some upward revisions in the forecast for the next several years.

Sales are now projected to expand by 8% YoY to 4.73 million units this year (+80k units from our previous forecast) and by 3% to 4.86 million units in 2024 (+166k units from last month). Sales in H1 2024 are expected to be boosted by government spending ahead of the general elections in April and May.

Despite the upward revisions, our forecast remains cautious.

Vehicle prices are estimated to have increased by 20-30% in the past two years due to the implementation of the BS-VI emission standard, stricter safety regulations, and higher costs of materials and production. Financing costs remain high, too.

In the overall economy, the general elections in April-May 2024 poses some uncertainty. Although Prime Minister Narendra Modi’s ruling party is widely expected to win, a new government normally pauses and reviews fiscal spending.

An uncertain global outlook and intensifying global warming (ex. flood and drought) present other risks to the economy and the new LV sales.