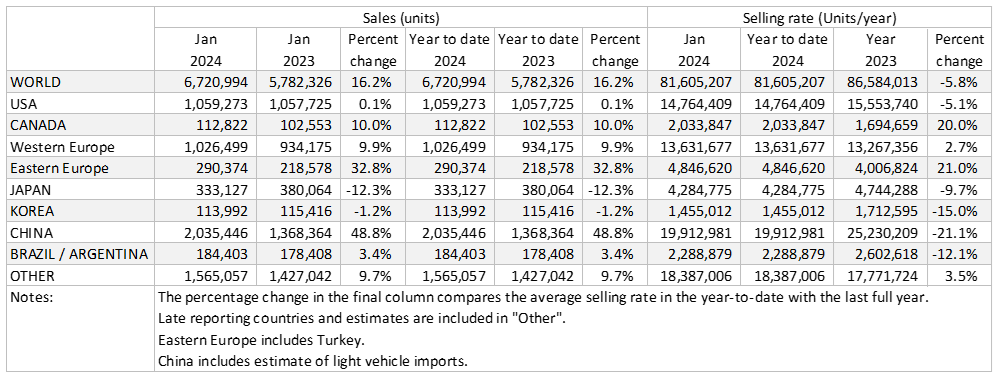

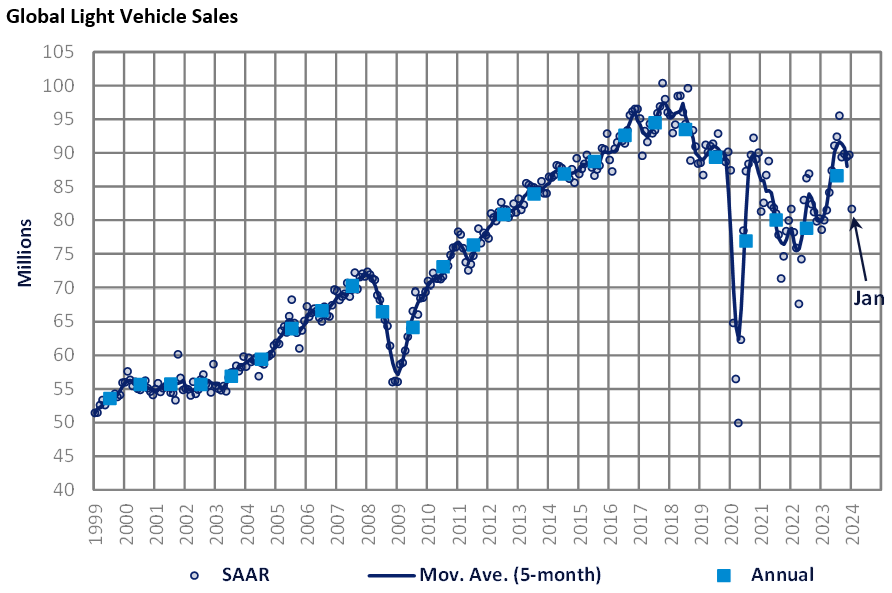

GlobalData’s latest analysis of the global light vehicle (LV) market shows that the seasonally adjusted annualized selling rate (SAAR) for January slowed to 82 million units/year (compared to a like-for-like 90 million units/year in December 2023). Some 6.7 million vehicles were sold last month (that was still up 6% YoY).

From this month onwards, we will exclude exports from the China sales total, where we had previously been including them. We have backdated this adjustment to 2018.

Key markets saw selling rates fall back in January. In the US, there were signs of pricing easing back at a faster pace. In Europe, it was a mixed picture as Western Europe’s selling rate slowed while Eastern Europe’s rate improved. China’s comparable selling rate was also weaker from December to January, even though raw sales grew well, YoY.

North America

The US Light Vehicle market maintained the same level as last year in January 2024 (+0.1% YoY), with sales reaching 1.06 million units. After a very strong December 2023, there was a payback effect in January, as the selling rate fell to 14.8 million units/year, down from 16.3 million units/year in December. Transaction prices could be showing signs of slowing down, as prices dropped significantly in January to US$44,874, down by US$1,332 on a month-over-month basis. Incentives continued their recent upward trend, with January marking the third consecutive months of incentives exceeding US$2,000, at US$2,499.

In January, Canadian Light Vehicles sales reached 112.8k units, as sales grew by 10.0% YoY. The selling rate increased in January 2024 to 2.03 million units/year, up from 1.79 million units/year in December 2023. Inventories remain tight in a few segments, but there are indications that the industry could be recovering towards pre-pandemic levels. In Mexico, sales grew by 18.6% YoY to 111.7k units. The robust pace of sales from 2023 continued into 2024 on the back of strong consumer spending, as the selling rate increased to 1.40 million units/year in January.

Europe

The Western Europe LV selling rate fell from slightly revised 14.8 million units/year in December to 13.6 million units/year in January, with a raw monthly registration of 1 million units, or +9.9% YoY. With supply restrictions fading, we expect underlying demand to dictate sales in 2024, though the economic situation remains challenging.

The Eastern Europe LV selling rate reached 4.8 million units in January, a significant improvement on the upwardly revised 4 million units achieved in December. The LV market registered 290k units (+32.8% YoY). Recovery in Ukraine and Russia, along with a strong performance in Turkey, are boosting LV sales in the region.

China

Starting this month, we are reporting China’s domestic sales (i.e., wholesales, excluding exports, plus imports, instead of the previous data series that included exports). Preliminary data indicates that domestic sales in China decelerated sharply in January. The January selling rate was only 19.9 million units/year (a 12-month low), down 24% from 26.2 million units/year in December. In YoY terms, sales increased by almost 49%, but that was because sales in January 2023 were abnormally weak, due to the expiry of the two major tax incentives in December 2022 and the timing of the Lunar New Year, which fell on 22nd January 2023. There were only 21 selling days in January 2023, compared to 31 selling days in January 2024. In January this year, average sales per day was 65.7k units, virtually the same as 65.2k units in January 2023. By that measure, January sales this year were as weak as the January 2023 sales.

At the beginning of January 2024, Tesla launched a new round of incentives, including low financing rates and insurance subsidies. And immediately after Tesla’s announcement, other major OEMs followed suit. Yet, the positive impact of the “price war” apparently faded. Consumer sentiment remains depressed in the face of a sluggish job market, the deteriorating property crisis, and an increasingly uncertain economic outlook.

The Japanese market is off to a weak start. The January selling rate was 4.28 million units/year, down 17% from a strong December. The sharp slowdown was caused by Daihatsu’s suspension of production and shipment of all its vehicles, due to the scandal over its safety test. (Daihatsu is a major automaker of Mini Vehicles, which account for nearly 40% of Japan’s total LV sales.) The major earthquake that hit Ishikawa Prefecture on New Year’s Day also caused some supply-chain disruptions.

The Korean market started the New Year with disappointing results as well. The selling rate decelerated sharply for the second month in a row to 1.46 million units/year in January. The slowdown can be attributed at least partially to Hyundai’s temporary shutdown of its Asan plant for retooling, but also to weakening demand, as the lagged and full impact of high interest rates is now hitting consumer spending. After the post-pandemic spending boom, consumers are now focusing on rebuilding their savings in the face of a slowing job market and an uncertain economic outlook.

South America

Brazilian Light Vehicle sales grew by 16.6% YoY in January, to 152.1k units. Sales are generally slower at the beginning of the year, as the selling rate shrank to 2.04 million units/year in January 2024, down from 2.57 million units in December 2023. However, the low base allowed volumes to increase comfortably YoY. Inventory levels increased in January to 216.5k units, up from 210.1k units in December, and the days’ supply marginally increased by 1 day to 40 days’ supply, despite some localized production stoppages.

In Argentina, Light Vehicle sales landed at 32.2k units in January, a decline of 32.7% YoY. The slowdown appears to be at least partly the result of the fact that some OEMs are facing problems sourcing parts due to unpaid debts. The selling rate also saw a sharp drop in January 2024, as the rate decreased to 252.4k units/year, down from 408.9k units/year in December 2023.