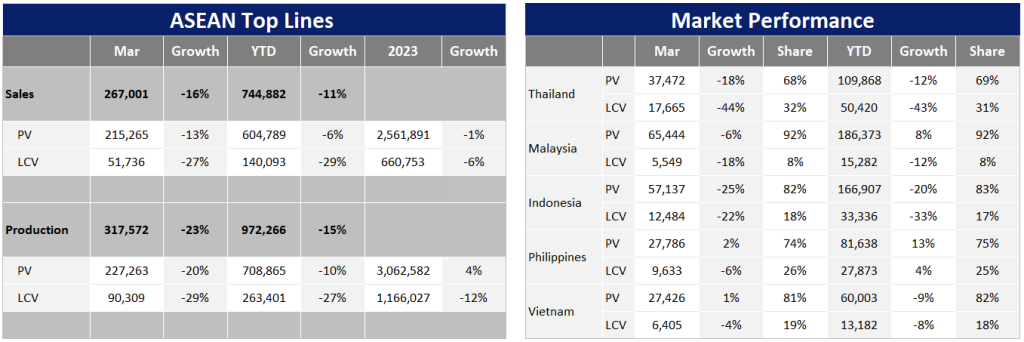

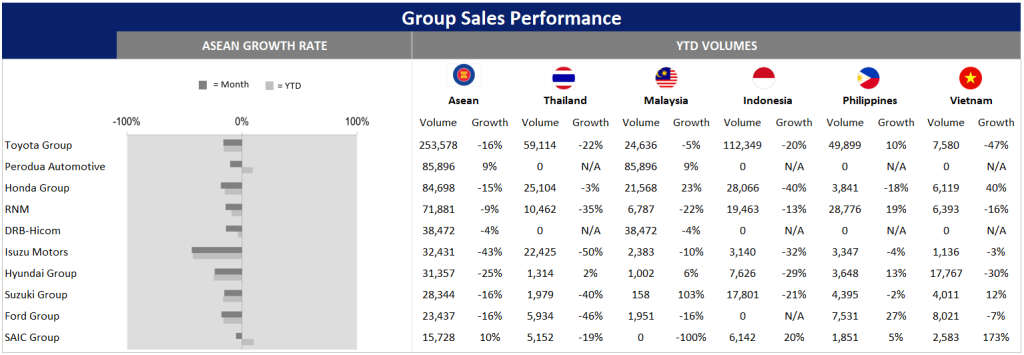

ASEAN Light Vehicle (LV) sales decreased by 11% year-on-year (YoY) in Q1 2024, primarily driven by lower sales volumes in Indonesia, Thailand and Vietnam, while Malaysia and the Philippines saw positive sales growth.

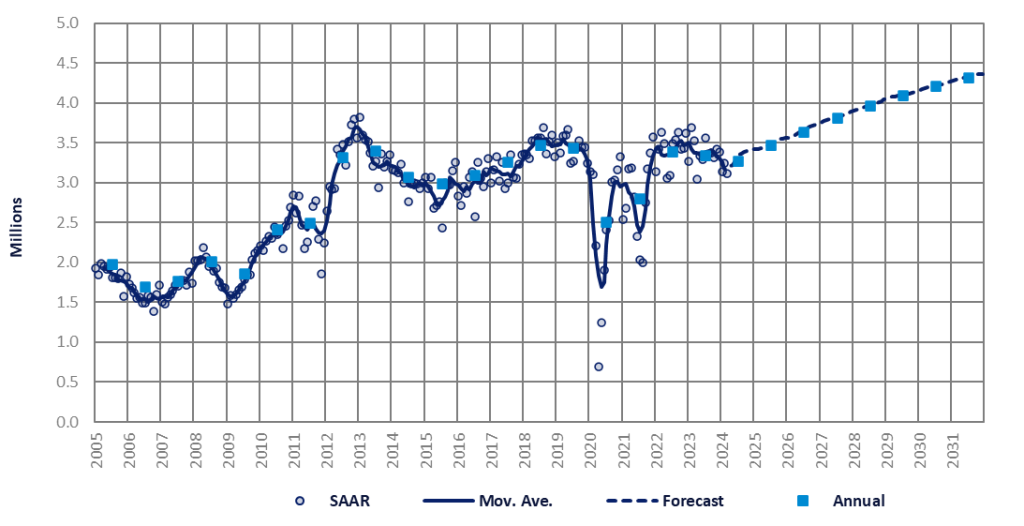

Indonesia’s LV sales plummeted by 22% YoY to 200k units in Q1 2024. Several factors contributed to the weak result, including consumer and business caution surrounding the presidential election in mid-February and disruption in March due to the Ramadan period. Additionally, a high base effect from a strong performance last year, driven by recovery from global supply chain disruptions and new model launches from popular brands like Toyota, Daihatsu and Honda, also played a part in the double-digit YoY decline. Preliminary data for April indicates a continued slump in sales (-18% YoY and -35% month-on-month (MoM)) due to shortened working days during the Eid holiday. Consequently, we have revised our near-term sales forecast downward. Sales are now projected to decline by 4% to 894k units in 2024, marking the second consecutive year of contraction. It is worth noting that the Bank of Indonesia raised the interest rate to 6.25% in April to address currency weakness, which may increase the cost of auto loans and tighten loan approval criteria.

After a 9% YoY decline in 2023, Thailand’s LV sales experienced a further substantial drop of 24% YoY in Q1 2024. In terms of vehicle type, Light Commercial Vehicle (LCV) sales fell by 30% YoY in 2023 and continued to decline by 43% YoY in Q1 2024, as a result of economic weakness, severe weather conditions, delayed government budget spending, and stricter auto loan approval. Passenger Vehicle (PV) sales, which had increased by 11.9% YoY in 2023, saw a reversal with an 11.7% YoY decline in Q1 2024, following the government’s reduction of cash subsidies for Battery Electric Vehicle (BEV) purchases from THB 150k to THB 100k in February 2024. Based on preliminary data, Thailand’s April sales dropped by 18% YoY and 14% MoM to 48k units, marking the lowest monthly sales in 32 months. Given this sustained weakness, we have adjusted our near-term sales forecast downward. Sales are now expected to decline by 6% to 708k units this year, with downside risks persisting. Credit conditions are unlikely to ease any time soon, due to high levels of household debt and non-performing loans.

Vietnam’s LV sales declined by 9% YoY in Q1 2024, due to the impact from the expiration of the temporary registration fee reduction in December 2023 and the Lunar New Year holiday in February 2024.

Despite this decrease, it is anticipated that sales will rebound and increase by 2% YoY to 385k units for full-year 2024. This growth is expected as the real estate sector has stabilized and is gradually recovering, and the country’s significant export and export-driven manufacturing sectors have rebounded from the previous year’s downturn. These factors are likely to support the economy and drive LV demand. Another notable development is the Ministry of Finance’s potential plan to reintroduce the registration fee reduction for locally-produced models, with a proposal expected to be submitted to the government in May.

On the other hand, the Malaysian LV market enjoyed an 8% YoY increase to reach 202k units in Q1 2024, driven by strong sales of the Perodua Bezza and Axia, the newly launched Honda WR-V, and the entry of new players such as Chery Group and BYD Auto. Consequently, Malaysia emerged as the largest LV market in ASEAN5 in Q1 2024. Based on Proton’s estimates, total industry sales volumes continued to increase strongly by 24% YoY to around 59k units. With the robust LV demand continuing into April, the sales outlook for 2024 has been revised upwards to 785k units. However, this projection represents a slight decline from the record high sales of 794k units achieved in 2023, as sales in H2 2024 are expected to decrease after fulfilling a large backlog of orders. However, there is a possibility of a spike in LV sales in H2 2024, fueled by rumors of the government considering cash subsidies for BEV purchases, similar to Thailand’s policy.

In the Philippines, LV sales surged by 11% YoY in Q1 2024, with notable increases of 15% YoY in January and 19% YoY in February. However, March saw a marginal 0.2% YoY increase and a 0.3% MoM decrease, possibly due to consumers delaying purchases to await sales promotions at the Manila International Auto Show event held from 7-10 April 2024. The sales outlook for 2024 has been adjusted slightly, with an increase of 3% expected, reaching 451k units. This growth follows three consecutive years of double-digit expansion and is the second-highest annual sales figure, trailing behind the peak of 461k units in 2017, which was inflated due to a tax hike in January 2018.

Overall, ASEAN LV sales are projected to decline by 2% YoY to 3.22 million units in 2024, due to the negative sales outlook in Indonesia, Thailand, and Malaysia.