Automakers had a bountiful Thanksgiving as Americans flocked to dealers and delivered a surprisingly strong sales month.

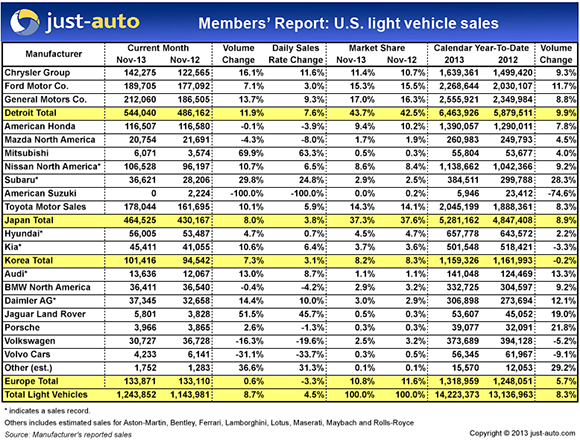

Total volume rose 8.7% with the more profitable trucks accounting for 51.9% of the deliveries, up from 50.2% in November 2012. Year to date (YTD), sales are 8.3% ahead of the first 11 months of 2012.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

November’s seasonally adjusted annualised rate (SAAR) came in at 16.41m, well above analyst estimates and the strongest reading since February 2007.

Chrysler’s new Jeep Cherokee, its showroom debut delayed by last minute fixes for the new nine-speed automatic transmission’s software, delivered the best first full month results of any fully redesigned vehicle in at least the past two years. Every current model posted improvement, giving Jeep an all time November sales record and helping Chrysler deliver the best November of the Detroit automakers.

Lincoln’s MKZ put the brand in the black with a 114% jump. All by itself, the MKZ has Ford’s long suffering Lincoln almost to the break even point for the year.

Slumping C-Max and soft CUV/SUV sales left Ford with the smallest improvement among the Detroit Three. The F-series pickup accounted for 35.8% of Ford brand sales.

General Motors’ sales rose 13.7% as retail sales continued to improve. Cadillac passenger car sales climbed 29% propelled by the new ATS and XTS. GM pickup sales were up but they still aren’t delivering the bump expected of a major update.

Toyota sales rose 5.9%, driven by a triple digit increase posted by the refreshed Avalon and a 56.5% jump in deliveries of the high volume RAV4. Lexus improved but still looks to finish the year a distant third in the premium segment.

Honda took a small hit in November as Civic sales fell 12.6%, offsetting minor improvements in other model lines.

Nissan reported record November sales with significant growth in several passenger car lines, including the high volume Altima and Sentra.

Among the second tier Japanese automakers, Mitsubishi posted its best November results since 2007 as sales of the Outlander and new Mirage boosted the brand to a 69.9% gain. YTD sales are now ahead of the first 11 months of 2012.

Subaru brought home an all time record November with a triple digit jump on Forester sales. Mazda came up 4.3% short of matching its November 2012 figures as drops in key models wiped out a triple-digit jump in sales of the 6.

Hyundai and Kia both delivered records in November but still lost a tenth point of market share. Kia remained in the red for the year.

Volkswagen brand sales were down 16.3% but its premium brands did well: Audi posted its 35th consecutive sales record and Porsche is now up 21.8% in YTD sales. VW definitely needs some pizzazz (Scirocco? Less vanilla styling?) to bring customers back to dealer showrooms.

Mercedes-Benz is heading to the top of the premium segment this year: record November results, aided by the CLA, put it over 7,600 sales ahead of BMW, which took a hit in light truck [SUV] deliveries last month.

Pickup sales continued strong, up 16.4% last month. In YTD sales, pickups clamed 14.0% of the total market, up a full point from 2012.

The traditional December push should have US light vehicle sales in the 15.5 to 15.7m unit range but even with November’s solid results, the rise of leasing and relaxed credit, year over year growth remains at just over 8%, the slowest since 2009.