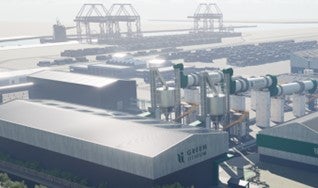

Green Lithium, which is constructing the UK’s first low-carbon merchant hard-rock lithium refinery, has partnered with Prospedia Capital, an emerging automotive sector fundraising specialist to raise up to £2.6 million of seed and venture capital.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

It will be covered under the UK’s Enterprise Investment Scheme (EIS).

It is expected that the lithium refinery, to be based in Teesside in the north of England, will disrupt the market as an alternative supplier to China for European battery supply chains.

Green Lithium says it has taken significant steps to derisk its business model, having secured over £14 million of private investment and UK government grants for various crucial aspects of its business model, such as bench-scale and pilot trials, engineering studies, independent life cycle analysis, and capital expenditure reports.

Green Lithium chief executive officer Sean Sargent said: “Even with all existing potential European suppliers being successful, there will still be a 43% deficit in the supply of this crucial battery-grade material. It’s a pressing issue requiring sustained government involvement alongside private investment.”

The firm is also working with the University of Sheffield to develop a patented process to commercialise its primary byproduct. This strong environmental stance should further instil confidence in potential investors.

Isobel Sheldon OBE, chief strategy and investment officer at Prospedia Capital said: “We’re delighted at this opportunity to help Green Lithium with its fundraising efforts,”

It is hoped that Green Lithium’s refinery will help carmakers localise their supply chains while scaling up battery production and reducing emissions from refining lithium hard rock to produce lithium hydroxide and carbonate.

The first step for the company is to build a demonstration scale-up plant, producing 1,250 tonnes of high-quality lithium chemicals annually, which has the potential to generate revenues of £28 million before the completion of the full-scale plant, which comprises two lines capable of producing 50,000 tonnes of lithium chemicals, sufficient for 1.2 million battery electric vehicles.

With over £1 million already pledged, this penultimate round of early-stage investment precedes an institutional funding round, enabling the construction of a scale-up plant, with further capital to be raised for a full-scale plant.