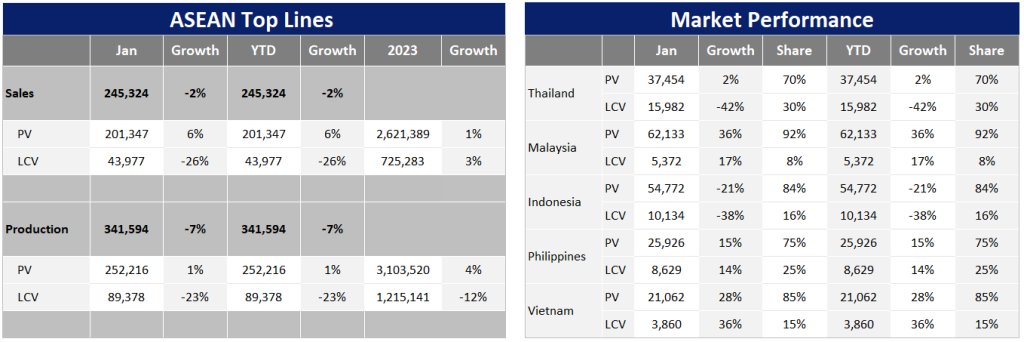

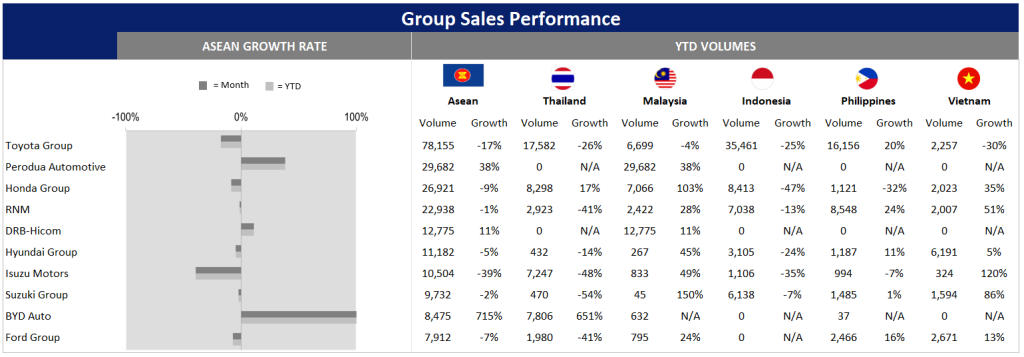

ASEAN Light Vehicle (LV) sales experienced a marginal 2% YoY decrease in January 2024 (January), with mixed results across the region. Indonesia and Thailand encountered significant declines, whereas Malaysia, Vietnam, and the Philippines saw robust growth.

Indonesia

In Indonesia, the Association of Indonesian Automotive Manufacturers (GAIKINDO) reported a 24% YoY downturn in January. Subsequent data suggests that February 2024 (February) sales continued to fall 18% YoY. The sluggish sales during the first two months were influenced by high inflation, the rise in interest rates, and uncertainty ahead of the presidential election.

Despite a 21% YoY market contraction in the initial two months of the year, we project a modest 3% rise in full-year 2024 sales. This forecast is predicated on two pivotal factors: 1) the revised Battery Electric Vehicle (BEV) incentive program, which allows automakers to import BEVs contingent upon investing in the country; and 2) the introduction of new Chinese competitors that are offering models at competitive prices. Additionally, there is speculation that the government may introduce incentives for hybrid vehicles and reduce the tax for Low Cost Green Cars (LCGC) from 3% to 0%. Such initiatives would likely lead to lower prices and stimulate demand in both segments.

Thailand

In Thailand, the LV market continued its decline with a 17% YoY drop in January, primarily due to the 42% YoY decrease in Light Commercial Vehicle (LCV) sales. This downturn was a result of stringent credit conditions and the faltering economy. In contrast, Passenger Vehicle (PV) sales increased 2% YoY. However, this growth rate decelerated from a 12% YoY increase in 2023, as January sales were disrupted by the Toyota and Daihatsu testing scandal, leading Toyota Thailand to halt vehicle deliveries to dealers, who then sold only in-stock models. Notably, the Toyota Veloz recorded zero units sold in the month.

Our advanced data indicates that Thai LV sales in February dropped by 28% YoY and 5% MoM to 51k units, as BEV sales slowed from 14k units in January to just 4k units in February, following the government’s reduction of the BEV cash subsidy starting February 1. Based on weaker-than-expected February sales, we have made minor downward adjustments to the LCV forecast, while maintaining the PV forecast. Total LV sales are now expected to increase by only 2% to 769k units this year, following a 9% decline last year, with risks skewed to the downside.

Malaysia

In Malaysia, January sales experienced a robust surge of 34% YoY, bolstered by the strong performance of leading automakers, such as Perodua (+38% YoY), Proton (+11% YoY), and Honda (+103% YoY), along with the new Chinese entrants, notably the BEV BYD and the affordable Chery brand. This remarkable growth can be attributed to the low base of the sales volume in January 2023, which was felt the impact of fewer working days in the month. It is noteworthy that the Chinese New Year festival took place in January last year. Subsequently, February sales continued the upward trend with a 3% YoY increase. Given that LV demand in January and February exceeded our projections, we have adjusted the forecast for Malaysia’s LV sales in 2024 to 766k units. Even so, our latest forecast represents a 3% YoY decline from the record highs of 2023, due to the pull ahead of a temporary tax cut on PV and diminishing backlogged orders. Another significant development highlighted in this report is the government’s contemplation of a cash subsidy for BEV purchases, the same as the policy implemented in Thailand, to stimulate BEV demand.

Vietnam

In Vietnam, sales in January rose 29% YoY due to the low base set in January 2023, when the Tet holiday period disrupted demand. However, January LV sales plummeted 53% MoM, as consumers had accelerated their purchases in December 2023 before the expiration of the registration fee reduction for locally produced models. Given the weaker-than-anticipated January sales, we have revised the 2024 sales forecast downward for the country from 409k units to 407k units.

Philippines

The Philippines market has sustained its robust performance into the new year, with a 15% YoY increase, thanks to the resolution of supply chain disruptions, the fulfillment of backlogged orders, and strong demand for newly introduced models. In light of January sales surpassing our expectations, we have modestly revised up the Philippines’ 2024 sales outlook to 448k units. The local industry’s optimistic outlook, spurred by new model launches, has prompted an upward revision in sales forecasts. However, potential headwinds, such as elevated interest rates and global economic uncertainties, could moderate growth prospects.

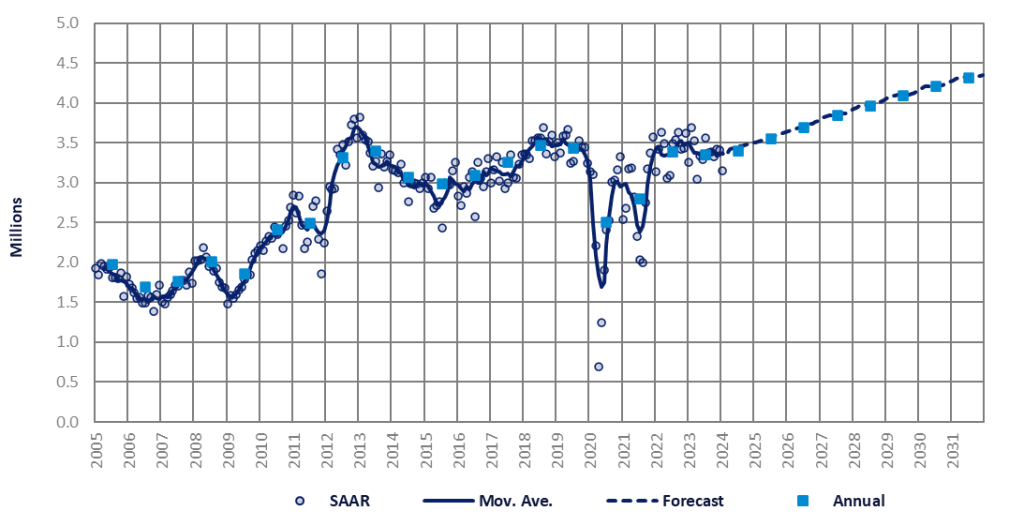

Despite an overall decline in ASEAN5 sales in January, the full-year forecast for 2024 has been increased to 3.35 million units, reflecting the upward adjustments in Malaysia and the Philippines. However, factors such as high household debt, stricter auto loan approvals, and sluggish economies could adversely affect 2024 sales, particularly in the markets of Indonesia, Thailand, and Vietnam.