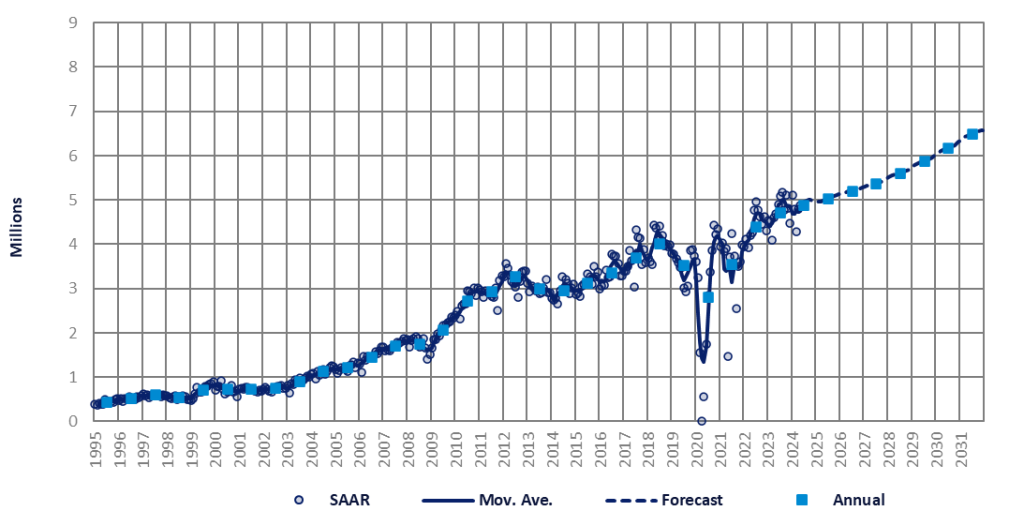

The Indian vehicle market continued to perform strongly, with the May selling rate inching up by 2% from the previous month, to 4.9 million units/year.

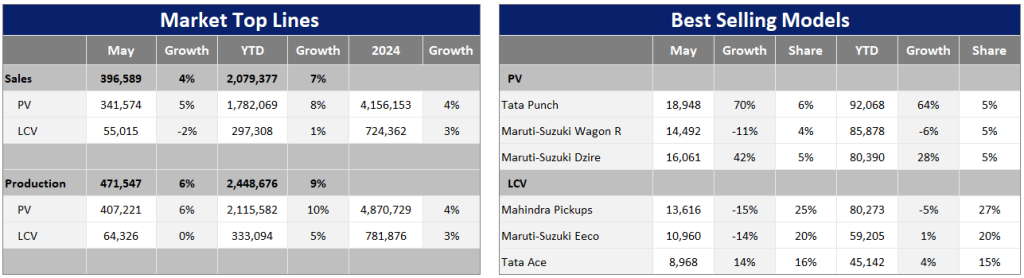

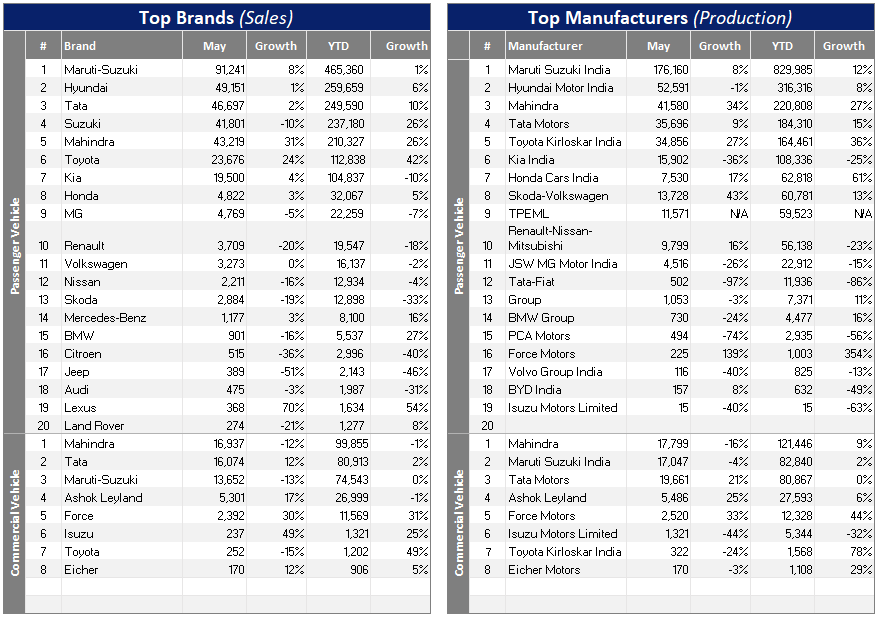

Total Light Vehicle (LV) wholesales in May stood at 397k units, which was up by 3% month-on-month (MoM) and by 4% year-on-year (YoY), despite high sales in 2023. Passenger Vehicles (PVs) accounted for 342k units (+4% MoM, +5% YoY), while Light Commercial Vehicles (LCVs) with gross vehicle weight (GVW) of up to 6T comprised 55k units (-5% MoM, -2% YoY).

Some consumers and businesses remained cautious and postponed vehicle purchases during the six-week general elections that ended in early June. In addition, showroom traffic slowed due to the extreme heatwaves experienced across the country.

On the other hand, demand for SUVs, including growth in rural areas, continued to drive sales and helped to offset lower demand for small and entry-level cars.

In May, retail sales of PVs and LCVs slumped to 349k units compared to 382k units in April and 372k units in March, according to data from the Federation of Automobile Dealers Associations (FADA).

Cumulative LV wholesales from January to May climbed by 7% YoY to 2.1 million units. This tally comprised 1.8 million PVs (+8% YoY) and 297k LCVs (+1% YoY). Therefore, the year-to-date (YTD) selling rate averaged 4.8 million units/year, slightly higher than last year’s record sales of 4.7 million units/year.

Meanwhile, inventory levels at dealerships have remained high, especially for entry-level and older models. As of June, inventory levels were reported to be at 55-60 days, equivalent to around 550k units. Consequently, carmakers and dealers are providing substantial incentives in the form of discounts and consumer schemes.

However, there remains a robust demand for SUVs, leading to a considerable backlog of orders for popular SUV models. As such, pending orders are estimated to be upwards of half a million units. Suzuki Group alone had over 225k orders pending as of early June, including 40k orders for the recently launched latest generation Maruti-Suzuki Swift.

Mahindra also had approximately 220k backlogged orders as of the end of May, with the Scorpio leading the pack, followed by the Thar and the recently launched XUV 3XO (XUV300 facelift). These three models account for 90% of Mahindra’s pending orders. Additionally, Hyundai has yet to deliver 65k ordered vehicles, including 33k units of the Creta.

As we analyze preliminary data for June, PV wholesales appear to be mixed for the major OEMs. Suzuki Group improved its volume by 2% YoY, while Hyundai reported no growth, and Tata Motors saw a decline of 8% YoY. Conversely, Mahindra’s PV sales surged by 23% YoY, while Toyota and Kia enjoyed YoY growth of 44% and 10%, respectively.

Following the conclusion of the general elections and the reappointment of Prime Minister Narendra Modi, we anticipate that buyers will return to the market. This will be further supported by numerous new models and generations that are planned for launch this year.

On the downside, extreme weather, such as heatwaves and floods, could impact not only rural demand, but also the entire economy. High interest rates, persistent inflation, and a record-low rupee also remain significant concerns.

Since sales in May were in line with our expectations, our forecast is unchanged, except for a minor adjustment in 2024. Sales are projected to reach yet another record high of 4.9 million units this year, reflecting a growth of 4% YoY.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center.