The UK new car market recorded its second successive month of growth in September, with registrations rising 4.6%, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT).

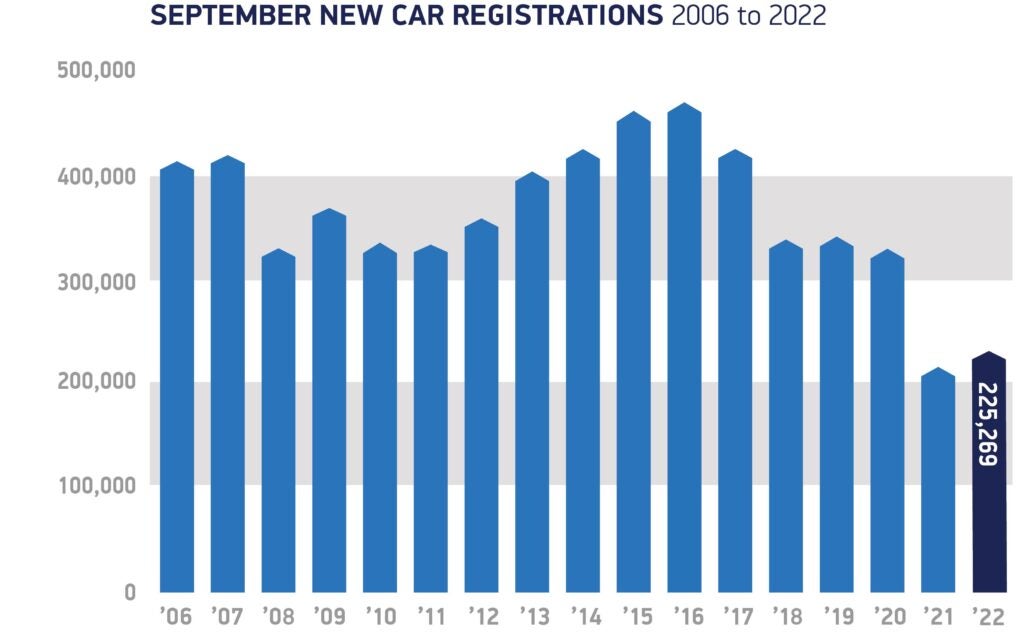

During what is typically the second biggest month of the year for the sector, 225,269 cars joined Britain’s roads. While this was a 9,957 unit increase on last year, when the industry recorded its weakest September since 1998, overall registrations for the month are still some 34.4% below pre-pandemic levels as the industry continues to battle issues constraining supply to fulfil a backlog of orders.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Bucking recent trends, registrations by large fleets grew by 12.5% or 11,315 units, although this still represents a significant (-39.7%) decline on pre-pandemic volumes. Registrations to private buyers, meanwhile, fell by 3.6%.

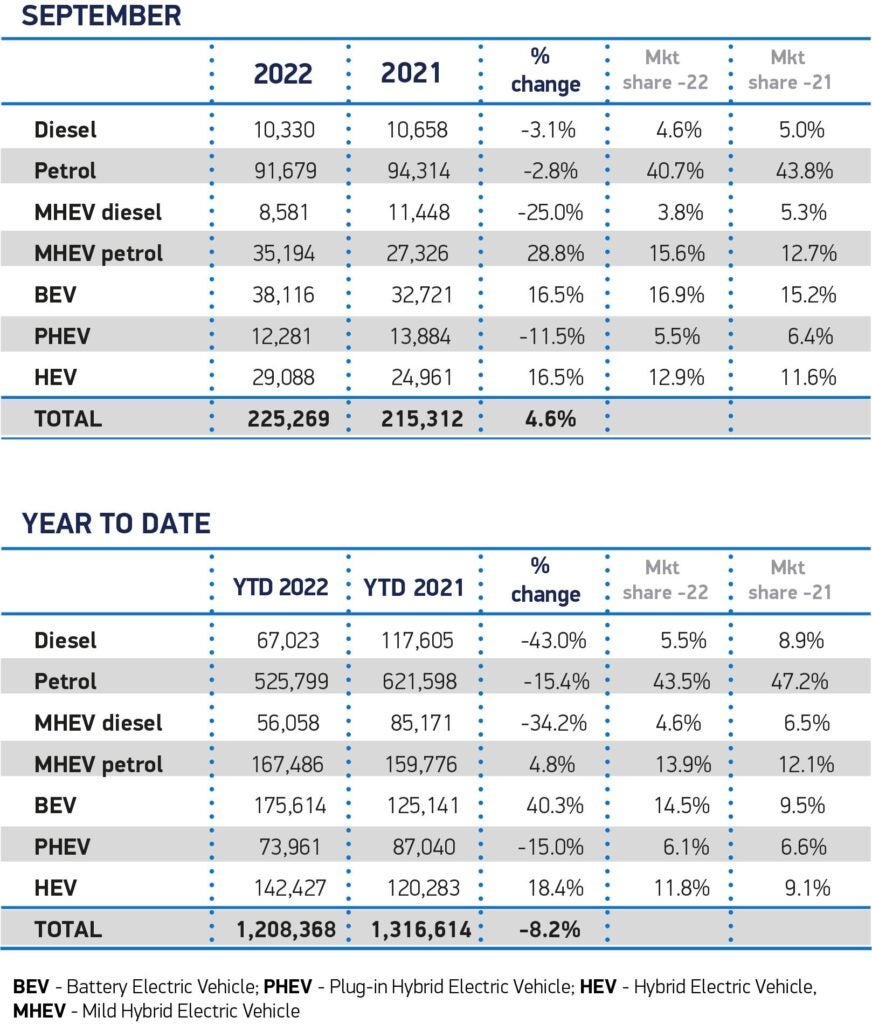

Electric vehicle uptake continued to rise, albeit at a slower rate of growth than seen earlier in the year, with the second highest monthly volume of battery electric vehicle (BEV) registrations in history, up 16.5% to 38,116 units. Although registrations of plug-in hybrid vehicles (PHEVs) declined by -11.5% to 12,281 units, overall plug-in vehicles accounted for more than one in five new cars joining UK roads in the month. As a result, almost quarter of a million (249,575) have now been registered in 2022 – meaning that UK drivers and fleets have now registered more than one million plug-in EVs, a quarter of which in this year alone.

Hybrid electric vehicle (HEV) registrations, grew by 16.5% to 29,088 units in the month, as petrol powered cars grew 4.3% to 126,873 units and diesels declined by 14.5% to 18,911.

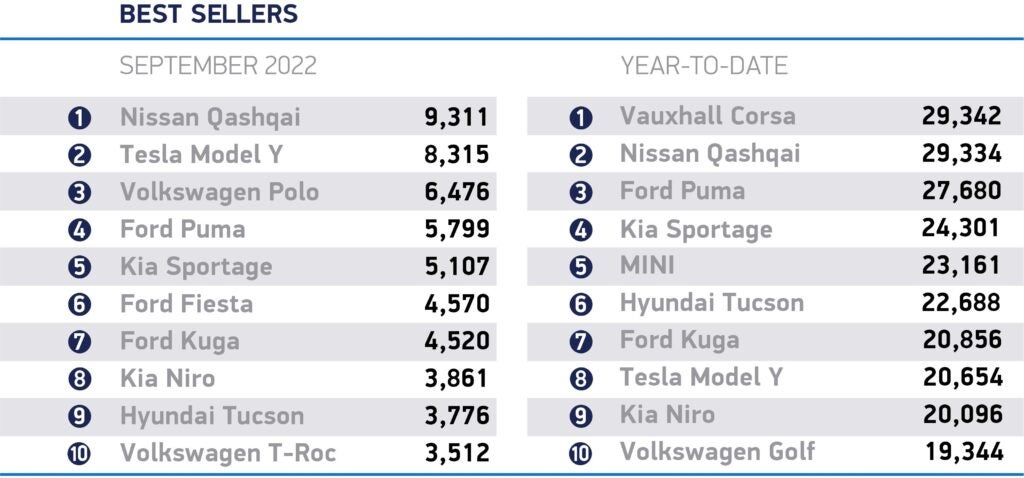

In terms of segments, the largest growth was seen in multi-purpose vehicles, which rose 509.2%, adding more than 10,000 units, to 12,068, a result of key new model availability. Superminis remained the most popular segment overall, accounting for 30.9% of all registrations.

The SMMT said that while growth is welcome, total registrations for 2022 remain down 8.2% on a weak 2021 performance and more than a third (35.1%) below the first three quarters of pre-pandemic 2019, equivalent to 653,903 fewer units.

Mike Hawes, SMMT Chief Executive, said: “September has seen Britain’s millionth electric car reach the road – an important milestone in the shift to zero emission mobility. Battery electric vehicles make up but a small fraction of cars on the road, so we need to ensure every lever is pulled to encourage motorists to make the shift if our green goals are to be met.

“The overall market remains weak, however, as supply chain issues continue to constrain model availability. Whilst the industry is working hard to address these issues, the long-term recovery of the market also depends on robust consumer confidence and economic stability.”

Chris Knight, Automotive Partner, KPMG UK, said: “Car makers are still working their way through the backlog of orders that have built up as a consequence of supply shortages, but higher household costs are shaping new demand.

“As consumer credit becomes more expensive due to higher interest rates, we expect to see a fall in the average price paid for new vehicles, whilst some consumers will delay buying a new car altogether. For existing customers facing increased outgoings, some will question the affordability of their car payments.

“Manufacturers are working hard not to pass their own cost increases onto customers in the form of higher prices. Whilst lower cost brands may feel this combination of factors presents opportunity to grow market share.”