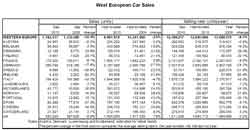

Car sales in Western Europe fell by 10.4% in September according to data released by JD Power Automotive Forecasting.

The market continues to compare poorly year-on-year to a 2009 market that was inflated by government scrappage incentives, JD Power said. However, the selling rate of 12.4m units a year was an improvement on the past few months.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Car sales in Germany were down by 17.8% in September with the year-to-date market down by 27.5%. The selling rate in Germany remains below 3m units a year.

The French market saw an 8% drop for September. It is the only major market in the region still to have a scrapping scheme in place – though this scheme is being reduced in increments through the year.

The Spanish car market saw another poor month with sales down 27%, reflecting the ending of scrappage support and a VAT rise.

The UK market was also year-on-year lower (-9%), in what is an important month because of the new registration plate.

JD Power said the remaining months of 2010 will see these negative year-on-year comparisons continue, with the market set to come in around 6-7% down for the full year at 12.8m units. The forecast for 2011 is for a further market decline of around 2% to a little under 12.6m units.

The 2011 full year market will be comparing to a 2010 market that still had ‘incentive inflation’ in the first half.

JD Power noted that uncertainty continues over the impact of the austerity measures now being adopted by European governments and ongoing sovereign debt worries and added that the ‘risk of a double-dip recession certainly cannot be overlooked’.

JD Power analyst Jonathan Poskitt told just-auto that the German car market is expected to decline by around 24% to 2.9m units this year. However, some pickup to the German car market is expected in 2011.

“Although German consumers are still cautious, there are signs that the position for the German car market will be improving a little in 2011,” he said. “But we are talking about a market of 3.1m units in our base case forecast for next year, still a low market by historical standards.”

Spain’s car market is in freefall this year and expected to turn out at around 1m units as the market continues to experience post-scrappage unravelling.

“It looks bleak for Spain on the basis of the economic fundamentals that influence car purchase,” Poskitt said. “On our current projections the car market in Spain is heading for a very bumpy landing for the remainder of this year and could be down by 2% overall in 2011.”