Moscow analysts estimate the sustained pressure under which the Russian rouble is currently straining, presents an opportunity for domestic suppliers.

The Russian currency has come under almost constant attack in the past year with markets unnerved by The Kremlin’s sabre rattling in Crimea and Ukraine, resulting in some predicting the automotive market could dive 40% in 2015 following significant falls last year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Figures from the AEB Automobile Manufacturers Committee (AEB AMC) in Moscow showed passenger car and LCV sales falling nearly 25% last month, pouring a hefty bucket of cold water on December’s numbers, which showed a modest rise as Russia’s scrappage scheme kicked in.

But the rouble’s troubles may have a silver lining for local automotive industries and component manufacturers, much in the way Russian producers have capitalised on Moscow’s imposition of its own sanctions on Western food imports.

“Of course, some Russian [automotive] suppliers [are] even winning in this situation because of devaluation of the rouble and high growth of prices of imported parts,” Ernst & Young CIS Automotive Group Head, Andrey Tomyshev, told just-auto from Moscow.

“What else I see is some Asian companies, especially Chinese ones, are increasing automotive in terms of building factories and acquiring assets in Russia. A number of Chinese OEMs are looking to building factories and don’t fear the crisis, because now it is quite cheap…the rouble is cheap.

“If you [have] dollars, you do investment at low cost. It is a good opportunity for new entrants to build a new factory.”

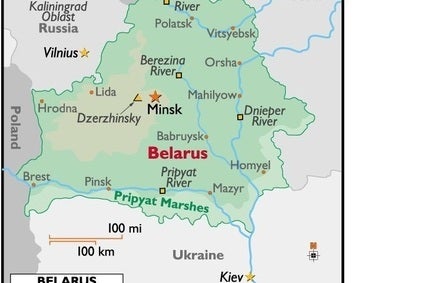

All business eyes in Russia will turn West today (11 February) as crucial talks take place in the Belarus capital of Minsk, bringing together President Vladimir Putin with his counterparts in Paris and Berlin as well as Kiev, in a bid to reach a settlement concerning the de facto civil war raging in Eastern Ukraine.

The European Union and the US have imposed a series of tough sanctions against Russia following its alleged involvement in Ukraine, with the threat of more to come should today’s delicate negotiations not yield a solution to the seemingly intractable crisis, which has hugely dented confidence in auto buyers.

Foreign OEMs are also taking stock of Russia, with General Motors for example, halting production at its St Petersburg plant for two months and the company temporarily suspending wholesale deliveries to dealers in December, citing the volatility of the rouble exchange rate.

The Ernst & Young analyst also estimates sales in Russia could plunge to levels last seen in the depths of the 2009 crisis, posting units of just 1.5m, with the former heyday of 2.9m not being seen until the end of the decade or beyond.