US light vehicle sales plunged 23.5% to 962,501 units last month from 1,310,525 a year previously. Year to date volume was off 12.8% to 10,725,477.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

According to WardsAuto.com, total car sales were down 4.3% to 5,601,552 units after nine months while trucks were down 20.6% to 5,123,552. But September car sales fell 18.7% to 481,141 while trucks were off 27.8% to 481,360 units.

“Consumers and businesses are in a very fragile place,” said Ford marketing and communications chief Jim Farley. “An already weak economy compounded by very tight credit conditions has created an atmosphere of caution.”

Detroit-based brands GM, Ford and Chrysler posted a 21.5% fall to 508,367 units in September and were 19.4% down to 5,150,408 year to date.

Ford took the biggest tumble last month – 31.2% to 118,401 – followed by Chrysler (-30.2% to 107,061) and GM (off 12.1% to 282,869).

To the end of the third quarter, Chrysler sales were down 25.3% to 1,179,517 units, Ford was down 17.2% on 1,557,114 and GM sales had softened 17.8% to 2,413,525.

“The economy is going through a difficult restructuring, resulting in great uncertainty among consumers,” Chrysler vice chairman and president Jim Press said.

“We are committed to supporting our customers with significant savings and innovative financing, and our dealers with new business solutions. Longer term, we all need to be investing in building a healthier automobile industry and be ready to compete when the economy strengthens.”

Detroit’s number-crunchers could, perhaps, take some comfort from the even larger falls appearing last night on spreadsheets in places like California and Tennessee.

Ignoring Isuzu’s 50.2% drop to 457 units as it all but exits the light vehicle market to concentrate on medium-sized haulage trucks, Suzuki posted the largest September fall amongst the Asian brands – 44.4% to 4,083.

Major players Toyota (off 29.5% to 144,260), Honda (-20.9%; 96,626), Nissan (-34.2%; 59,570) and Hyundai (-22.3%; 24,765) all posted falls last month as did the smaller brands Kia (-24.8%; 17,383), Mazda (-32.9%; 16,169); Subaru (-8.3%; 14,491) and Mitsubishi (-36.5%; 7,378).

Dave Zuchowski, Hyundai Motor America’s national sales head, said: “While we are disappointed in September sales results, we believe it is consistent with that happened in the overall industry.”

Not one of the Asian brands posted a rise in fact.

“This September was an incredibly volatile month for Wall Street,” said American Honda sales chief Dick Colliver. “Obviously, no one is immune to market shifts as dramatic as we have been seeing.”

Asian brand cars sales were down 27.6% to 388,908 in September and off 6.3% to 4,880,899 year to date.

In the first three quarters, Toyota sales were down 10.4% to 1,793,303, Honda was off just 1.1% to 1,180,583 and Nissan down 3.4% to 785,774. Subaru alone was up – 3.7% to 143,789.

“We are up 4% in total sales for the year and the Subaru Impreza, Forester and Legacy sedan are on record pace with their best nine-months results ever,” said Tim Colbeck, head of sales for Subaru of America.

European brand sales were off 23.5% last month to 65,226 units and down 12.8% to 694,170 for the three quarters.

Leader Volkswagen posted 24,693 September sales, off 4.4% (YTD: -1.0%; 241,184 units), BMW was down 22.7% to 18,506 (-4.8%; 236,327 YTD) and Daimler was down 4.6% to 20,569 sales last month and actually up 8.5% to 195,583 year to date.

Porsche, which recently updated its 911 line, was down 42.5% to 1,458 units in September and off 19.8% to 21,076 YTD.

“We are fortunate to have set a rational plan in place for the entire year. While our sales this month are on a level with others, in the year to date, we are still tracking better than the overall premium market,” said BMW of North America president Jim O’Donnell.

Audi of America chief Johan de Nysschen said: “We believe that Audi will maintain its strong luxury market share despite consumer concerns about the economy, and we expect to see momentum around the new A4 continue to build well into the fall season.”

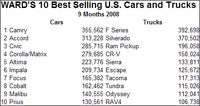

Though truck sales were down, two nameplates were still the top selling single models in the US for the year so far – Ford’s perennial F-series (392,698) and GM’s Chevrolet Silverado (370,502).

Top cars YTD were the Toyota Camry (355,562), and Honda’s Accord (313,228) and Civic (285,715).

Graeme Roberts