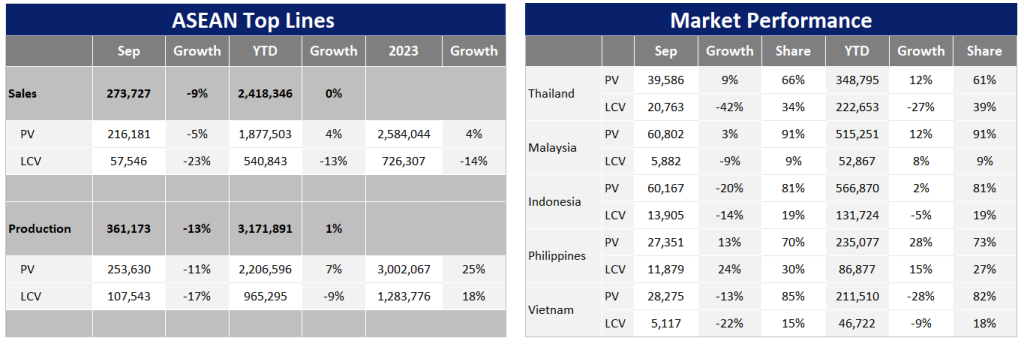

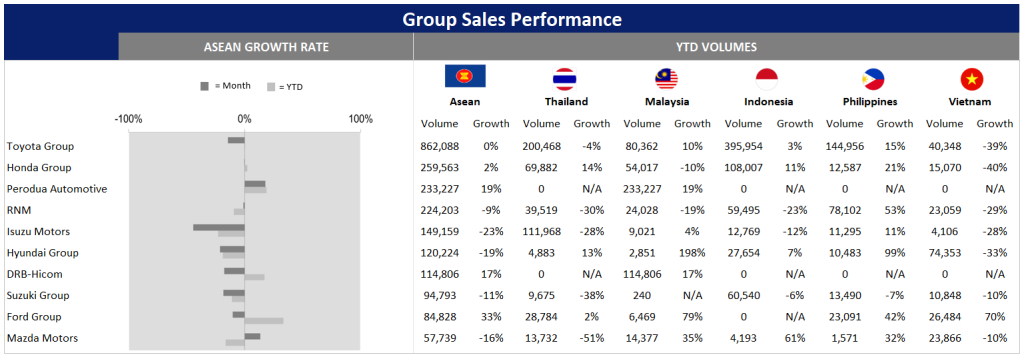

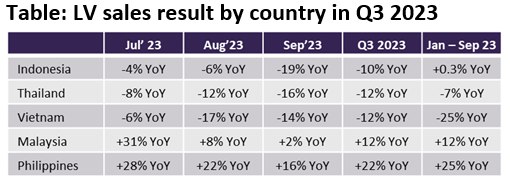

ASEAN Light Vehicle (LV) sales dropped by 9% YoY in September which was the second consecutive month of decline. As such, the market fell by 3% YoY and 0.1% YoY in Q3 and January-September 2023, respectively. This poor Q3 sales were mainly due to the declining sales trend in Indonesia, Thailand and Vietnam.

Look at the details of these three countries, Indonesia LV sales dropped a sharply 19% YoY in September and 10% YoY in Q3 2033 due to a) fading demand after the GAIKINDO Indonesia International Auto Show (GIIAS) in August 2023; b) September 2022 sales saw the third highest monthly level last year since the government completely ended the temporary tax cut measure in the month; c) tighter auto loan approval, amid higher non-performing loans (NPLs) and interest rates; and d) consumers waiting to see the new government’s policy after the presidential election in February 2024.

Based on the preliminary data, October sales remained weak (-13% YoY). Due to the unfavourable economic conditions, the gloomy global situation and weak sentiment, we lowered our Indonesia sales outlook to 927 units in 2023.

In Thailand, the overall market dropped 12% YoY and 7% YoY in Q3 and January-September 2023, respectively. Separated by vehicle type, Passenger Vehicle (PV) sales rose 10% YoY and 12% YoY in Q3 and January-September 2023, respectively thanks to the strong demand of new generation Toyota Yaris Ativ and the government’s cash subsidy to purchase BEV models amounting to THB 150k (or USD 4k). The cash subsidy program initially required buyers to purchase and register within December 2023. Currently, the government has amended the requirement by extending the registration period to January 2024. This led us to slightly increase the country’s PV sales outlook this year.

In contrast, Light Commercial Vehicle (LCV) sales dropped 35% YoY in Q3 and 27% YoY in January-September due to the weak economic situation. Moreover, the higher interest rates and tightened auto financing conditions have impacted both PV and LCV sales this year but the impact on LCVs has been larger than PVs, as many buyers of Pickup trucks are self-employed and/or in an informal business sector. These buyers are facing difficulty obtaining approval for financing. Based on our advance data, Thai October sales continued to decline 8% YoY, which is likely due to the weak LCV sales. So, we cut our LCV sales forecast through to the long term. Thai LV sales was now projected to be 766k units in 2023 and will not return to 1.0 million units until 2029.

Despite that the Vietnamese government re-introduced the temporary registration fee reduction by 50% for locally built models from 1 July to 31 December 2023, Q3 2023 sales still declined by the double-digit rate of 12% YoY as the payback of the registration fee halving scheme last year, higher financing costs, and tightened credit conditions. Moreover, consumer and business confidence have tumbled, as the country’s once bubbling property market has gone bust after the government took measures to rein in leveraging and launched anti-graft campaigns. Since sales continued to underperform our expectation and schemes failed to boost demand, we cut our Vietnam forecast through to the long term and projected 2023 sales of 400k units, or a 15% decline from last year.

For Malaysia and Philippines, we increased our 2023 sales outlook for the latter based on the fact that a) our market intelligence indicated that Perodua still has a huge number of backlogged orders, and increased supply at Perodua is pushing up sales in the overall Malaysia market; and b) Philippines sales results were robust, which were driven by both the supply and the demand sides. It is worth noting that Perodua for accounted around 40% of the Malaysia LV market and that imported CBU vehicles accounted for around 80% of Philippines LV sales. The recovery of the supply chain is one of the key positive factors for the Philippines market.

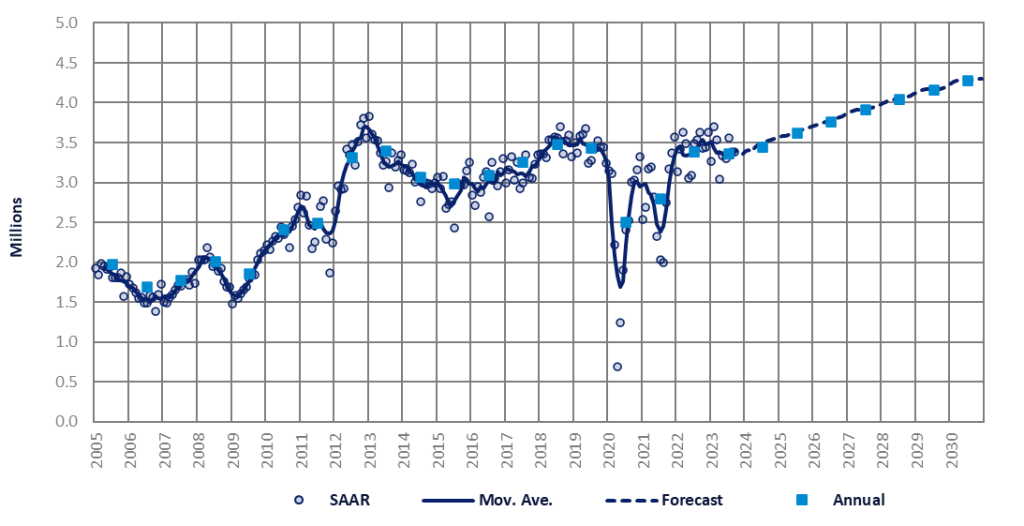

In conclusion, ASEAN5 2023 sales were lowered by around 1% compared to our previous report, with downward sales revisions made for Indonesia, Thailand and Vietnam and upward adjustments made for Malaysia and Philippines. As such, 2023 sales were projected to be 3.31 million units or a 1% YoY decline. Then, 2024 sales will marginally increase by 2% YoY to 3.39 million units, with downside risks being the weak economy and global tensions.