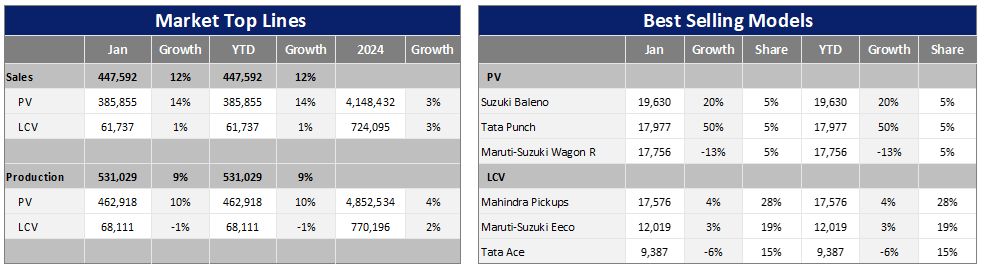

The Indian market made a solid start in the New Year, as Light Vehicle (LV) wholesales in January rose by 33% month on month (MoM) to 448k units.

Not only that, but the January tally was also up by 12% year on year (YoY), even though year-ago sales were also strong.

Passenger Vehicle (PV) wholesales were at 386k units (+36% MoM, +14% YoY), while sales of Light Commercial Vehicles (LCVs) with GVW up to 6T were at 62k units (+17% MoM, +1% YoY).

The January selling rate thus reached a robust 5.1 million units/year, up 14% from a relatively weak December – when OEMs cut deliveries to dealerships to reduce stock at the end of 2023.

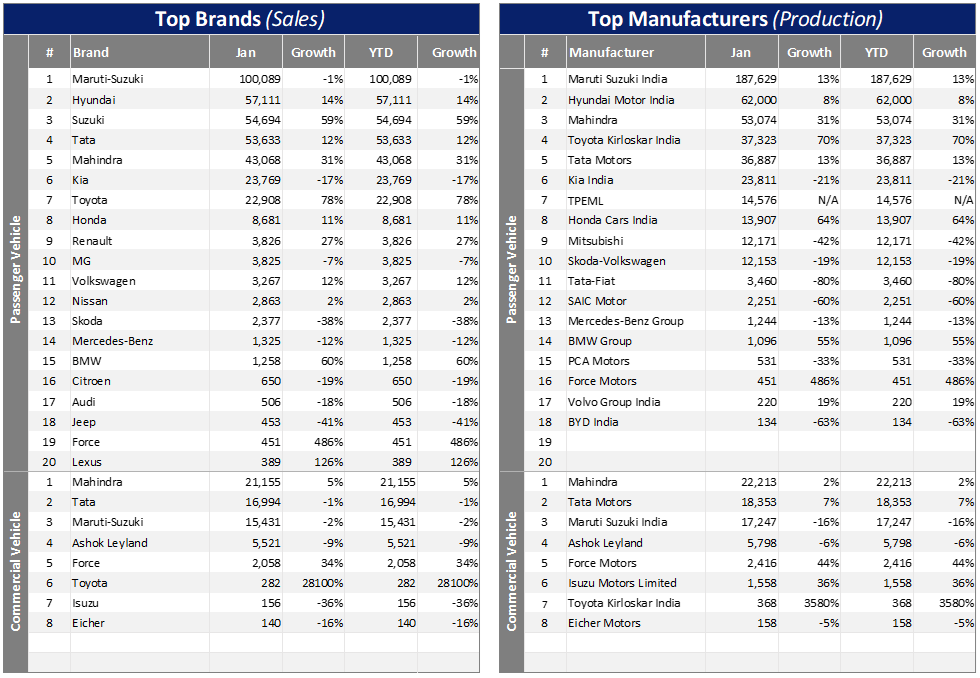

In January, however, OEMs increased deliveries to respond to strong demand, in particular consistently robust appetite for SUVs (which have been the driving force of the market).

In addition, several model updates were launched in January, including the facelift versions of the popular Hyundai Creta and Kia Sonet (both are Sub-Compact SUVs), bolstering January wholesales. Discounts and incentives also helped OEMs move weak-selling models, such as Mini Cars and older vehicles (including SUVs).

At the same time, retail sales of PVs and LCVs in January climbed to 443k units versus 335k units in December 2023, according to data from the Federation of Automobile Dealers Associations (FADA).

“SUV demand, along with the introduction of new models, greater availability, effective marketing, consumer schemes, and the auspicious wedding season underpinned this strong performance,” said FADA President Manish Raj Singhania.

While the average inventory for PVs in India at the end of January 2024 was down slightly to 50-55 days versus 55-58 days in December 2023, it remains above comfort levels. OEMs are thus pressured to further reduce stock.

As a result, the leading OEMs including Maruti Suzuki, Hyundai, Tata, and Mahindra reduced their PV dispatches in February when compared to their volumes in January. Preliminary data for February suggest that Maruti Suzuki and Tata each cut their PV wholesales by 4% MoM, while Mahindra trimmed its deliveries by 2% MoM. Yet, the biggest cut came from Hyundai that slashed its wholesales by 12% MoM in February.

Meanwhile, the Indian government announced the interim FY2024-2025 Union Budget before the general elections in April and May. The key proposal in the budget was an increase in infrastructure spending to a record level, which is expected to have a large multiplier impact on the economy. The budget, however, did not include any big new populist schemes, and showed fiscal prudence.

The budget proposals also did not include any tax incentives for the auto industry and market. It, however, included a budget for the FAME II scheme to promote EVs and support for development of technology to go green, such as biodegradable fuel and materials. Other measures, such as increased capital expenditure, should help the auto industry indirectly, as well.

On the monetary front, the Reserve Bank of India (RBI, the central bank) is widely expected to cut interest rates soon after holding the benchmark rate at 6.5% for more than a year, as inflation continued to moderate.

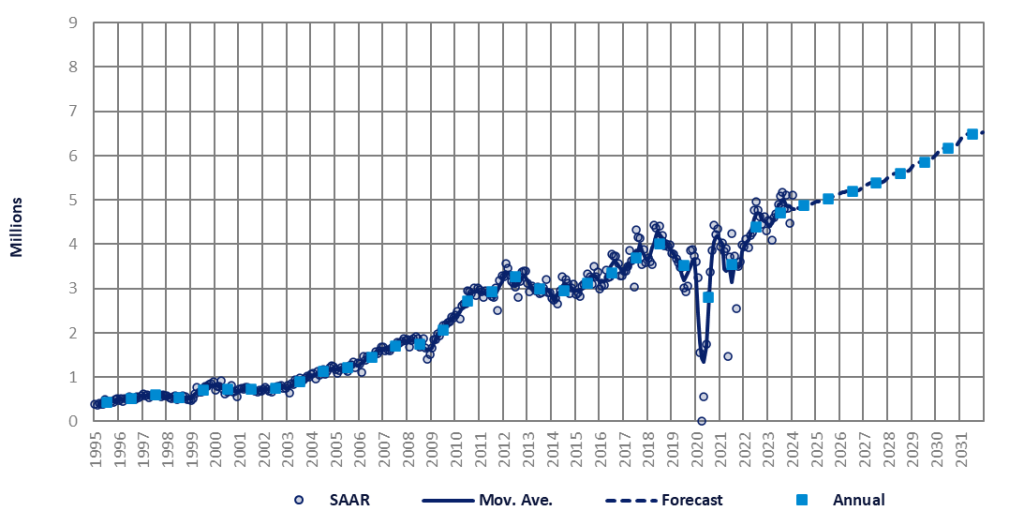

Our forecast is unchanged, except for a minor upward adjustment in 2024. LV sales are expected to increase by 3% YoY to a record high of 4.9 million units this year.

The downside risks to the 2024 forecast arise from still high interest rates and an increasingly uncertain global outlook, while an upside risk comes from a spate of new model launches/updates as well as consistently strong demand for SUVs.