As a major player one of the pioneers in the industry, Tesla’s entry will intensify the competition in the Indian battery electric vehicles (BEVs) market, according to GlobalData, a leading data and analytics company.

The long-awaited Tesla entry into the Indian automotive market seems to be gaining momentum in recent months. Elon Musk’s statement after his meeting with the Indian Prime Minister, Narendra Modi, on the latter’s US visit, has further cemented expectations over its entry.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Sumit Das, Senior Analyst at GlobalData, says: “Tesla’s entry is expected to force current EV makers to rethink their vehicle offerings, as it offers a wide range of technologically advanced features in their cars, whereas, in India, those can only be found on high-end models. This will surely create a change in the automotive sector, and we can see some changes in technology advancement and added features in new models.”

Furthermore, by setting up a manufacturing facility, GlobalData says Tesla will be able to maintain price parity with other players in the mid-range EV segment, with companies like MG, Mercedes, and Audi all trying to conquer the market. Mercedes has increased the production of its EQS at the assembly line in Chennai due to growing demand for EVs.

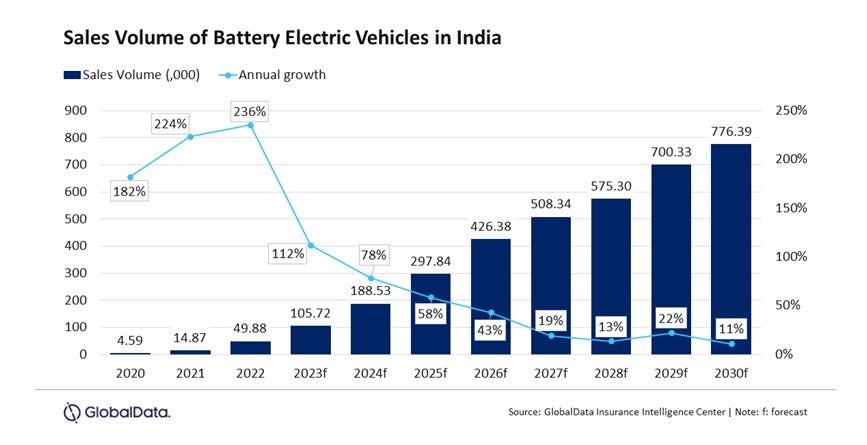

India became the world’s third largest passenger vehicle market, overtaking Japan in 2023, which exemplifies the market’s attractiveness for foreign companies such as Tesla to set up their manufacturing in the country. Sales of BEVs in the Indian market recorded just shy of 50,000 units in 2022 and are expected to record a compound annual growth rate (CAGR) of 25.7% over the next decade to reach one million units by 2033.

Gorantala Sravan Kumar, Associate Project Manager at GlobalData adds: “Recent discovery of the third largest lithium-ion reservoir in Jammu and Kashmir, and Rajasthan states, amplified the necessity of establishing EV manufacturing plants for global OEMs in India. Tesla is one of them, and looking at the long-term market attractiveness, setting up a manufacturing facility in India will help the company penetrate the market and leverage the Li-ion reserves.”

India is expected to post a CAGR growth of nearly 35% from 2023 to 2030 in EV production, with more than one-fifth of the total cars produced in the country expected to be BEVs during this period. This estimation indicates that the country has a potential market for EVs, with a scope for new entrants. In addition, the availability of low-cost resources will also be expected to force global automakers to consider establishing their manufacturing facilities in India.

Das concludes: “New foreign players entering the market will surely bring new technologies and provide a better user experience. After its entry into the Indian market, MG has changed the face of the market with its huge offerings, both in terms of features and technology. That has made other homegrown or foreign players implement the same in their cars. However, the impact can only be seen if Tesla can price and market its product in a competitive price segment.”