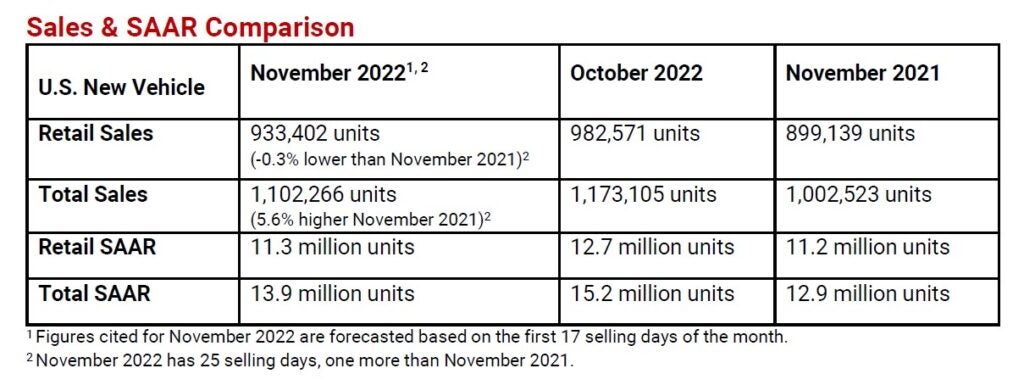

US new vehicle sales for November are forecast by LMC Automotive and JD Power to reach 1,102,300 units, a 5.6% increase over November 2021. Comparing the sales volume without adjusting for the number of selling days translates to an increase of 9.9% from 2021.

The underlying gain reflects an improving supply situation.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Thomas King, president of the data and analytics division at JD Power said: “November results demonstrate that vehicle production is continuing to improve, with available retail inventory exceeding one million units for a second consecutive month and a larger share of manufacturers’ production being allocated to fleet customers. The increased production is enabling a 9.9% increase in total vehicle sales (non-selling day adjusted) for the month of November.

“On the retail side, demand continues to exceed supply, as evidenced by continued strength in transaction prices, retailer profits, inventory turn rates and minimal manufacturer discounting. However, as inventories and interest rates rise, these metrics will show signs of either moderation or decline.”

New vehicle transaction prices continue to rise but at slower pace than earlier this year. The average price in November will set a record for the month of $45,872, an increase of 3.1% from a year ago.

The record transaction prices mean that buyers are on track to spend nearly $42.8 billion on new vehicles this month—the highest level ever for the month of November and a 7.0% increase from November 2021.

King added: “Looking at December and into 2023, the dynamics observed in November are expected to persist. Gradual improvements in vehicle availability will lead to improvements in the new-vehicle sales pace, but per-unit prices and profitability will moderate. Rising interest rates and falling used-vehicle values will compound this rebalancing of the industry price-volume equation. However, it is important to recognize that the overall health of the new-vehicle industry is exceptionally strong and will remain so in the coming months.”

Global light vehicle selling rate uptick forecast

Jeff Schuster, president, global forecasts, LMC Automotive, said that the global light vehicle selling rate is expected to increase slightly in November to 86.5 million units but volume growth from November 2021 is expected to be moderate at 8%. He also warned that the potential for new lockdowns in China and a rail strike in the United States add some risk to the outlook for November and December, although inventory is generally improving.

“The full-year outlook for 2022 has slipped to 81.5 million units, which is just 70,000 units higher than 2021,” he said. “In 2023, we expect to see a rebalancing of supply and demand, and the overall volume effect due to supply disruption should fall to 2.9 million units from 7.3 million units in 2022. The 2023 outlook is tempered slightly by weakening economic conditions, down to 84.6 million units from our previous forecast. The market remains quite dynamic as some improving variables are countered by negative ones.”