The UK automotive sector recorded a highly positive start to 2022 as the car market in January surged by 27.5% and some 115,087 new cars were registered, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

However, the large year-on-year gain in January is against January last year when lockdown restrictions kept car showrooms shut. The SMMT pointed out that the market remains well below pre-pandemic levels and January’s total was 22.9% lower than in January 2020.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Semiconductor shortages continued to create short-supply to the market last month and on the demand-side many analysts also note that UK households will be squeezed this year by rising prices for many consumer goods and other items (especially energy bills, a major area of uncertainty due to skyrocketing wholesale gas market prices). Retail price inflation in Britain is expected by the Bank of England to peak in excess of 7% in April, putting a squeeze on real incomes.

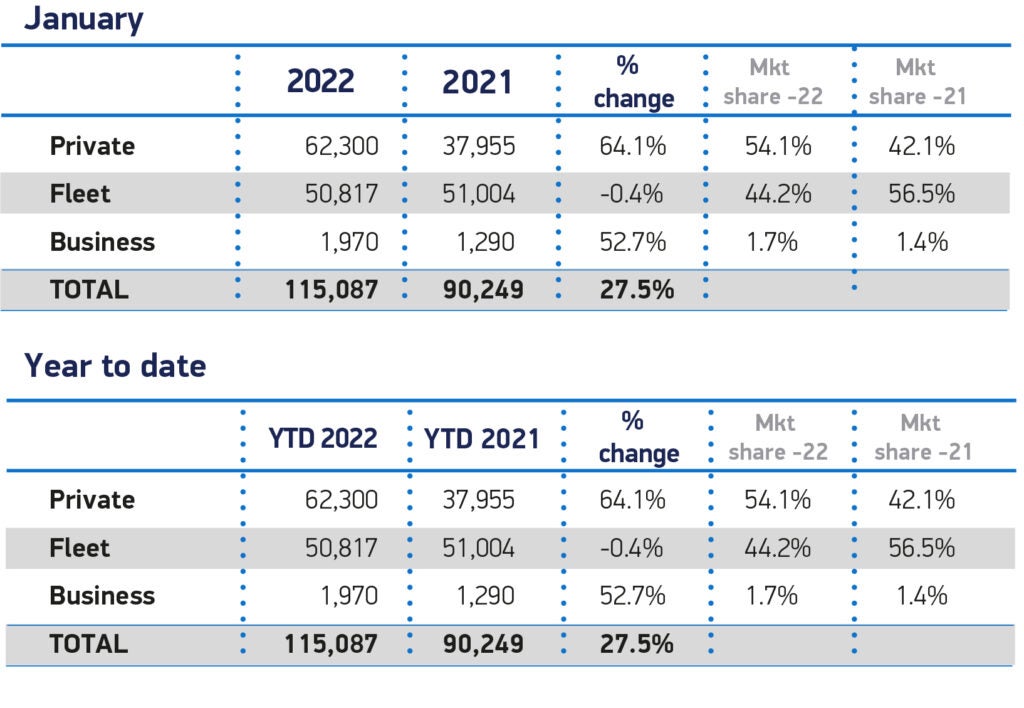

January’s growth was driven by private buyers, as manufacturers sought to prioritise these customers given supply constraints, with this segment of the market registering 62,300 new cars sold, up some 64.1%, year on year – and just -5.6% off pre-pandemic levels.

Large fleet registrations, meanwhile, remained broadly flat with last year at 50,817 units (down -0.4%).

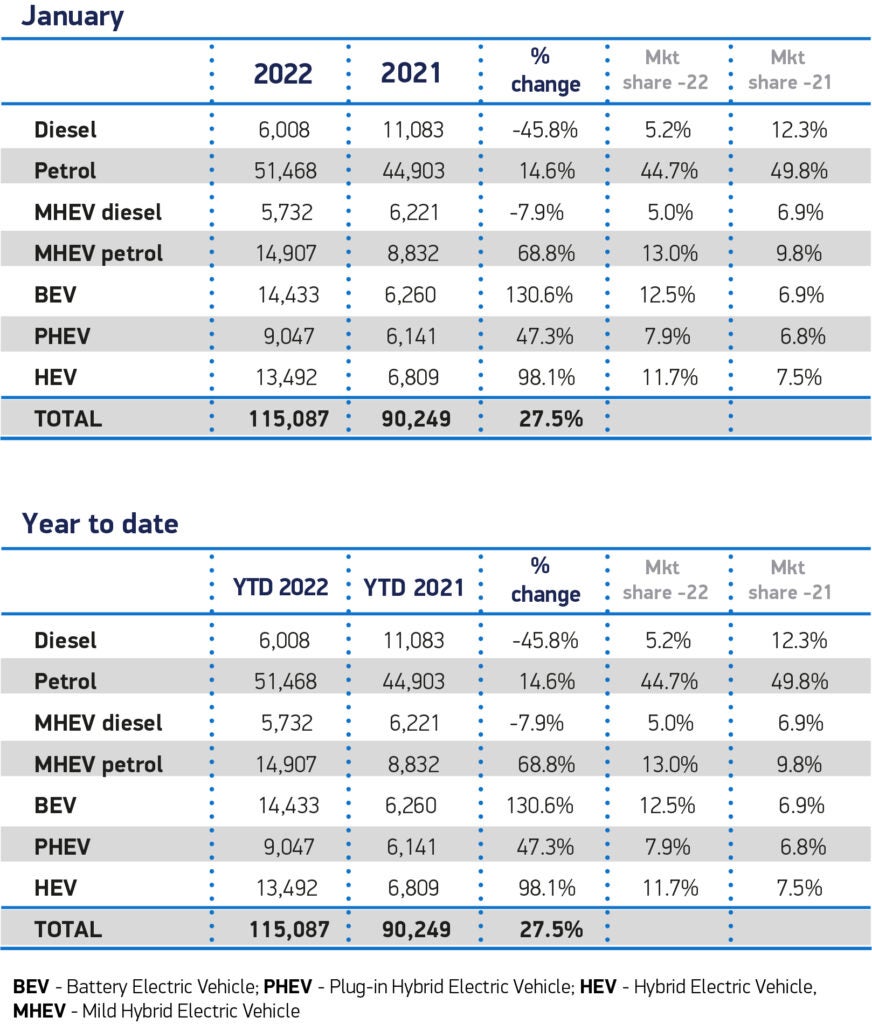

Share taken by electrified vehicles continued to rise last month. Battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) cars accounted for 71.5% of the uplift in registrations. Plug-in vehicles enjoyed another bumper month, with 14,433 BEVs and 9,047 PHEVs registered, equal to some 20.4% of the market. With 13,492 HEVs also registered, almost one in three new cars joining British roads in January was electrified.

There are now more than 140 plug-in car models available to UK buyers, with almost 50 more scheduled for release in 2022.

The rapid pace of change is underlined by the latest market outlook from the SMMT, which forecasts registrations of BEVs and PHEVs to grow by 61% and 42% respectively in 2022, meaning that, by the end of the year, almost one in four new cars would come with a plug.

Overall, total new car registrations are expected to rise 15.2% on 2021, to 1.897 million units. This is a downward revision from October’s outlook of 1.96 million, as the ongoing semiconductor shortage, increasing costs of living and rising interest rates are expected to dampen some demand in 2022.

A 2022 market of 1.897 million would still be down 17.9% on the pre-pandemic 2019, but the recovery is expected to continue into 2023, with the market projected to climb above two million units for the first time since 2019.

Mike Hawes, SMMT Chief Executive, said: “Given the lockdown-impacted January 2021, this month’s figures were always going to be an improvement but it is still reassuring to see a strengthening market. Once again it is electrified vehicles that are driving the growth, despite the ongoing headwinds of chip shortages, rising inflation and the cost-of-living squeeze. 2022 is off to a reasonable start, however, and with around 50 new electrified models due for release this year, customers will have an ever greater choice, which can only be good for our shared environmental ambitions.”

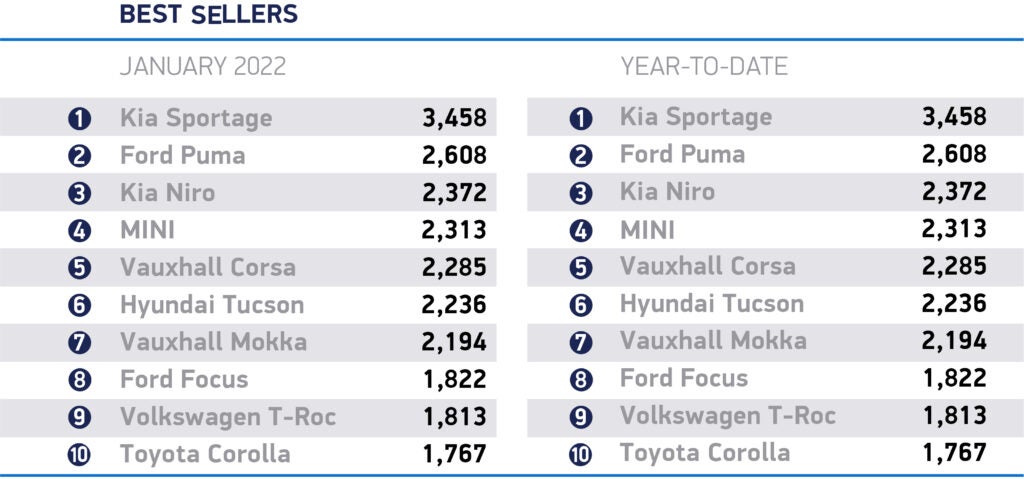

Brand shares in the month continued to show skews due to supply constraints and knock-on effects (retail channels prioritized). Kia led the UK car market for the first time ever and the Sportage was top-selling model.

UK car sales by brand, January 2022| Brand | Jan 22 | share | Jan 21 | share | %ch |

|---|---|---|---|---|---|

| Kia | 10,504 | 9.13 | 6,271 | 6.95 | 67.50 |

| Audi | 8,567 | 7.44 | 6,583 | 7.29 | 30.14 |

| Volkswagen | 8,514 | 7.40 | 7,569 | 8.39 | 12.49 |

| BMW | 8,380 | 7.28 | 7,002 | 7.76 | 19.68 |

| Toyota | 8,030 | 6.98 | 4,514 | 5.00 | 77.89 |

| Ford | 7,456 | 6.48 | 8,706 | 9.65 | -14.36 |

| Vauxhall | 6,562 | 5.70 | 5,599 | 6.20 | 17.20 |

| Mercedes-Benz | 6,355 | 5.52 | 6,600 | 7.31 | -3.71 |

| Hyundai | 5,624 | 4.89 | 3,099 | 3.43 | 81.48 |

| Nissan | 4,379 | 3.80 | 4,633 | 5.13 | -5.48 |

| Peugeot | 4,038 | 3.51 | 2,931 | 3.25 | 37.77 |

| MG | 3,560 | 3.09 | 1,374 | 1.52 | 159.10 |

| MINI | 3,450 | 3.00 | 1,670 | 1.85 | 106.59 |

| Volvo | 3,324 | 2.89 | 3,180 | 3.52 | 4.53 |

| Skoda | 3,213 | 2.79 | 3,088 | 3.42 | 4.05 |

| Land Rover | 2,827 | 2.46 | 3,628 | 4.02 | -22.08 |

| Honda | 2,545 | 2.21 | 970 | 1.07 | 162.37 |

| Renault | 2,381 | 2.07 | 1,581 | 1.75 | 50.60 |

| SEAT | 2,167 | 1.88 | 2,454 | 2.72 | -11.70 |

| Mazda | 2,054 | 1.78 | 748 | 0.83 | 174.60 |

| Dacia | 1,853 | 1.61 | 834 | 0.92 | 122.18 |

| Citroen | 1,650 | 1.43 | 1,479 | 1.64 | 11.56 |

| Fiat | 1,328 | 1.15 | 412 | 0.46 | 222.33 |

| Porsche | 1,313 | 1.14 | 919 | 1.02 | 42.87 |

| Suzuki | 969 | 0.84 | 460 | 0.51 | 110.65 |

| Lexus | 858 | 0.75 | 626 | 0.69 | 37.06 |

| Jaguar | 659 | 0.57 | 914 | 1.01 | -27.90 |

| Cupra | 654 | 0.57 | 213 | 0.24 | 207.04 |

| Polestar | 318 | 0.28 | 326 | 0.36 | -2.45 |

| DS | 314 | 0.27 | 109 | 0.12 | 188.07 |

| Jeep | 196 | 0.17 | 165 | 0.18 | 18.79 |

| Bentley | 134 | 0.12 | 89 | 0.10 | 50.56 |

| Ssangyong | 120 | 0.10 | 47 | 0.05 | 155.32 |

| Alfa Romeo | 98 | 0.09 | 84 | 0.09 | 16.67 |

| smart | 95 | 0.08 | 84 | 0.09 | 13.10 |

| Subaru | 89 | 0.08 | 30 | 0.03 | 196.67 |

| Maserati | 67 | 0.06 | 50 | 0.06 | 34.00 |

| Abarth | 49 | 0.04 | 61 | 0.07 | -19.67 |

| Alpine | 30 | 0.03 | 5 | 0.01 | 500.00 |

| Genesis | 15 | 0.01 | 0 | 0.00 | 0.00 |

| Mitsubishi | 0 | 0.00 | 362 | 0.40 | 0.00 |

| Other British | 200 | 0.17 | 157 | 0.17 | 27.39 |

| Other Imports | 148 | 0.13 | 623 | 0.69 | -76.24 |

| Total | 115,087 | 90,249 | 27.52 |