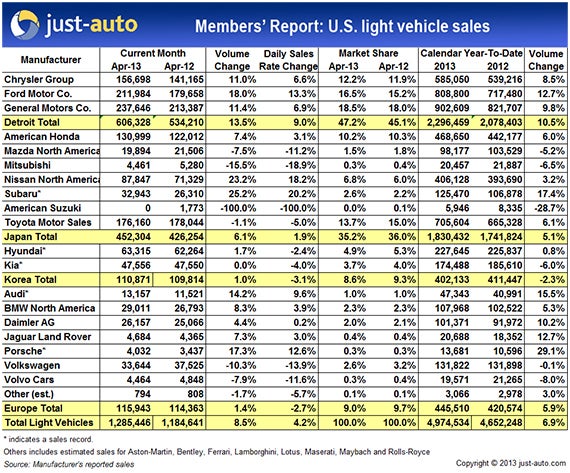

US light vehicle sales continued their upward swing in April, finishing up 8.5% year on year at 1.29m for the month. Year-to-date (YTD) results were 6.9% ahead of the first four months of 2012.

While volume growth was higher in April than in March, the seasonally adjusted annualised rate (SAAR) came in at 14.92m, below the forecast 15.2m. This is causing some concerns among market watchers and manufacturers hoping for 15m-plus sales this year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

April was a banner month for the Detroit automakers: all reported double digit improvements and increased market share. As a group, Chrysler, Ford and General Motors claimed 47.2% of the market.

The gains were due in part to a 27.0% surge in sales of full-size pickups which accounted for 11.9% of total light vehicle sales. This is a good sign for the US economy as pickup sales tend to reflect growth in construction and other industries.

Total light truck share increased from 46.2% of the market last year to 49.1% this year.

Ford finished the month 18.0% ahead of last year as the Fusion kept its spot as the top selling American badged car. The botched rollout of the new Lincoln MKZ saloon was forgiven as cars finally hit dealer lots. Almost by itself, the MKZ brought in a 20.7% increase for the brand.

General Motors reported an 11.4% increase in deliveries with all four divisions in the black. Cadillac’s new ATS and XTS boosted sales 34.3% in April and the Verano and Encore gave Buick an 11.1% lift.

Chrysler, hampered by model changes at Jeep, gained 11.0% over April 2012 as Ram pickup sales soared 48.5%. The Dart was one of several models reporting best ever April sales. On the downside, the flagship Chrysler 300 seems to be going through a prolonged slump and the once unbeatable Chysler Town and Country and Dodge Caravan minivans now trail the Honda Odyssey and Toyota Sienna.

Citing reduced fleet sales, Toyota came up 1.1% behind April 2012. Truck sales remained strong but Toyota brand car sales fell and the Camry was outsold for a second consecutive month, this time by the Honda Accord.

Honda light truck sales and a strong month from Acura gave Honda a 7.4% gain. Sales of the Odyssey, Pilot and Acura RDX were major contributors.

Sales of the Sentra, Altima and Pathfinder drove Nissan sales up 23.2%, the largest improvement among the major players.

Subaru reported another monthly sales record while Mazda and Mitsubishi missed their marks. American Suzuki – exiting the US as far as cars and SUVs are concerned – reported zero sales.

Both Hyundai and Kia reported April sales records though Kia’s was by just six units. Kia’s new, upscale Cadenza saloon went on sale in April and it will be interesting to see how the brand perceived by most Americans as budget-friendly fares in the segment.

Audi reported another monthly sales record, as did Porsche. VW itself reported a 10.3% shortfall, the first such in a while.

Mercedes-Benz maintained a slim lead over BMW in the luxury segment as both companies reported sales increases.

Volvo sales fell 7.9% as almost all of its model lines came up short.

Both Jaguar and Land Rover enjoyed improved results in April as sales rose 7.3%.

Some fret about April’s low SAAR being a sign of trouble ahead; just-auto thinks it’s a bit early to batten down the hatches. While conditions could change dramatically, the first four months of 2013 show little deviation from the trends of the past few years. There’s no reason yet to think 2013 won’t deliver 15m sales.

|