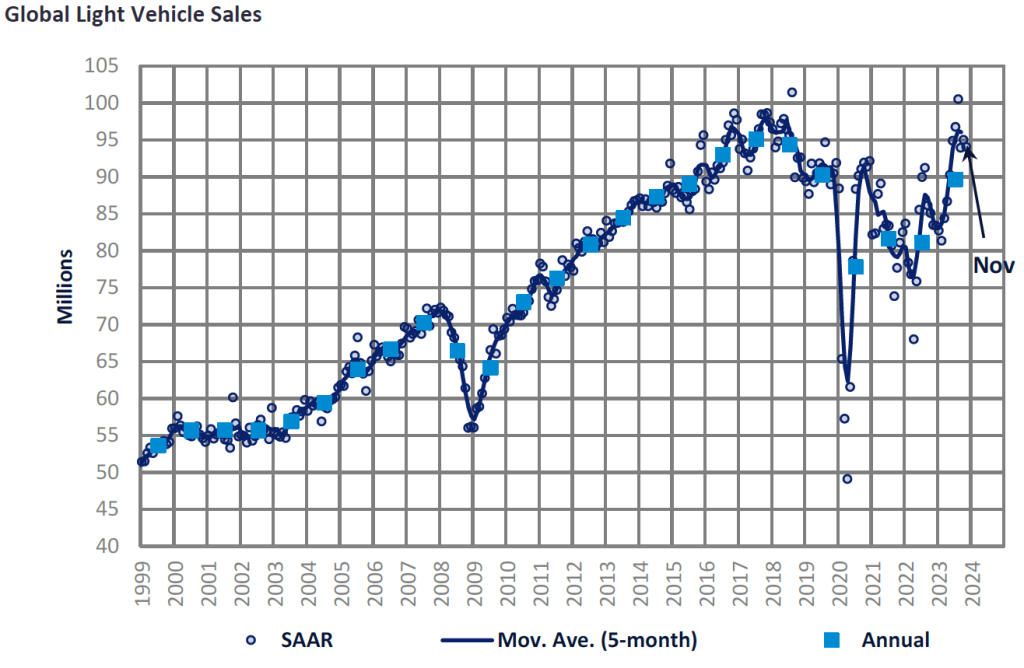

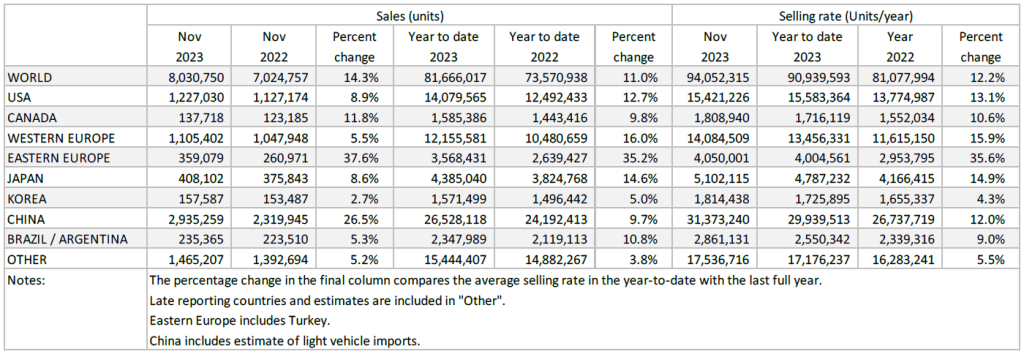

The Global Light Vehicle (LV) selling rate for November was 94 million units/year, slightly lower than the upwardly revised October figure of 95 million units/year. The market was up 14% YoY and in YTD terms 82 million vehicles registered, 11% higher than YTD Nov 2022.

US sales were helped by agreements being settled between the Detroit 3 OEMs and the union, ending the strikes, along with increased incentives during Thanksgiving and Black Friday. China’s market in November also benefited from heavy incentives and discounts by OEMs and dealerships. Meanwhile, European regions continued their recovery. With supply constraints fading, adverse macroeconomic headwinds are a concern heading into 2024.

North America

The US Light Vehicle market grew by a moderate 8.9% YoY in November, to 1.23 million units, while on the other hand the selling rate slightly decelerated to 15.4 million units/year, down from the 15.6 million units/year reported in October. Sales were impacted in October due to the impact of the UAW strike, but the strike was settled by November due to the Detroit 3 OEMs coming to agreements with the union. Transaction prices remained at a high level in November, as the average price was US$45,621, down by only US$23 from October. However, incentives skyrocketed by US$465 MoM to US$2,312, which was likely caused in part by Thanksgiving and Black Friday sales.

In November, Canadian Light Vehicle sales reached 137.7k units, an increase of 11.8% YoY, but breaking the streak of monthly sales above the 150k unit mark. The selling rate dropped to 1.81 million units/year in November, from 2.01 million units/year recorded in October. Looking at Mexico, sales expanded by 34.9% YoY in November, to 128.4k units, boosted by the ‘El Buen Fin’ sales event. However, this uptick was in line with historical norms and so the selling rate declined slightly MoM, to 1.35 million units/year, from 1.38 million units/year in October.

Europe

The Western Europe LV market registered 1.1 million units (+5.5% YoY) in November with a selling rate of 14.1 million units/year, up from October’s result. The region has sold 12.2 million units YTD, 16% higher than YTD November 2022. Supply constraints have continued to ease, helping to fulfil backlogged orders, though the weak economic outlook will, to a degree, be a drag on sales in 2024.

The East European LV market registered 359k units in November, 37.6% higher than November 2022, with a selling rate of 4.1 million units/year. This is similar to October’s selling rate, with 3.6 million units sold YTD, 35.2% higher than YTD November 2022. Sales growth in the region is strongly supported by Russia, which grew over 100% YoY in November.

China

The Chinese market is set to end the year with record sales. According to preliminary data, the selling rate continued to moderate from its peak in July and August (almost 36 million units/year) to 31.4 million units/year in November, but that was still an impressive result. The YTD average selling rate reached 29.9 million units/year. In YoY terms, sales (i.e., wholesales that include exports) increased by 26.5%, due partially to a low year-ago base, and 9.7% YTD.

In November, consumers rushed to take advantage of heavy discounts and aggressive incentives offered by OEMs and dealerships. Domestic sales of Passenger Vehicles (PVs) expanded by 21% YoY against the pandemic-hit weak sales a year earlier and 2.8% YoY, YTD. With brisk sales of NEVs, which accounted for more than a third of total vehicle sales, Chinese brands continued to advance. Looking ahead, however, the sustainability of the “price war” and a slowing economy are concerns.

Other Asia

The Japanese market remains robust, as the improved supply of semiconductors continued to boost production and thus sales. The selling rate reached 5.1 million units/year in November and achieved 4.39 million units/year YTD. Yet, sales in the first eleven months of this year were still 8% lower than sales in the same period in the pre-COVID 2019. While the delivery time for most models has shortened markedly in the recent months, demand is now losing momentum in the face of sticky inflation, falling real wages and global uncertainty.

The Korean market surprised on the upside, with the November selling rate accelerating to a strong 1.81 million units/year. Hyundai’s sales advanced strongly, driven by triple-digit YoY sales growth of the Santa Fe, Grandeur and Kona. Light Commercial Vehicles posted a positive YoY gain for the first time since June 2023, boosted by the introduction of the LPG version of the Hyundai Porter Light Truck , of which the diesel version has been discontinued, due to the new environmental regulations that will become effective in January 2024.

South America

Preliminary estimates indicate that Brazilian Light Vehicle sales increased by 5.1% YoY in November, to 201.6k units. This is the second consecutive month where sales have exceeded 200k units, but only the third month in 2023 to break through this level. The selling rate slightly slowed in November, to 2.40 million units/year, from the 2.46 million units/year reported in October. Sales were strong for Pickup trucks in the month of November, as the popularity of the segment continues to grow. Inventory levels dropped in November to 252k units, down from 263k units in October, and the days’ supply figure declined by 1 day to 36 days.

In Argentina, Light Vehicle sales are estimated to have increased by 6.8% YoY in November, to 33.7k units. As sales declined on a MoM basis, the selling rate also slowed in November to 464k units/year, down from 480k units/year recorded in October. Despite negative reports around automakers facing worsening struggles with securing parts for vehicle manufacturing amid the economic crisis, sales held up well in November.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center