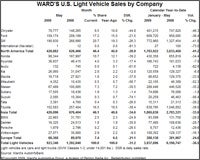

The US light vehicle market declined by almost 34% year-on-year in May to 923,346 units. On an adjusted daily selling rate (DSR) basis the drop was estimated by Ward’s at 31.2%.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

However, some analysts pointed to a welcome bottoming of the underlying market and higher retail sales, suggesting the industry is entering a period of stabilisation.

“The big jump in consumer confidence in May translated into a solid gain in retail vehicle sales compared to April,” said Don Esmond, senior vice president of automotive operations for Toyota Motor Sales.

While the figures were not very good for the Detroit Three, Ford turned in a relatively strong month with sales off ‘only’ 21% on last year.

George Pipas, head of US sales analysis at Ford, said annualised light-vehicle sales were about 10m units in May, a little higher than the 9.86m seen in April.

Ford said it sold 161,197 cars and light trucks in the US last month. Sales of the Ford Fusion rose 9.4% as the company began selling new 2010 models, including a hybrid version.

GM said it GM said it delivered 191,875 vehicles in May, helped by 110,866 truck sales.

Ward’s estimated GM sales as off 26% on year-ago levels and GM was reported to have enjoyed strong holiday sales.

Despite liquidation sales by Chrysler dealers, Chrysler sales were a staggering 48% down on last year. However, the beleaguered firm said that it managed to sell more vehicles to retail customers in May than any other month so far this year, despite its entry into bankruptcy.

The year-on-year comparison was unfavourable for the Japanese makers who were riding high last year when oil prices spiked. Toyota said its US sales fell 40% from last year but climbed 21% on April. Honda Motor Co. reported its year-over-year volumes dropped 41% while Nissan Motor Co. said sales fell 33%.

In the first five months overall light vehicle sales were estimated by Ward’s at 3,937,696 units, down 36.5% on last year on a comparable DSR basis.

Analysts cautioned that signs of a bottoming of the market are welcome, but that the course of the economy will be critical in the coming months.

Market volatility will also be compounded by the impact of the Chrysler and GM bankruptcies and how consumers and other OEMs react to that.