JD Power forecasts that total light vehicle sales in the US for the month of March will be 28.9% down on last year at 1,188,300 units, as low inventory and the chips shortage continues to bite.

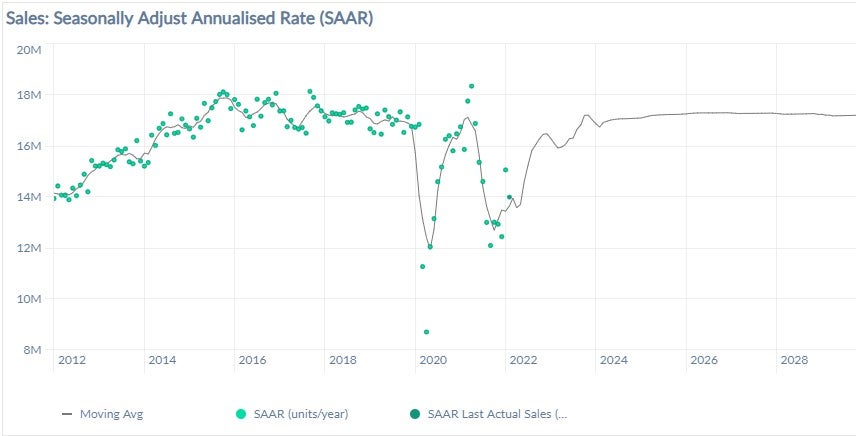

The seasonally adjusted annualized rate (SAAR) for total US light vehicle sales is expected to be just 12.7 million units, down 5.1 million units from 2021.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

New vehicle total sales in Q1 2022 are projected to reach 3,228,000 units, an 18.4% decrease from Q1 2021.

Thomas King, president of the data and analytics division at J.D. Power said: “Typically, March is a high-volume sales month with elevated promotional activity because it marks the end of the fiscal year for some manufacturers and the close of the first quarter for others. In March 2021, consumers purchased almost 1.4 million new vehicles at retail. This year, with fewer than 900,000 units in inventory, it will be impossible for the sale pace to even approach last year’s level. Given the strong demand and extremely constrained inventory situation, it should be no surprise that manufacturer discounts are at their lowest level ever, while prices and profitability set records for the month of March.”

For March, incentive spend per vehicle expressed as a percentage of the average vehicle MSRP is trending toward an all-time low of 2.3%, down 5.4 percentage points from March 2021 and the third consecutive month below 3.0%. From an absolute value standpoint, average incentive spend per vehicle is on pace to reach an all-time low of $1,044, a decrease of 68.7% from a year ago. One of the factors contributing to the reduction in incentive sending is the lack of deals for vehicles that are leased. Leases accounted for 30% of all new vehicle retail sales in 2019. This month, leasing will account for just 18% of retail sales.

With consumer demand for new vehicles remaining robust, new vehicle prices continue to maintain their record levels. Average transaction prices are expected to reach a March record of $43,737, a 17.4% increase from a year ago. For Q1 2022, average transaction prices are expected to reach $44,129, an 18.0% increase from Q1 2021.

Thomas King said: “Vehicles continue to sell quickly, and most of those vehicles have been ordered—or purchased—by buyers before they arrived at the dealership. This month, a record 56% of vehicles will be sold within 10 days of arriving at a dealership, while the average number of days a new vehicle is in a dealer’s possession before being sold is on pace to be 18 days—down from 54 days a year ago.

“Despite reduced sales volumes, higher prices mean that, in aggregate, consumers are on track to spend a healthy $45.7 billion on new vehicles this month, the second-highest on record for the month of March and 12.0% below March 2021. Even with a 14.8% decrease in sales volume retail consumers are on track to spend $124.8 billion, on new vehicles in Q1 2022 a 2.0% increase from Q1 2021.

“Dealers also continue to benefit from high transaction prices with total retailer profit per unit— inclusive of grosses and finance and insurance income—being on pace to reach $4,931, an increase of $2,656 from a year ago, but snapping the five-month streak of profits above $5,000. For Q1 2022, total retailer profit per unit is on pace to reach $5,013, an extraordinary 126% increase from Q1 2021.”

From a dealer profitability standpoint, the elevated per-unit profit level is more than offsetting the drop in sales volume total aggregate retailer profits from new-vehicle sales is projected to be up 62.5% from March 2021, reaching $5.2 billion, the best March ever and the second highest amount of any month on record. For Q1 2022, aggregated retailer profits from new vehicle sales is projected to reach $14.2 billion, an astounding 95% increase from Q1 2021 despite the 14.8% decrease in sales volume.

As expected, interest rates increased, but at a tempered level. The average interest rate for loans in March is expected to increase four basis points from a year ago to 4.40%. Conversely, new-vehicle buyers are benefiting from more equity on their trade-in vehicles. The average trade-in equity for March is trending towards $9,274, an 81.3% increase from a year ago.

Even with elevated trade-in values, the average monthly finance payment is on pace to hit a record high of $658 for the month of March, up $73 from March 2021. That translates to a 12.4% increase in monthly payments from a year ago, which is still below the 17.4% increase in transaction prices.

Thomas King: “In April, with inventory and production levels still projected to be at historical lows compounded by global events, the overall industry sales pace will continue to be supply constrained. Therefore, April’s sales pace will be dictated mostly by manufacturers’ procurement, production and distribution efforts. Regardless of inventory position or production levels, manufacturers and retailers will continue to benefit from both the elevated—and pent-up—levels of consumer demand, giving them the ability to maintain historically high profitability on nearly every unit sold.”

Global Sales Outlook

Jeff Schuster, president, Americas operations and global vehicle forecasts, LMC Automotive described the global market situation as similarly constrained versus last year: “February global light-vehicle sales ended as expected at 78.1 million units, down from 82.3 million units a year ago. In year-over-year terms, sales were down just 2,000 units, but the disruption effect from timing of the Chinese New Year, last year’s level was a weak base. Sales continue to be held back by supply chain issues, though we are seeing some erosion of underlying demand as the economic outlook deteriorates. March is expected to suffer from the added effect of the war in Ukraine and an increase in inflationary pressure on consumers worldwide. Volume is currently projected at 7.1 million units, down 15% from March 2021. The selling rate is projected to be 74.0 million units, a drop of 4 million units from February and a staggering 14 million units lower than March 2021.

“Risk in the outlook for the global economy and vehicle sales has increased significantly since last month. The compound of extending existing disruptions from supply shortages and the war in Ukraine has created a volatile market, causing to make a substantial downgrade to the 2022 outlook. Global light-vehicle sales are forecast at 82.6 million units in 2022, down 4% or 3.2 million units from our forecast last month. The revision cuts the growth rate to just 1% from 2021 and additional risk for the remainder of the year could push volume down below the 2021 level, potentially affecting the recovery pattern over the medium-term.”